Unsure If You’ve Done Enough Due Diligence?

Stress Test Your Deal in 90 Minutes—Before You Lock Up Your Money for Years

A private, 1-on-1 session to uncover red flags, compare your deal to others, and walk away knowing exactly what to do next.

Get a second opinion—before making a five-figure mistake

Surface red flags even polished sponsors hide

Benchmark your deal with 2 comparable operators

Walk through your materials step-by-step and uncover what’s missing

Know exactly what to ask the sponsor next

Sound Familiar?

You’re successful. You’ve made good money and you’ve built a career or business that others admire.

But that success doesn’t automatically make you a smart “passive investor”.

Because passive investing?

That’s a different game—and most people are playing it blind.

No one taught you how to evaluate deals, vet operators, or ask the tough questions.

So you work with what you have.

You rely on:

A referral from a buddy who “knows a guy”

A pitch deck full of polished graphics and projected returns

A set of questions you cobbled together from a handful of podcasts

You think you’re doing due diligence—

But what you’re really doing… is guessing.

Most “passive investors” aren’t actually investing. They’re wiring money and hoping the sponsor knows what they’re doing. That’s not a strategy. That’s a liability.

The #1 Mistake New Passive Investors Make

It’s not investing in a bad deal.

It’s trusting the pitch more than the process.

Most investors don’t lose money because they’re reckless.

They lose it because they follow a half-baked process—just enough to feel confident—but not enough to avoid a costly mistake.

So you:

Borrow someone else's “top 10 questions to ask a sponsor”.

Mistake the sponsor’s confidence for competence.

Trust the projections—without challenging a single assumption.

Ignore red flags because “a friend is investing too”.

Rush to commit because “it’s filling up fast”.

And then?

You wire the money without ever:

Asking for documents and investor updates to verify the sponsor’s claims.

Asking what could go wrong—and how they’d handle it.

Comparing the opportunity against multiple alternatives.

And clarifying if the deal actually fits your investment goals.

You pull the trigger—without ever really knowing what you’re getting into.

And when the deal goes south—and eventually, one will—And when the deal goes south—and eventually, one will—

You’ll have no answers. Just a pit in your stomach… and a quiet voice saying: “I should’ve known.”

I’ve seen it happen – more times than I can count.

People wire $50,000 into a deal—only to spend years trying to unwind the mistake.

You don’t want to be that person.

Because when a deal goes south, it’s not just the money that hurts

It’s the embarrassment.

It’s that moment you have to look your spouse in the eye and admit:

“I lost all of it.”

Then comes the fallout: The 2–3 years you’ll spend just to get back to where you were.

This isn’t just about losing capital.

This is about your timeline to freedom.

Because a bad deal doesn’t just cost you money—it costs you time.

And time is the one thing you can’t get back.

What If You Had a Second Set of Eyes—

Before You Wired $50K?

From Someone Who’s Seen the Patterns, the Pitfalls, and the Red Flags You Might Miss

You wire the money without ever:

A clear process to validate your assumptions

Insight from someone who’s reviewed hundreds of passive deals

Certainty to say "yes" (or confidently walk away) with zero doubt

And because of that clarity, you finally experience:

The freedom to say “no” to work you don’t want to do

The relief of income hitting your account—without lifting a finger

Certainty to say "yes" (or confidently walk away) with zero doubt

The confidence that you’ve made a genuinely smart decision with your money once you get that clarity?

You stop sitting on the sidelines

You start building real momentum

And your cashflow becomes something you can actually count on

But that kind of clarity doesn’t happen by accident.

It happens when you get a second opinion from someone who’s actually done it.

The Deal Evaluation Session

A 90-Minute Private Strategy Session to Vet Your Deal, Avoid Costly Mistakes, and Invest With Confidence

Most investors don’t lose money because they’re reckless.

They lose it because they don’t know what to ask—until it’s too late.

In this confidential, 1-on-1 90-minute session for accredited investors, I’ll help you evaluate the sponsor, and give you the second opinion most investors only wish they had before they got burned

Plus - you’ll leave with….

