Still STRUGGLING To VET DEALS?

Build A Cashflowing Portfolio In 12 Months – Without Becoming A Full‑Time Underwriter

Cashflow Academy is a 12‑month, hands‑on program for accredited investors deploying $50K–$1M+ into private alternative investments who want weekly help applying a proven three step process to real deals before they wire.

Spots are limited and filled on a first-come, first-served basis.

In Cashflow Academy, you’ll get:

Weekly office hours to walk through real deals with an LP investor earning multiple six figures per year in passive income

A clear allocation plan across income, equity, and tax benefits

Proven tools to define your Buy Box, vet deals, operators, and structures so you stop guessing

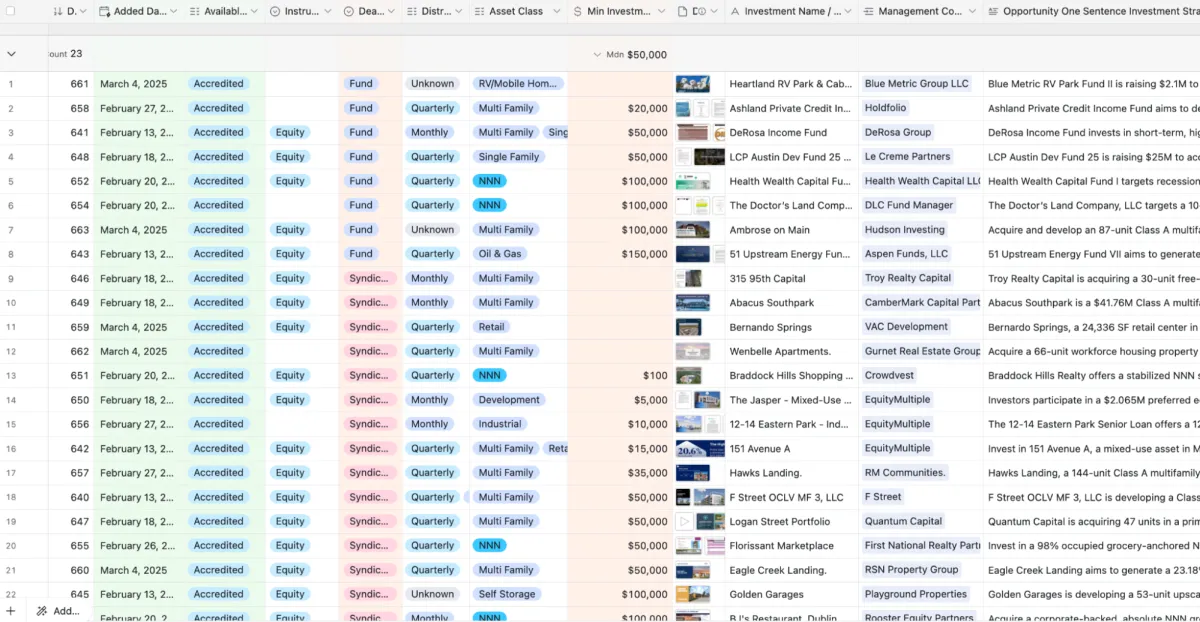

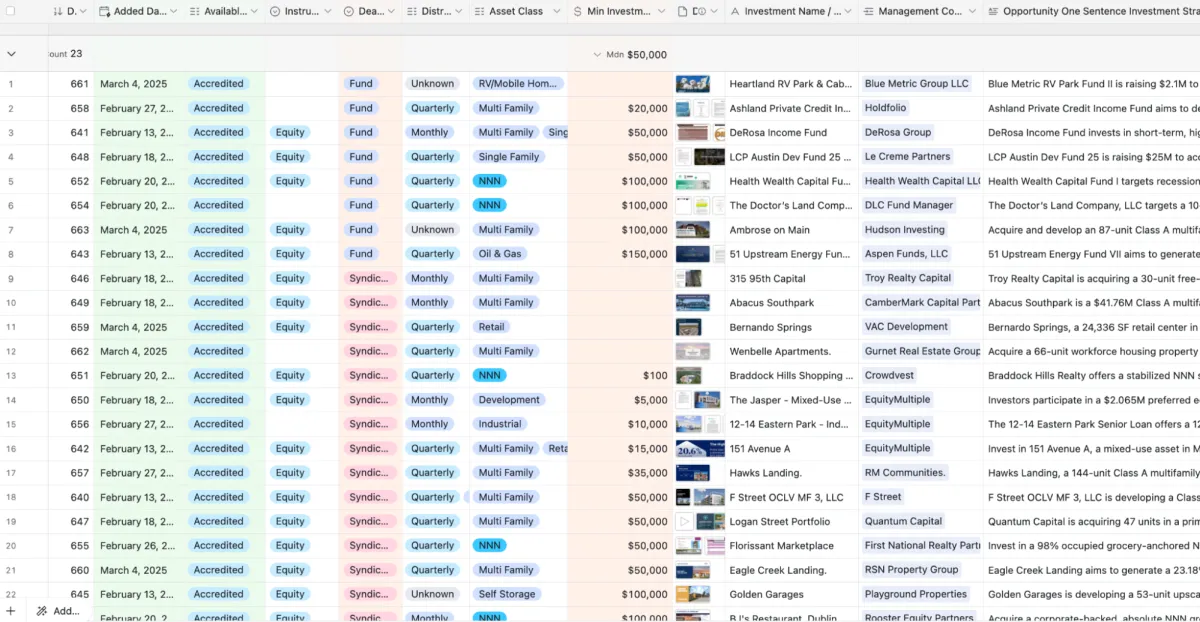

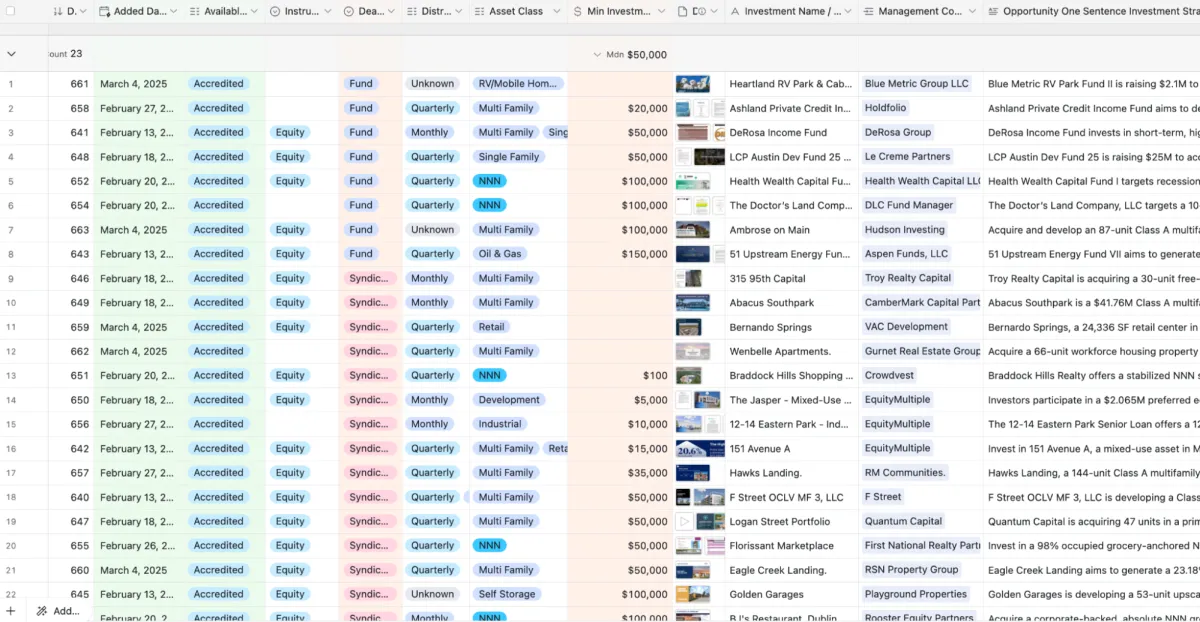

Access to a curated database of 800+ private deals you can filter by asset class, strategy, and income/tax focus

