INVESTMENT EDUCATION FOR HIGH-INCOME PROFESSIONALS

Build Six-Figures in Passive Income - Without Figuring It All Out Alone

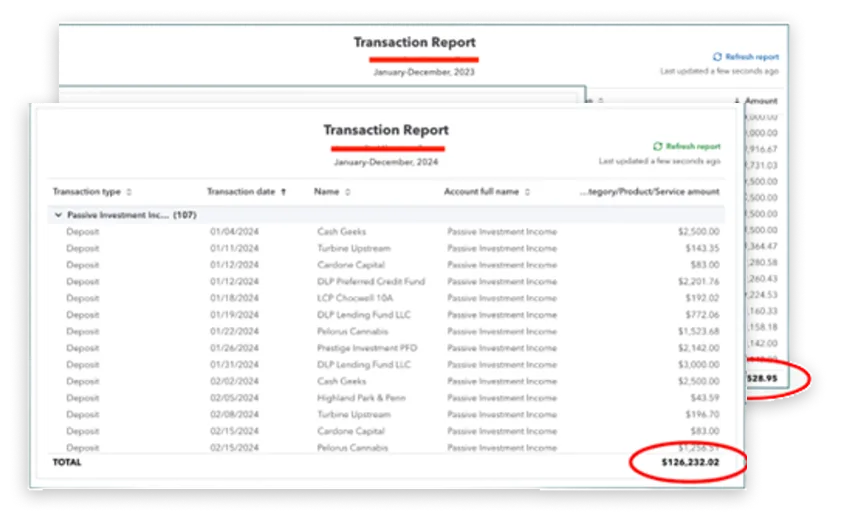

We help accredited high‑income professionals turn volatile, stock‑heavy, tax‑heavy portfolios into predictable cashflow with private deals, clear frameworks, and 1:1 guidance—so you’re not guessing off pitch decks and podcasts.

I make over $200k/yr or have a $1M+ net worth excluding my primary residence.*

100% free. Built for accredited and serious soon‑to‑be investors.

TRUSTED BY Executives OF:

Is This You?

You’ve crushed it in your career, but private investments still feel like guesswork.

You’ve made a few private investments—but they’re not generating the returns you were promised.

You’ve asked all the questions you know to ask… but it still feels like there’s a blind spot you can’t see.

You don’t have time to underwrite like an analyst, but you also don’t want to blindly trust every deck.

You’re overexposed to stocks and W‑2 taxes and know there’s a better way… you just don’t know where to start.

If that sounds like you, the LP Starter Kit will give you a clearer way to look at LP deals, instead of winging it one deck at a time.

Where Most High Earners Get Burned

Most investors don’t lose money because they’re reckless.

They lose it because they trust the pitch more than the process.

They follow half‑baked due‑diligence checklists they found online.

They mistake confidence and slick marketing for a real track record.

They wire $50K because “a buddy is in it too” – without really knowing what they’re buying.

The LP Starter Kit gives you the same front‑end tools I use myself—a clear Buy Box, 25 example debt funds, and a thorough checklist—so you can compare deals like a serious LP instead of picking from whatever happens to land in your lap.

What If You Didn't Need To Figure It Out Alone?

When my dad passed away, I suddenly became responsible for managing my mom’s retirement. We had money, but no plan. No roadmap. And no trustworthy source to help us figure it out.

I wasn’t trying to “beat the market.” I just wanted to make sure my mom never ran out of money.

That experience forced me to learn how to invest—with real responsibility, not just theory.

And that’s when I realized something:

There are thousands of high-income professionals in the same boat. They’re great at making money, but when it comes to investing—they’re stuck guessing.

That’s why I built Grow Your Cashflow—to give you the roadmap I wish I had.

The LP Starter Kit is your first step: clear questions, real examples, and a simple way to start investing intentionally instead of winging it.