Peace of mind about your next move

A clear list of questions to take back to the sponsor

Honest, experienced insight from someone who isn’t trying to sell you the deal

The confidence to stop second-guessing and start investing intelligently

Ready to see if this session is a fit?

But Why Should You Listen To Me?

In 2021, my dad passed away unexpectedly.

He left my mom with a multi-million dollar inheritance but no clear plan to make it last. So I stepped in.

Naturally, I did what most people would do: I called financial advisors.

They smiled, nodded, and pitched their firm’s products: mutual funds, ETFs, market-based portfolios that made them money whether the market went up or down.

But none of it would give her real income.

None of it was designed to support her lifestyle.

And the whole “hope it grows” strategy? That wasn’t good enough.

I wasn’t about to hand her future over to someone else’s spreadsheet.

So I decided to figure it out myself.

I Thought I Knew What I Was Doing…

Until I Realized I Didn’t

I wasn’t new to investing.

I’d deployed over $150 million at TechStars', one of the top early-stage VC firms in the world.

I could underwrite founders.

I could read financials.

I understood risk.

But passive investing? That’s a different beast.

I had a “buy box.”

I followed referrals.

And I invested with polished sponsors.

But what I didn’t have was a system for evaluating real cash flow.

So I did what most investors do:

I chased IRRs on polished decks.

I assumed “big AUM” meant “safe”.

I asked surface-level questions and accepted confident answers.

The results?

Deals that looked great on paper—but didn’t deliver when it mattered.

Even Smart People Lose Money When They Don’t Know What to Look For

That’s when it hit me:

Even experienced investors can get passive investing completely wrong.

And that was me.

So I did what I always do when I hit a ceiling—I went looking for better answers.

That led me to Go Bun dance, a mastermind full of high-net-worth men who weren’t just talking about passive income… they were living off it.

They weren’t chasing trends or trying to look smart.

They were playing a different game:

Freedom, not flash. Income, not ego.

So I rebuilt everything.

I scrapped the guesswork.

And I created a system that could work for me, and for my mom.

What Happened Next?