The ACHIEVE System so you can make confident invest‑or‑pass decisions for the next decade

Trusted By Executives Of:

Dear future passive earner

Let’s be honest.

“Work until 65 and live off 5%” isn’t a plan.

It’s a slow bleed.

A million dollars used to sound like winning the game.

Now you see the numbers:

Northwestern Mutual says the average American needs $1.46M just to maintain their lifestyle in retirement.

That’s a 53% jump since 2020.

By the time you’re ready to slow down, what does that number look like? $2M? $3M?

And all of it assumes you keep playing the same game:

Ride the market

Hope it’s up when you need it

Pray inflation doesn’t eat the rest

Warren Buffett said it best:

“If you don’t find a way to make money while you sleep, you will work until you die.”

You’ve already know how to make money.

The real problem now is how to make that money work for you.

If you’re reading this, you’re not looking for a get-rich-quick scheme

You want to be an informed, strategic investor - someone who makes their money work for them without being tied to a screen all day.

Maybe you’ve reviewed deals but never invested because you didn’t know how to vet the operator.

Or you’ve made investments but they stopped paying distributions...

...Or, they never cash flowed in the first place...

Maybe you’ve invested with a sponsor and you’re only getting 1% return on your deal (instead

of the double digit yields you were promised).

Either way, you might be familiar with asset classes like:

Multifamily apartments (where returns regularly hit 25% and your capital doubles in 5 years)

Multifamily apartments (where returns regularly hit 25% and your capital doubles in 5 years)

Oil & gas (where you can write off up to 80% of W-2 income)

Oil & gas (where you can write off up to 80% of W-2 income)

Private credit (funds that let you “park” money and get higher yields than money markets)

Private credit (funds that let you “park” money and get higher yields than money markets)

Mobile home parks & self-storage (investments that cashflow from day one)

Mobile home parks & self-storage (investments that cashflow from day one)

But if you’re like most investors, maybe you’re having trouble pulling the trigger.

The internet is full of people bragging about “passive income.”

Few of them could actually walk you through how they picked their last deal.

That’s the gap.

You’re surrounded by opportunities, but:

No real plan – just scattered decks, podcasts, and pitch calls

No clear Buy Box – no simple way to say “this fits what I’m building” vs “this is noise”

No reps with one checklist – so every $50K decision feels like a brand‑new leap of faith

So you do the “safe” thing and wait.

Meanwhile:

Inflation quietly taxes every dollar sitting in your accounts

You miss the income and appreciation you could have earned in solid deals

You leave depreciation and tax benefits on the table, and keep sending more of your W‑2 to the IRS than you need to

And the day your investments can actually replace your paycheck never gets any closer

That’s the #1 Reason Most People Never Build Passive Income

It’s not lack of capital.

It’s not a lack of opportunity.

It’s lack of confidence.

Confidence to commit to the right investments – and walk away from the wrong ones.

When you don’t have a clear system, you either:

Invest blindly and hope for the best, or

Stay on the sidelines and keep trading time for money.

Neither leads to financial freedom.

So nothing changes. And you're stuck:

Watching your kids grow up through pictures and videos instead of memories

Making investments that never go anywhere

Going on vacation only to deal with headaches from work emergencies

Jumping from one high-stress job to another, never finding real stability

Digging into your savings if you’re laid off

Managing rentals / Airbnbs and dealing with headaches 24/7

Always putting off that “greater purpose” in your life…

Or retiring when you’re 65 – too late to enjoy what you’ve built

You don’t fix this by finding ‘the perfect deal.’ You fix it by upgrading how you make decisions.

What If You Didn’t Have to Figure Out Passive Investing Alone?

Here’s a secret: investing isn’t about finding the “perfect” deal.

It’s about having a proven system to evaluate opportunities, avoid common pitfalls, and invest with confidence.

What if you had that system?

What if you had someone who has literally achieved what you’re trying to achieve – earning over $250,000 a year in passive income – and is a former fund manager to guide you?

What if you could:

Borrow their expertise,

Get a second set of eyes on your deals, and

Make smarter investment decisions from day one?

You would have the power to:

Choose when you work, and when you don’t

Finally say “I don’t need your paycheck”

Shift out of your very active W‑2 and actually enjoy your wealth

Spend more time with your family

Stop trading life energy for incremental returns

That’s exactly what I built Cashflow Academy to do – give you a system, real deal flow, and ongoing support while you deploy capital.

Choose when you work, choose when you don’t

Finally say “I don’t need your paycheck”

Quit your VERY active W2 and enjoy your wealth

Spend more time with your wife and kids

Find your true purpose in life outside of making money

Stop trading your life energy and time for added returns

Earn 10%-30% without an ounce of work outside due diligence now you can…

Introducing

Cashflow Academy

Your 12-Month Alternative Investing Mastermind

If you don’t want to rely on your W‑2 forever, you need more than scattered pitch decks and sponsor webinars.

You need:

A clear investment allocation plan,

A repeatable decision process you trust

And a room where you can test your thinking on real deals before you wire $50K–$1M+

Cashflow Academy is a 12‑month, hands‑on program for accredited investors where we:

Map out your passive income & depreciation goals,

Refine your Buy Box and allocation across alternative strategies

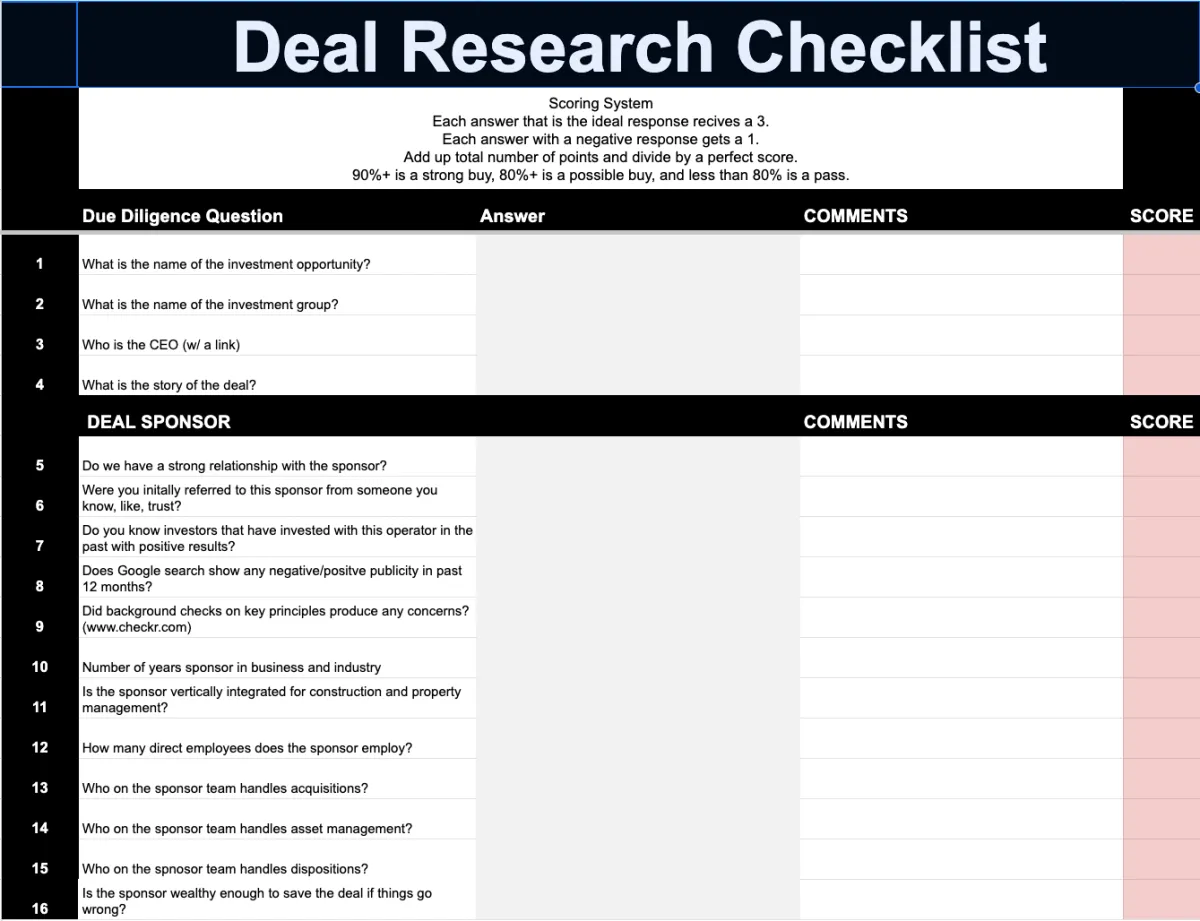

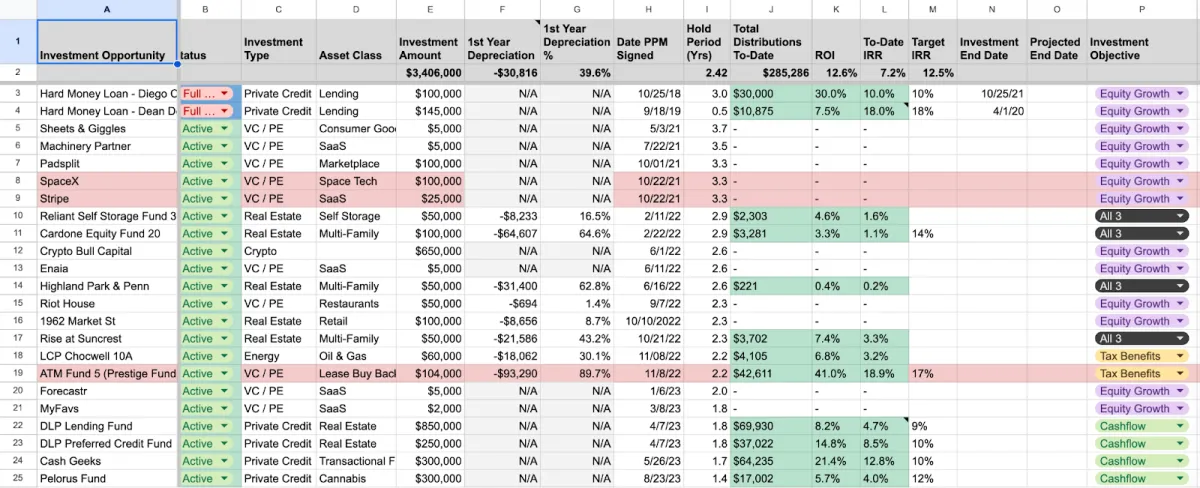

Use my tools (Buy Box Builder, Deal Research Checklist, portfolio worksheets, and the 800+ deal database) to evaluate real opportunities together using the ACHIEVE System.

In your first 90 days, the focus is simple: get real reps.