— Pascal Wagner

Here’s How We Help You Build Passive Income Without the Guesswork

Step 1:

Download The

LP Starter Kit

See real examples of private deals and get the three front‑end tools I use with clients:

→ LP Buy Box Builder

→ 25 example debt funds

→ Debt fund checklist

Step 2:

Book a

Deployment Gameplan Call

A 60 minute 1:1 call where we:

→ Clarify what you’re solving for (cash flow, tax, de‑risking)

→ Unpack your biggest LP investing challenges

→ Decide together whether working more closely makes sense

Step 3:

Join Cashflow Academy

(if it’s a fit)

For accredited investors deploying serious capital who want:

→ A 12‑month deployment plan and weekly support

→ Help reviewing real deals before you wire money

→ Access to my full deal database, frameworks, and live deal reviews

Don’t Just Take Our Word For It.

Real stories from high‑income professionals who stopped guessing, started investing intentionally, and finally felt confident in their decisions.

Philip Kopesdy

Strategic Account Executive

"I Finally Got A Clear Roadmap"

"I Had Been Piecing Things Together For Months. This Program Gave Me A Framework, Templates, And A Mentor To Cut Through The Noise"

Kathleen Marcell

Customer Success & Operations Executive

"I Now have a lot more confidence"

"I have A much better Framework for Reviewing deals And Asking better questions when talking with Sponsors"

Ian Johnston

Healthcare Professional

"This Program Pulled It All Together For Me"

"Between the deal flow, the course, and your podcast, I finally got the reps I needed to feel confident reviewing deals and asking the right questions"

Matthew Sommers

Fractional CFO

"I would highly encourage

others to participate"

"The proof is in the pudding. Payments are being delivered as anticipated. And that goes a long way when it comes to investing."

Philip Lima

Founded & Exited B2B Analytics Firm

"Built for first-time fund investors"

“I didn’t want to make a big bet right away. This let me ease in, understand how it all works, and still get exposure to a fund I believed in. The returns have been steady, and I didn’t have to jump through hoops.”

You Don’t Need $250K to Invest Like the Pros

We pool capital from investors like you to access institutional-quality funds typically reserved for ultra-high net worth individuals.

DLP Lending Fund

Target Return: ~8%

Distributions: Monthly

Instrument: Debt

Liquidity: 90 Days

Fund Size: $1 Billion

Investment Minimum: $200 $50k

Spectra Velocity Fund I

Target Return: ~8%

Distributions: Monthly

Instrument: Equity

Liquidity: Annually

Fund Size: $1 Billion

Investment Minimum: $200k $50k

DLP Housing Fund

Target Return: ~8%

Distributions: Monthly

Instrument: Equity

Liquidity: Annually

Fund Size: $1 Billion

Investment Minimum: $200k $50k

Learn How High-Income Investors Think

Join our weekly show where we break down real deals, interview operators, and walk through the strategies used by top professionals building passive income portfolios.

Tired of market volatility? Learn how high-income professionals are creating reliable, hands-off cash flow through private investments.

In each episode, we cover:

How to find & evaluate high-yield investment opportunities

The smartest ways to reduce risk while maximizing ROI

The proven playbooks high-income professionals use to build passive income

No fluff. No hype. Just smart conversations to help you think like a pro.

Frequently Asked Questions

Who is the LP Starter Kit for?

It’s built for high‑income professionals and accredited investors who want to start using private deals to build passive income but don’t have time to become full‑time underwriters.

Do I need to be an accredited investor?

Most of the deals and strategies we discuss are designed for accredited investors. If you’re not there yet but close, the Starter Kit will still help you understand how this world works and what to prepare for.

What happens after I download the LP Starter Kit?

You’ll get instant access by email. Over the next few days, I’ll also send short lessons showing you how I think about deals. When you’re ready for live opportunities, I’ll invite you to join the Deal Flow Membership.

Are you giving me investment or tax advice?

No. Grow Your Cashflow provides education and deal flow introductions. We don’t provide personalized investment, tax, or legal advice. You should always consult your own advisors before investing.

Grow Your Cashflow LLC and its members do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Terms of use | privacy policy