Predictable Income Real Freedom

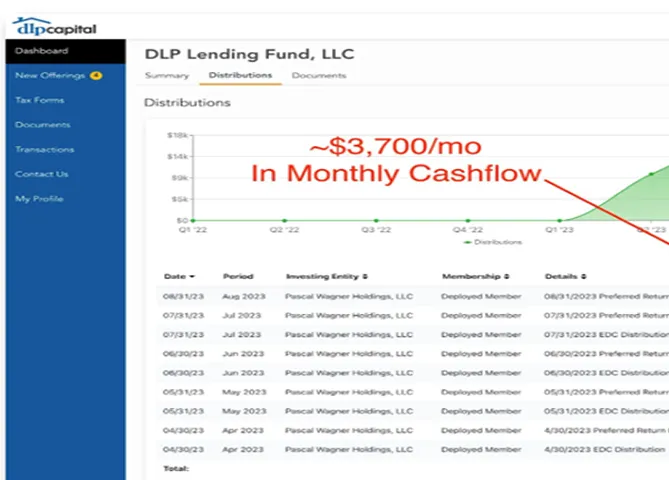

~$3,700 per month from a lending fund

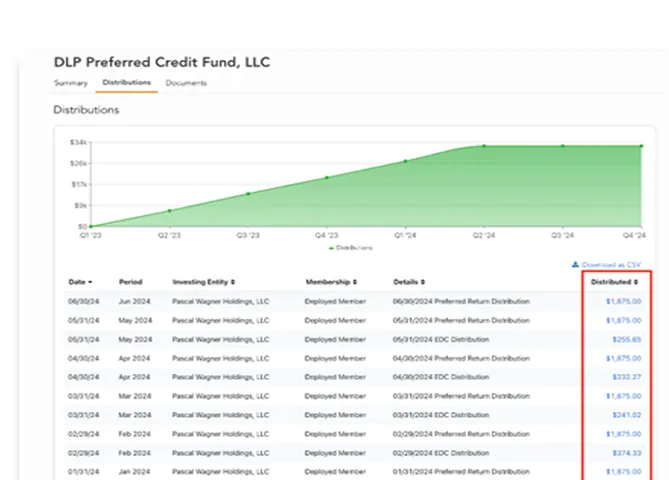

$2,100+ per month from a Preferred Credit Fund

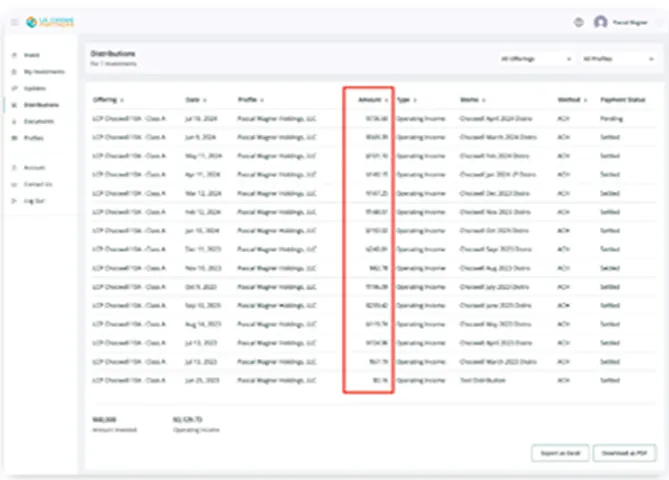

$500 per month (and growing) from an oil & gas fund

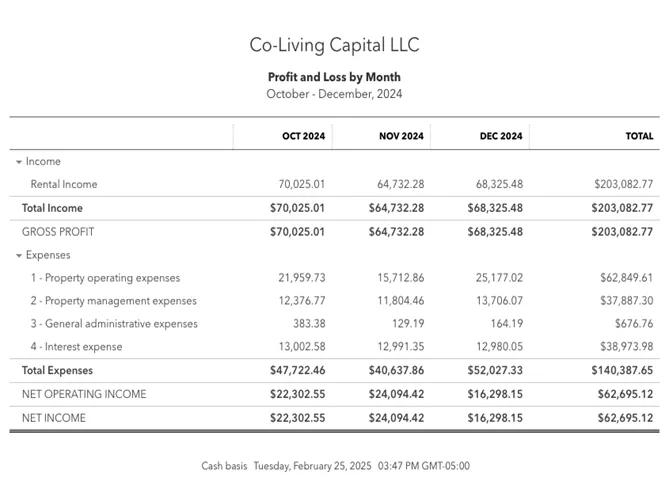

Plus $20,000+/mo from my own private real estate portfolio

If you’ve ever wondered what a reliable, diversified cashflow portfolio actually looks like—this is it.

And Along the Way, I’ve Helped Others Do the Same

I’ve coached 13+ investors to build their own income portfolios.

I launched a deal curation platform and my own feeder fund.

And most importantly— I helped my mom go from an overwhelmed inheritor… to someone who now

earns passive income every month—without lifting a finger.

I’ve sat through the pitch decks, heard the rehearsed webinars, and seen what gets glossed over when sponsors want your money fast.

I know what most investors miss…

Because I missed it too.

And if you’re about to wire $50,000 into a deal—and something doesn’t quite feel right?

You don’t need another hype-filled pitch.

You need a second opinion from someone who’s been in the trenches.

And who will tell you the truth.