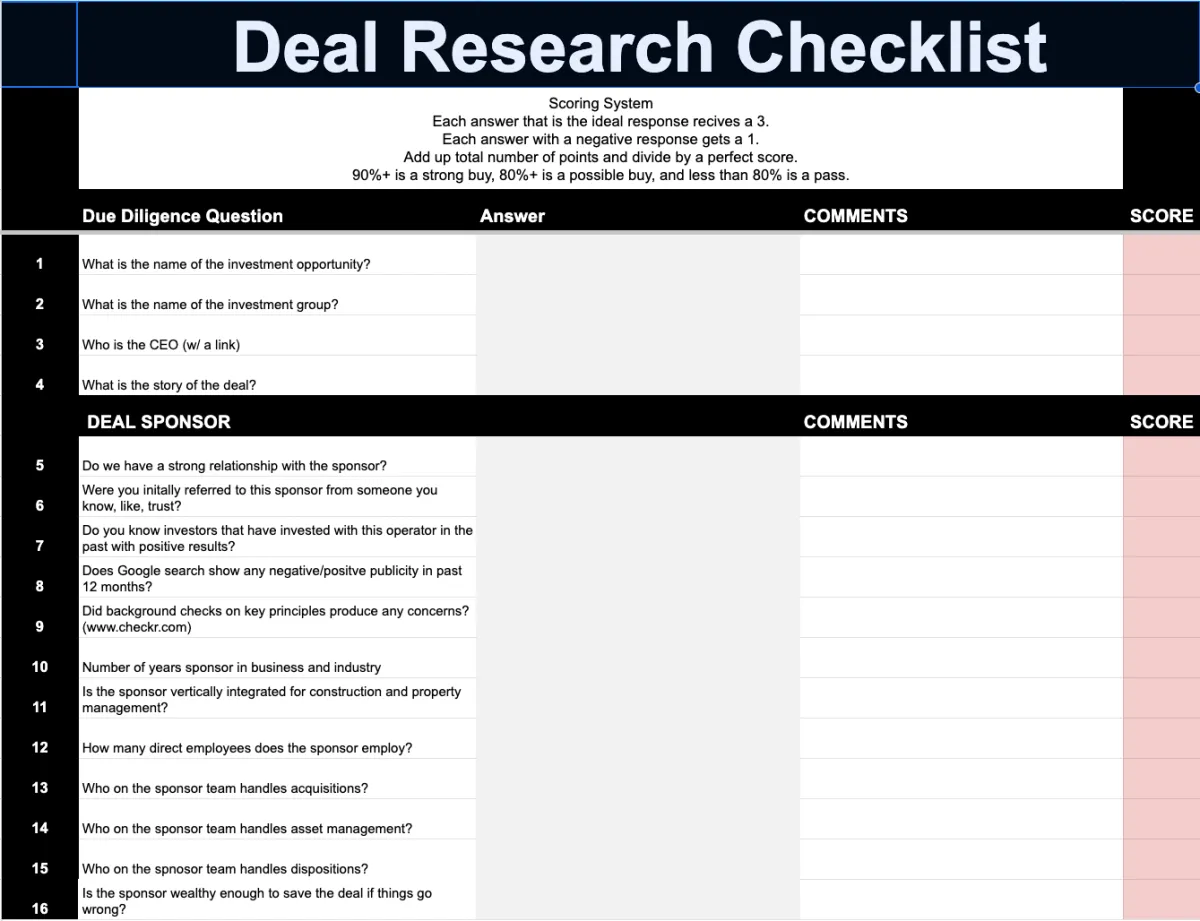

Assuming you put in the effort - you’ll fully evaluate at least 3 live deals using the Deal Research Checklist and make clear invest‑or‑pass decisions on each one.

Over 12 months, you build a repeatable process you can use on every deal you see for the next decade.

Hi, my name is Pascal Wagner.

I didn’t set out to become “the passive income guy.”

I was forced into it.

In 2021, my dad passed away, leaving my mom an inheritance…but no source of consistent income.

So, over the next 6 months, I spent $50,000+ and countless hours attending masterminds, investor dinners, and burning the midnight oil finding the right passive investments.

Ones that provided her monthly cashflow, so she wouldn’t have to sacrifice her lifestyle, healthcare, or retirement.

I accomplished that goal (she’s currently receiving $10,000+ in 100% passive income each month).

And once I felt confident enough, I moved the majority of my net worth into passive investments as well.

Today, I help other accredited investors do the same thing – but with far less confusion, trial‑and‑error, and risk.

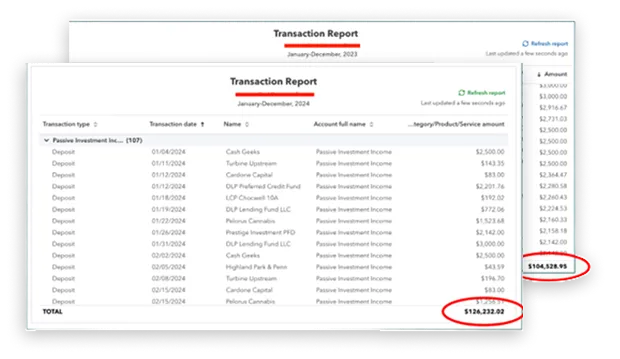

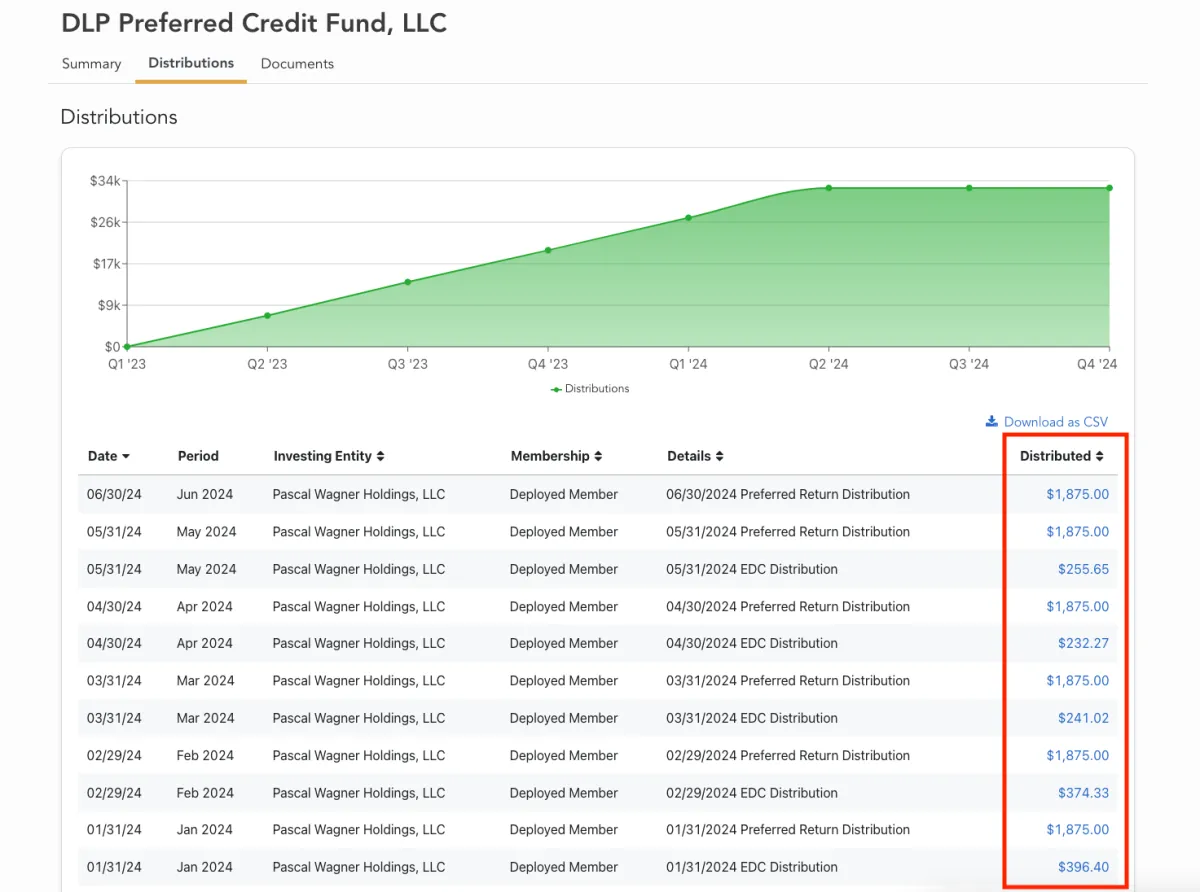

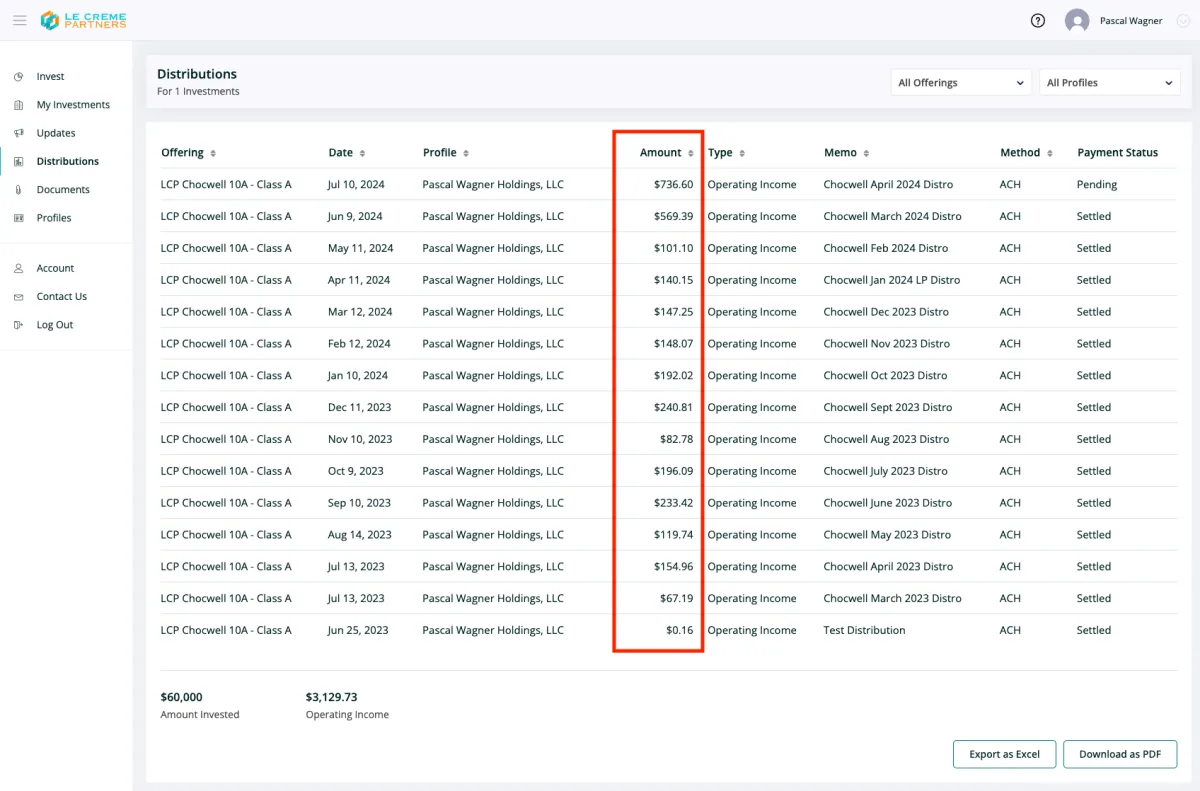

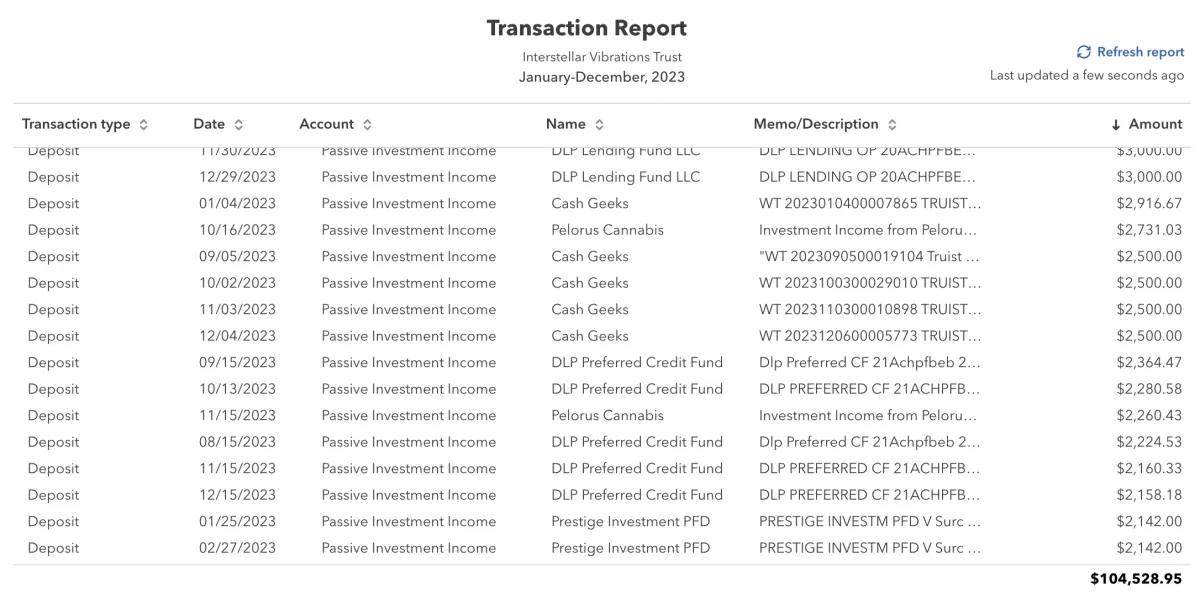

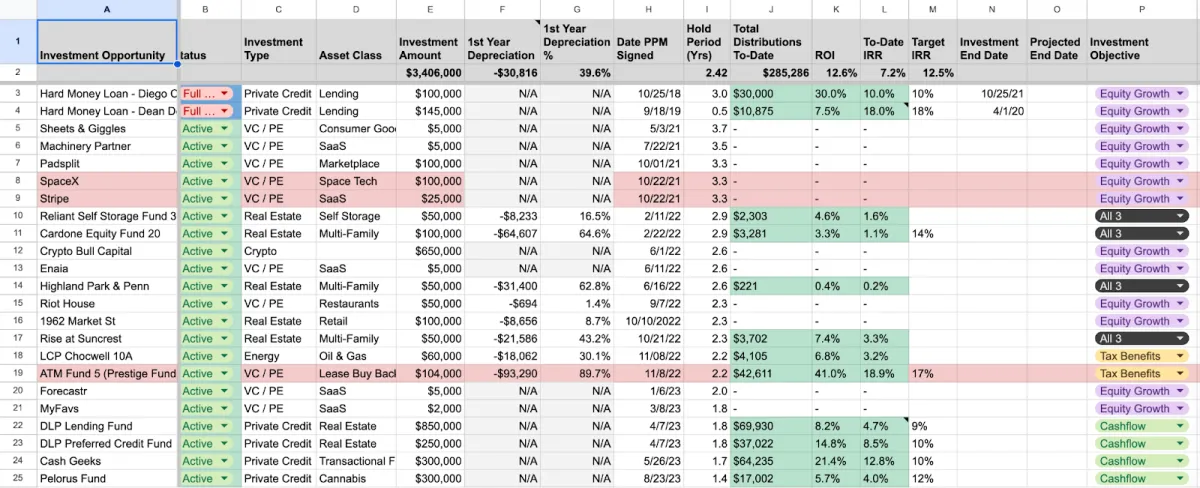

Here are earnings snapshots from my passive portfolio:

Now, I’m teaching accredited investors how to get the same results from passive investing...while removing the uncertainty, doubt, and hesitation that comes with allocating personal capital.

Who Cashflow Academy Is For

For Busy W-2 Professionals Who Want Time Freedom

You’ve worked hard to build a successful career. The paycheck is good, but the trade-off? Long hours, constant stress, and the nagging thought:

“How much longer do I have to keep doing this?” You want to build real wealth without being chained to your desk.