Here’s EXACTLY What You Get When Invest The Deal Evaluation Session

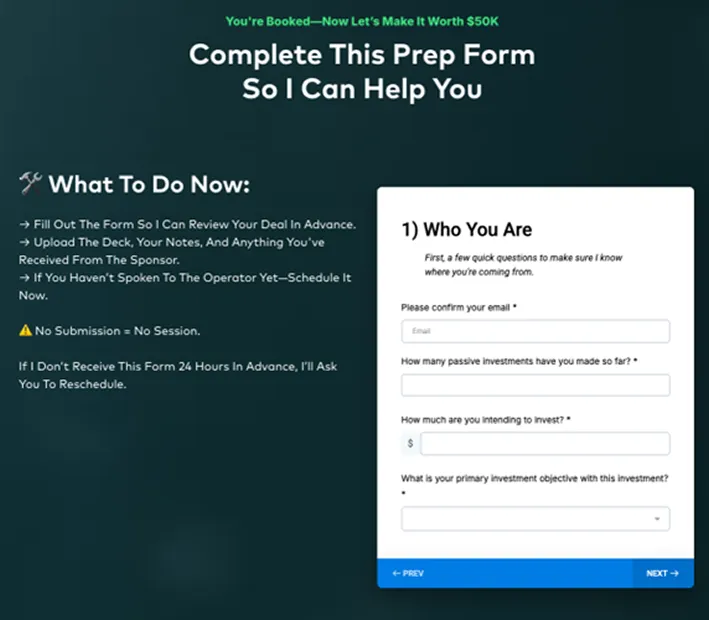

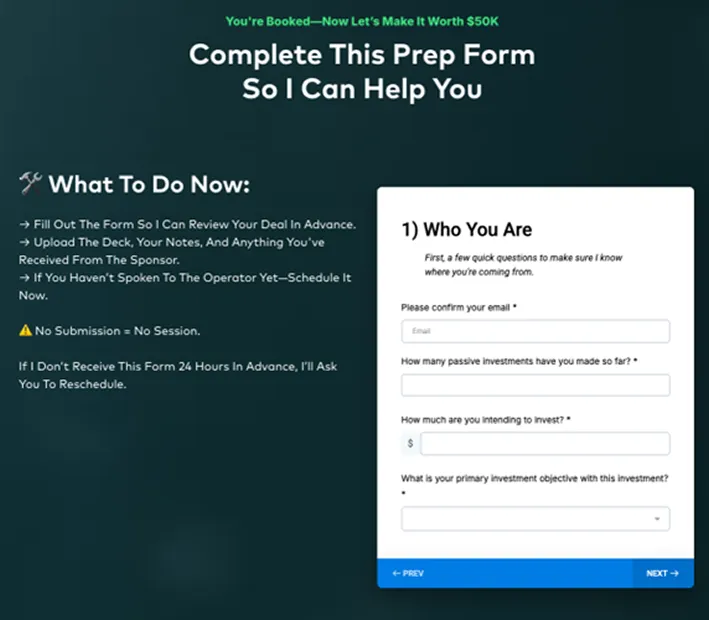

Pre-Call Prep & Submission Form

Before our session, you’ll be asked to complete a short intake form where you’ll upload everything you’ve already gathered about the deal.

That includes:

The pitch deck and PPM.

Your notes or any docs you’ve requested.

A link to the operator’s website.

Any correspondence or updates from the sponsor.

Important: You should have already reviewed the materials, taken notes, and had at least one conversation with the operator. This session is only valuable if you’ve done some of the groundwork.

My goal? I want to see exactly what you’ve seen—so I can help you figure out what’s missing.