Active Investors Who Are Tired of Managing Tenants

You got into real estate for freedom, but instead, you’re stuck dealing with tenants, maintenance calls, and property headaches. You just want cashflow without the stress of being a landlord.

You’re ready to shift from active to truly passive investing (where your money works for you).

Entrepreneurs Who’ve Had a Liquidity Event

You built something from the ground up. And now? You’ve successfully exited.

But you don’t want to just park your money in index funds and hope for the best.

You want a plan to grow your wealth without going back to full-time hustle mode.

If you’re an accredited investor planning to deploy at least $50K into private deals in the next 12 months, this is built for you.

In Cashflow Academy,

You’ll Learn How To…

Find and evaluate operators you can actually trust

Stop relying on gut feelings, referrals, or how good their webinar felt.

Use a simple checklist to break down any private deal in minutes, not days

Whether it’s a fund or a syndication, you’ll know exactly what to look at first.

Design an allocation that matches your goals: income, growth, and tax efficiency

So every deal you say “yes” to has a clear job in your portfolio.

Decide how much capital you really need to hit your numbers

(e.g. $10K, $20K, $30K+/month in passive income or a specific W‑2 tax reduction target).

Compare funds and syndications apples‑to‑apples

So you can quickly see which ones fit your Buy Box and which ones are a hard no.

Understand what “normal” fees, terms, and structures look like

And when those details quietly tilt the deal against you.

Build a decision process you actually trust

So you’re not second‑guessing every wire or stuck in analysis paralysis for months.

The Three Pillars Of

Cashflow Academy

Cashflow Academy isn’t just more videos or a Slack group.

It’s a system built around three pillars that work together so you don’t just learn – you actually deploy capital with confidence.

Pillar 1: Education

(The ACHIEVE System)

You get the ACHIEVE System course and supporting trainings that:

- Break down how to set income, growth, and tax/depreciation targets

- Show you how to design a sensible allocation across alternatives

- Teach you how to read decks, PPMs, and structures without getting lost in jargon

No fluff, no theory for theory’s sake – just the core concepts you need to make better decisions.

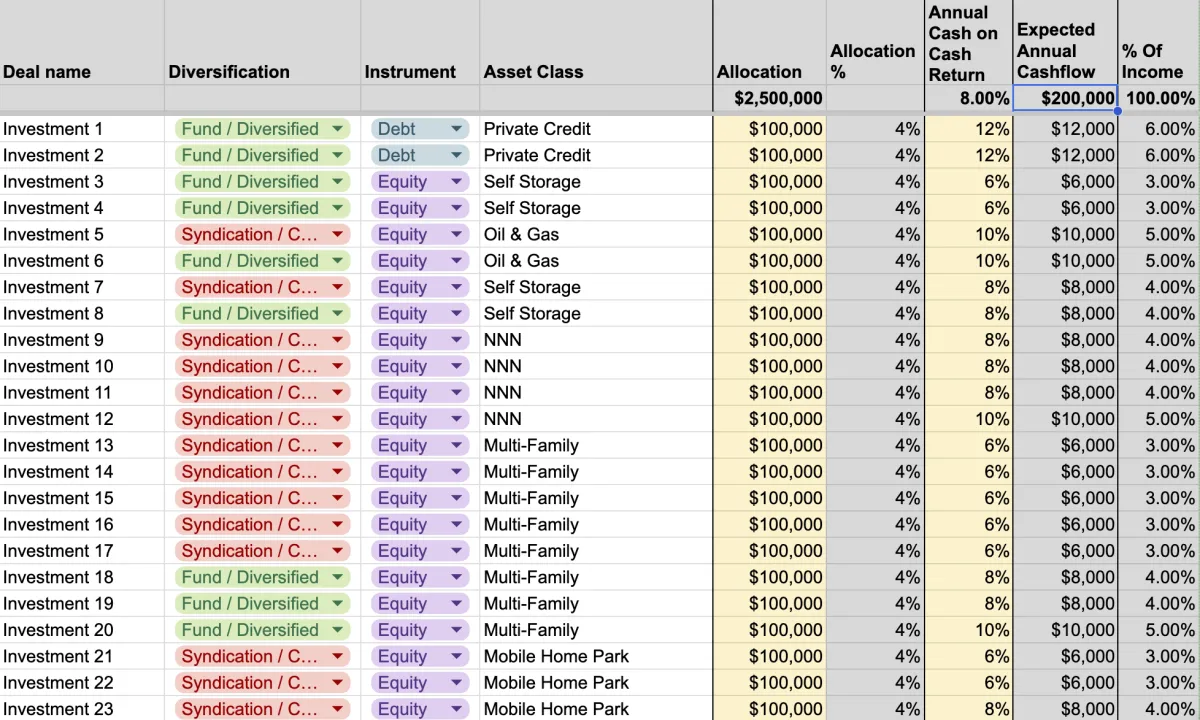

Pillar 2: Tools & Deal Flow

You get the exact tools and deal flow I use in my own investing:

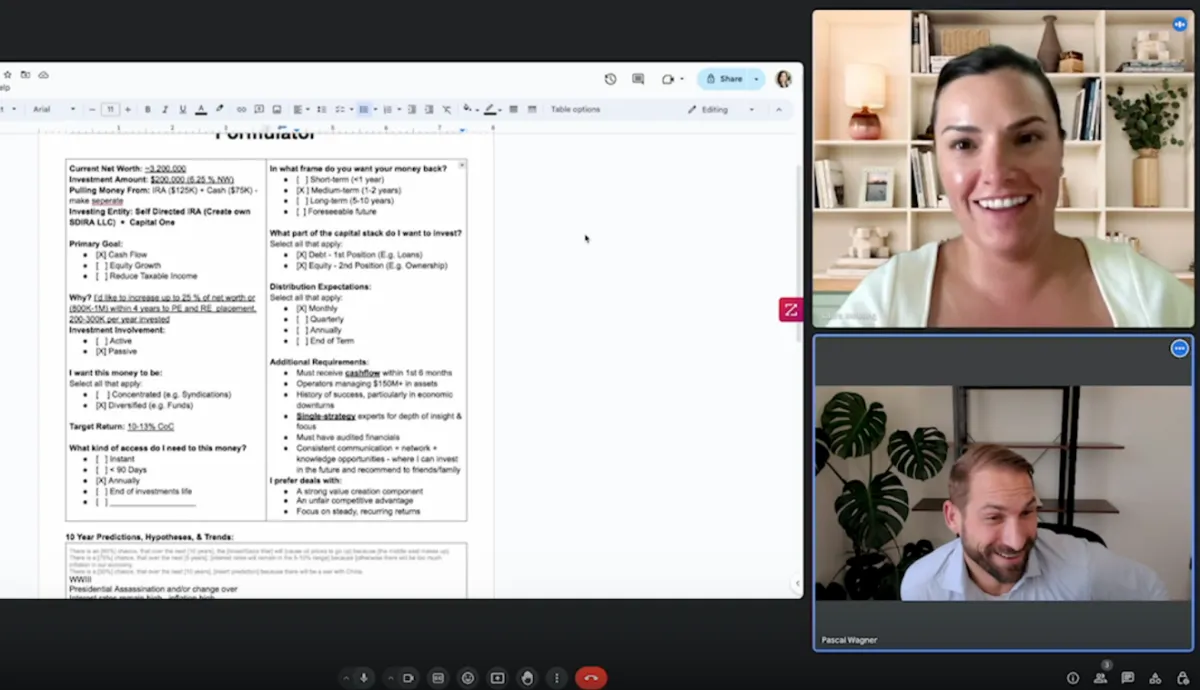

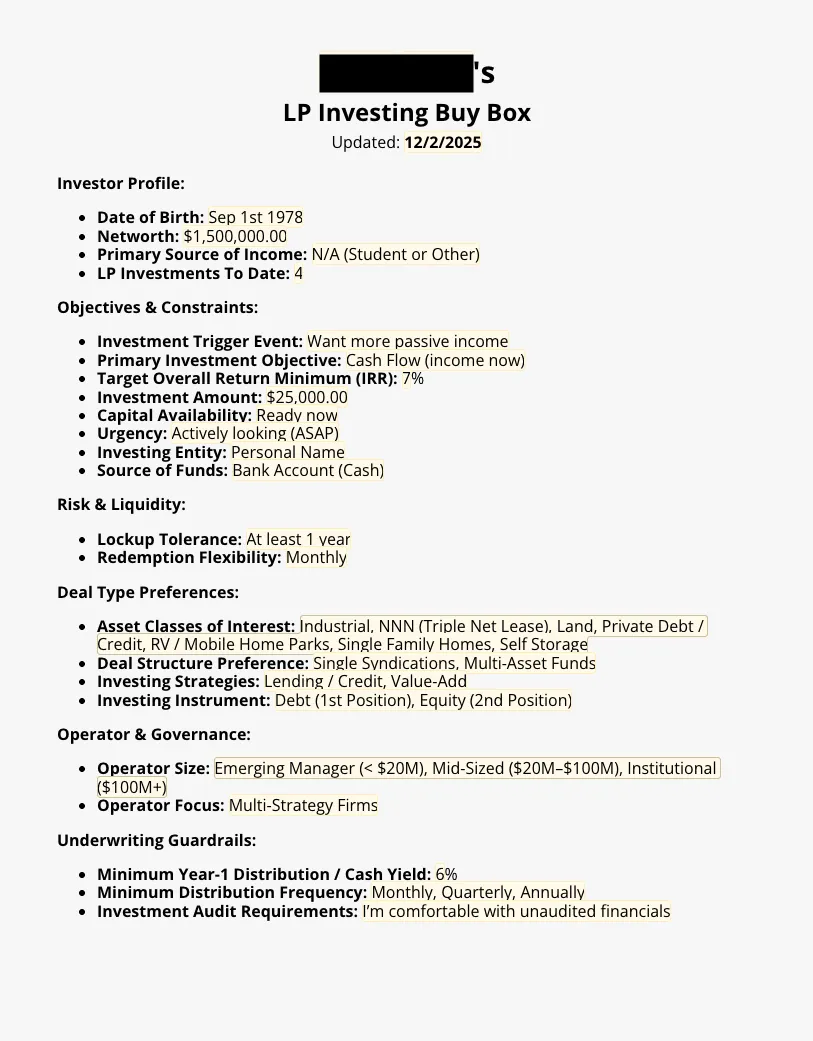

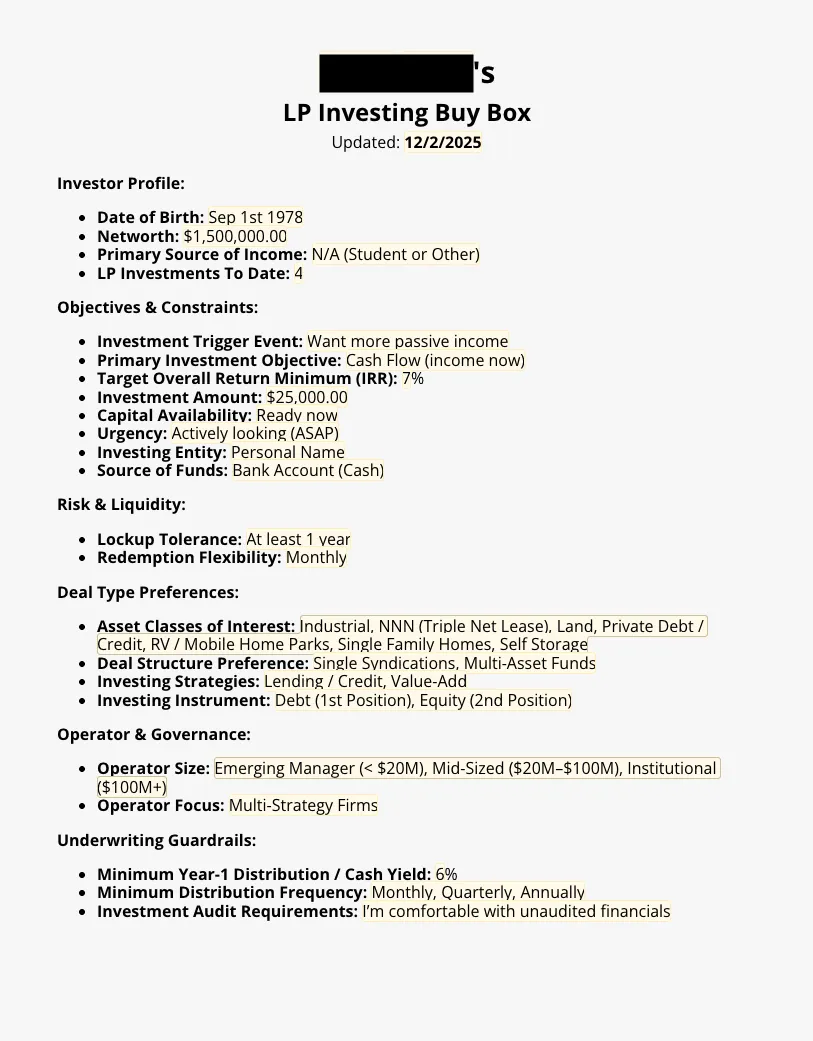

- Buy Box Builder to define what’s in, what’s out, and what’s “maybe”

- Deal Research Checklist to evaluate operators, structures, and numbers before you wire