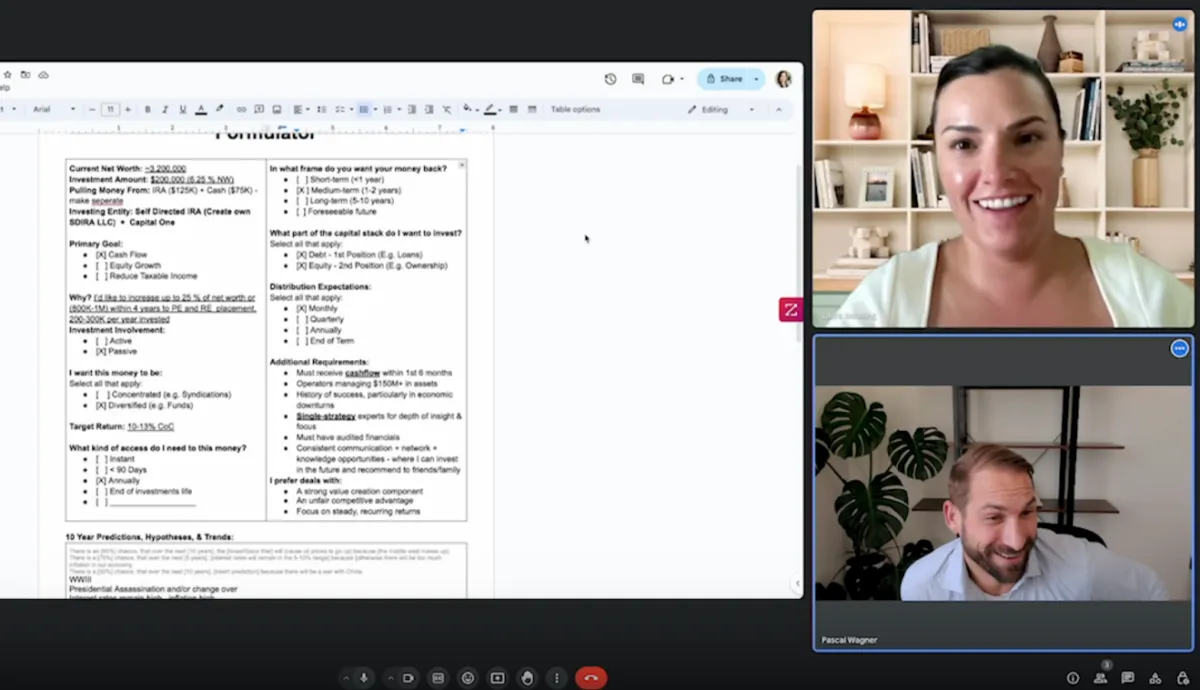

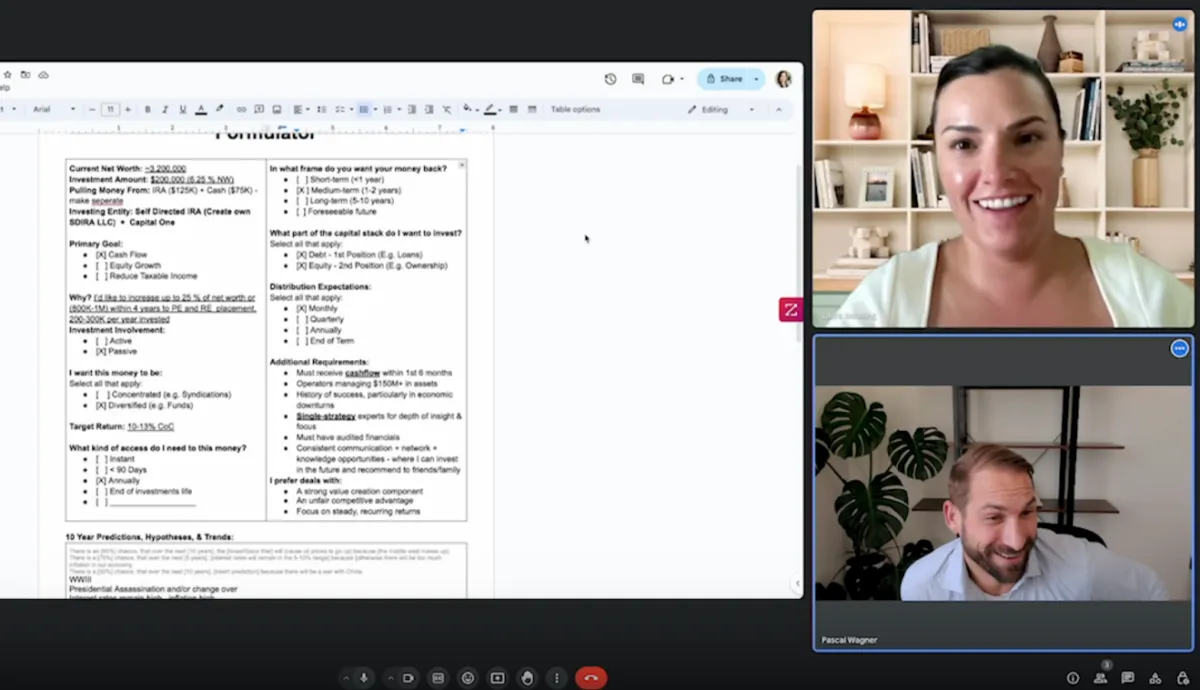

Live Deal Evaluation (1-on-1 With Me)

On the call, we’ll go deep into one deal. You’ll walk me through your process—what drew you to the deal, what you liked, and how you evaluated it.

Then I’ll ask the questions you didn’t know to ask. I’ll show you where the gaps are. And I’ll flag the yellow (or red) flags you may have missed.

You’ll get a list of critical questions to ask the operator—plus insights on what the answers should sound like.

And you’ll get a sneak peek of the internal checklist we use inside the Cashflow Academy, so you can see how your current process stacks up against a best-in-class one.

2 Comparable Operators to Benchmark Quality

Most investors evaluate a single deal in a vacuum. That’s dangerous.

You wouldn’t buy the first house you walk into—or invest in the first stock someone pitches.

So why treat private investments any differently?

I’ll bring 2 comparable deals or operators in the same niche so you can:

Calibrate quality (Is this actually best-in-class—or just the only one you’ve seen?)

Understand how your current deal stacks up

Explore alternative options if your current one doesn’t hold up under pressure

Even if you move forward with your original deal, you’ll know exactly why—and have full conviction behind your decision.

Wrap-Up: Feedback, Takeaways & Next Steps

This isn’t about me telling you yes or no. It’s about you walking away with:

A clearer lens to evaluate any deal you see

Real questions to ask operators (that expose risk most miss)

And a gut-level sense of whether this deal actually makes sense for you

At the end of the session:

I’ll ask for your feedback so I can keep improving this offer.

If you loved the experience, I might ask if you’re open to filming a quick testimonial.

And if you’re ready to stop guessing and start building a real portfolio, I’ll show you what we do inside Cashflow Academy.

No pressure. Just the next step if it makes sense.

Everything You Need to Make a Confident Call — Even After the Session Ends

Because smart investing isn’t just about one conversation—it’s about having the tools, resources, and backup to follow through with conviction.

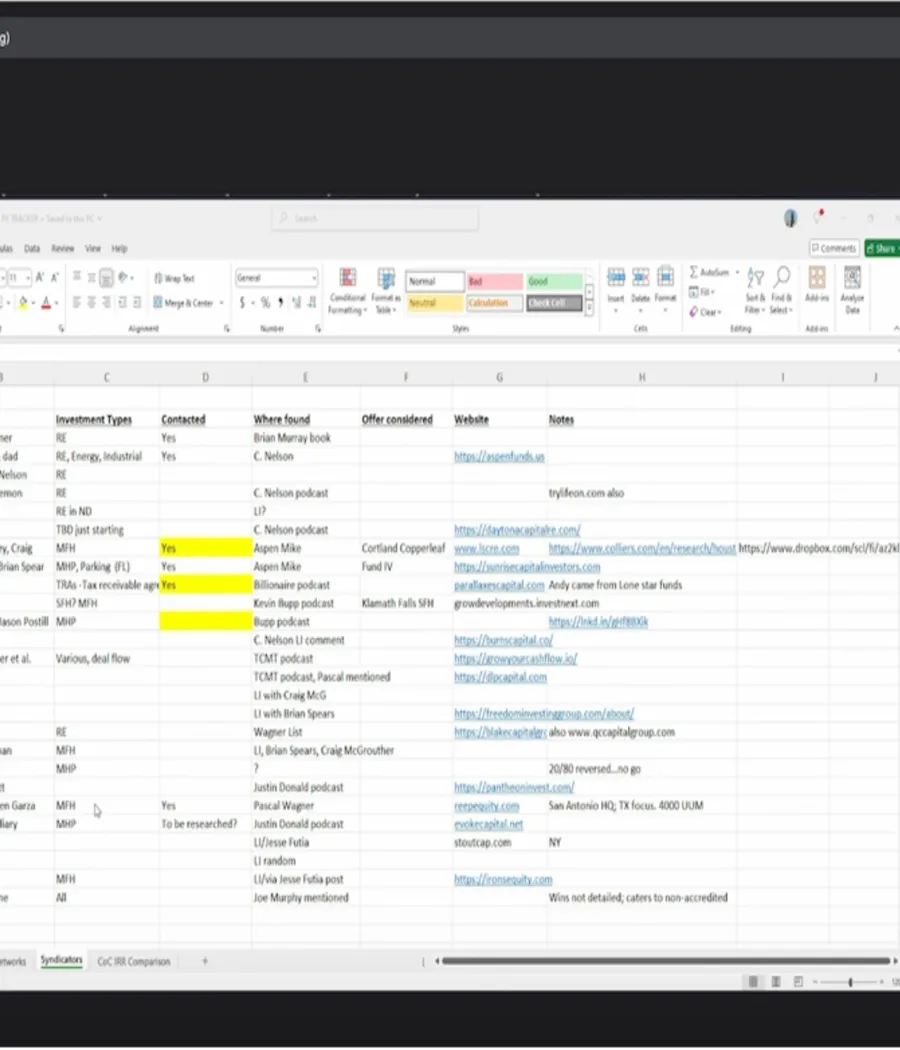

BONUS #1: The Comprehensive Investment Database High-Net Worth Investors Would Kill For

If you don’t have a deal yet, you’ll get access to a curated list of deals and operators I’ve reviewed. It’s a shortcut to building deal flow and finding the right fit.

Use it to jumpstart your deal flow or benchmark what you’ve already got on your radar.

A shortcut that could save you months of hunting—or worse, wiring into the wrong deal.

BONUS #2: 7 Days of Private

Follow-Up Access

Investing decisions don’t end when the Zoom call ends. That’s why you’ll have direct line access to me for a full 7 days—ask follow-ups, get feedback on new information, or get help handling sponsor conversations.

No ghosting. No generic email bot.

Just clear, unfiltered insight when you need it most.

BONUS #3: 100% Credit Toward Cashflow Academy (If You Join Within 48 Hours)

Love what you learned in the session and want ongoing mentorship?

You’ll get full credit for this session if you enroll in Cashflow Academy within 48 hours.

That means your session was basically free.

Plus, you’ll have a proven system and community to keep building real, recurring income—deal after deal.

What Real Investors Say

After Booking This Session

Don’t just take my word for it. These investors booked the deal evaluation session and walked away with

clarity, confidence, and thousands saved in potential mistakes. Here’s what they had to say:

"There were some aha moments, like 'I didn’t even think about that.'"

"I feel super comfortable putting 50k into a debt fund after this conversation. I just needed someone to confirm I’m on the right track."

"This was super helpful... I’ve joined a few webinars, but you’ve given me the confidence to move forward with using my self-directed IRA for this."

"My comfortability has really come from feeling like the person I’m talking to knows what they’re talking about

"This was great... this is good timing for me to have this”

"This was empowering. It’s nice to know I’m on the right track, and a lot of other people are doing this too."

A 90-Minute Session That Pays Off For Years

When Tod first booked this session, he wasn’t

looking for investment advice.

He was looking for clarity.

He’d already been doing the work—listening to

podcasts, reading materials, reviewing deals.

In fact, he had multiple operators sending him

opportunities, including a few he felt good about.

But that was the problem

Every deal sounded promising.

Every operator had a pitch.

Every deck looked polished.

And every deal seemed “urgent.”

Tod didn’t want to make a mistake.

He didn’t want to ignore a red flag because he liked the sponsor.

And he didn’t want to wire $50,000+ just because a deal “felt right.

”So in our session, we pulled everything out on the table.

We reviewed his investment thesis.

We walked through the risks of fixed vs. floating debt.

We compared distributions, profit splits, tax implications, fund structures, and operator track records.

And we dug into the questions most investors forget to ask—until it’s too late.

What Tod walked away with wasn’t a yes or no.

He walked away with a process.

A checklist. A framework. A fresh lens for decision-making.

And weeks later, when one of the operators he had been considering delayed distributions to their investors…

Tod wasn’t one of them.

His words?

"Just seeing how you break things down helped me realize how much I didn’t know—and how close I was to making a bad call."

This session isn’t about making decisions for you.

It’s about helping you make them with confidence.

It’s your Investor’s Insurance Policy—not because it eliminates all risk, but because it helps you avoid the unnecessary ones.

In just 90 minutes, you’ll:

See exactly where your deal sits on the risk/reward spectrum.

Get 2–3 comparable deals to benchmark against.

Know what to ask the operator before you sign.

Build a framework you’ll use for every deal going forward.

This is the process I use to protect my own portfolio.

It’s the same process that’s helped investors like Tod go from anxious to confident.

Because smart investors don’t just chase returns.

They slow down just long enough to make sure they’re betting on the right ones.

Who This Is (and Isn’t) For

Let me be blunt.

If you’re just looking for someone to “bless your deal,” nod their head, and confirm your gut feeling—this isn’t for you.

But…

If you’re about to wire $50,000 into a deal…

And you’re second-guessing the numbers, the sponsor, or whether this thing actually fits your goals—

Then this might be the most valuable 90 minutes of your investing year.

Here’s the catch:

You must be an accredited investor. That means:

You earn $200K+ as an individual (or $300K+ as a couple),.

Or you have a net worth over $1M (excluding your primary residence)

Why?

Because the deals we’ll be reviewing—and the database you’ll gain access to—are exclusively for accredited investors.

If you don’t meet that bar, this session won’t be helpful.

But if you do?

You’re exactly who I built this for.

My 100% “No BS” Guarantee

This session should be the most valuable 90 minutes you spend on your investment strategy this year.

If you attend the call, complete the pre-call checklist, and don’t walk away with meaningful clarity—

Email me within 24 hours and I’ll give you a full refund.

No awkwardness. No red tape. No hassle.

You’re making a five- or six-figure decision.

This is your zero-risk way to pressure-test it before wiring the money.

Limited Beta:

Only 10 Spots Available Over the Next 4 Weeks

This Deal Evaluation Session is something I’ve only offered inside Cashflow Academy—until now.

I’m pulling it out as a standalone offer because it’s consistently been one of the most valuable parts of the program.

But this version? It’s still in beta.

That means:

I’m testing the format to see how it works on its own.

I’m limiting it to just 10 investors over the next 4 weeks

And I haven’t decided if I’ll raise the price, change the format, or keep offering it at all

If you see this page live, spots are still available.

Once it’s full, the offer closes—or the price goes up.

So if you’re considering a deal right now, and want a second opinion from someone who’s actually done this…

This is your shot.

Investment: $1500 $497

You’re about to wire $50,000 into a deal—and once it’s gone, it’s gone.

No refunds.

No do-overs.

Just regret... or results.

That’s why smart investors buy clarity before commitment.

Spend $497 now. Save—or earn—50X later.

This 90-minute session is not a coaching call.

It’s a deal-vetting war room—a tactical strategy session designed to protect your capital, your freedom, and your peace of mind.

Walk away from a bad deal? That’s $50,000 saved.

Move forward on the right one? That could pay you for years.

Don’t feel 10X clearer? Email me, and I’ll refund you—no questions asked.

$497 protects $50,000.

Or it earns you 10X that.

Or it costs you nothing.

The real risk?

Is doing nothing.

Make Your Next $50K Investment with Confidence—Not Guesswork

Book Your Deal Evaluation Session — $497

Have A Few Questions?

(Only 10 spots available during this beta round)

Copyright © 2024. All rights reserved.