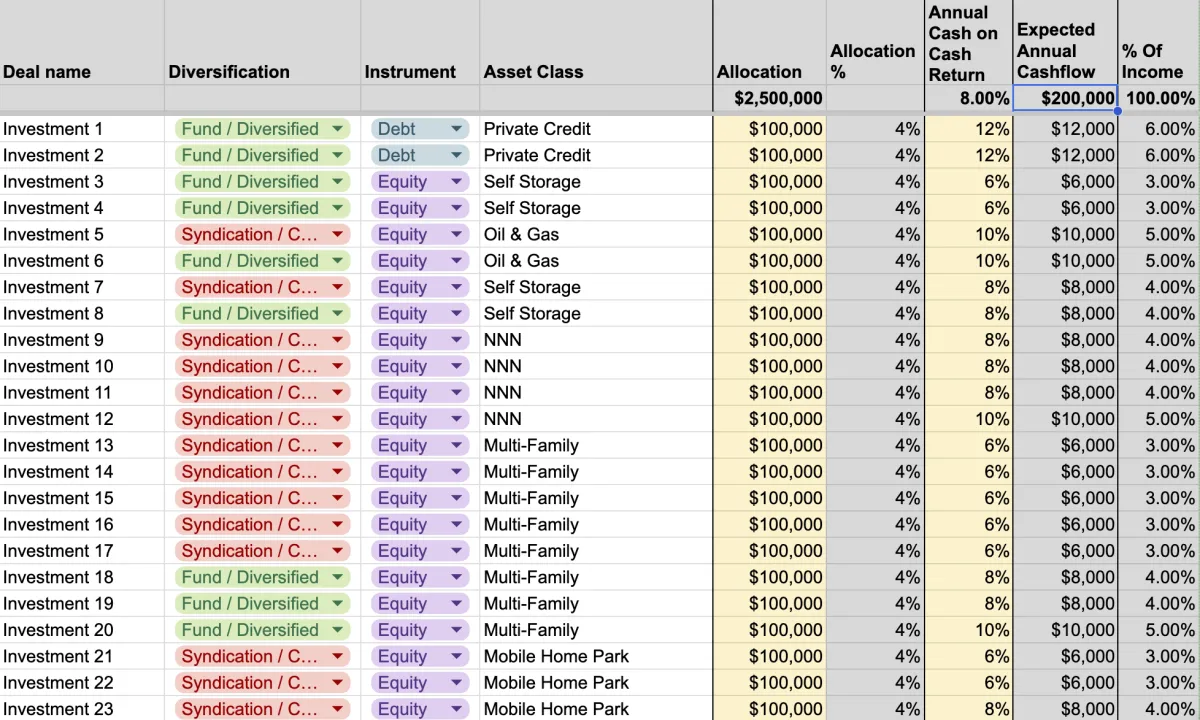

- Asset Allocation Worksheet to see your current vs target portfolio

- Airtable Deal Database with 800+ current and historical deals you can filter by asset class, strategy, and income/tax focus

The right tools turn “random pitches” into a real pipeline you can manage.

Pillar 3: Live Support & Accountability

Information and tools aren’t enough. You also get:

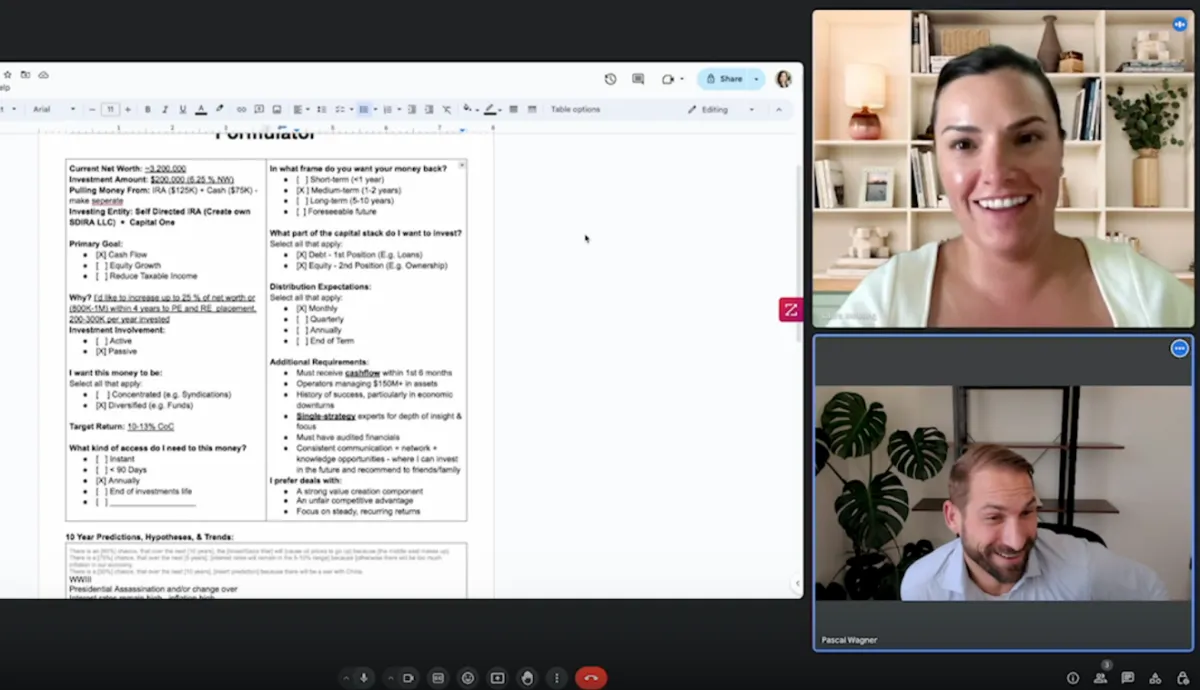

- A 60‑minute 1:1 Gameplan Call to map your next 12 months

- Weekly office hours / deal hot seats so you can bring live deals and see others do the same

- A clear 90‑day Sprint with milestones, so you know exactly what to focus on first

You’re not doing this alone in your head. You have a room, a framework, and a guide keeping you honest while you deploy.

What We’ll Work Through Together In Your First 90 Days

Your first 90 days inside Cashflow Academy are about getting real reps, not binging theory.

If you came in through the LP Starter Kit, you’ve already taken a first pass at your Buy Box. Here we refine it. If you came straight into Academy, we build it from scratch.

Milestone 1 – Get Oriented & Set Targets

(Your Gameplan call + early office hours)

Clarify where you are now vs. where you want to be (income, growth, and tax/ depreciation goals).

Review your current portfolio and honest risk tolerance.

Identify the biggest barriers that have kept you from taking action.

Assign key pre‑work: mapping your current allocation, target allocation, and first pass at your thesis.

Outcome: You know exactly where you’re starting from, what’s holding you back, and what we’re aiming at together.

Milestone 2 – Build (or Refine) Your Investment Framework & Buy Box

If you came from Deal Flow, you’ve already filled out the Buy Box Builder once. Here we refine it. If you came straight into Academy, we build it from scratch.

Walk through your Asset Allocation Worksheet and your Buy Box.

Decide how much weight you put on cashflow, appreciation, and tax benefits.

Turn that into a clear Buy Box: what’s in, what’s out, and what’s “maybe.”

Start applying that filter to real decks inside Deal Flow or the deals you’re already seeing.

Outcome: You have a written, working framework you can use to quickly eliminate bad fits and focus your time on high‑quality opportunities.

Milestone 3 - Compare Real Deals

(Not Hypotheticals)

Whether the deal comes from our database or your own pipeline, you bring actual opportunities into office hours:

Compare multiple investments against your Buy Box and each other.

Read key metrics (cash‑on‑cash, IRR, downside scenarios, fee structures) in context.

Spot marketing hype vs. real risk‑adjusted returns.

See how other members are thinking through their deals, so you can piggyback on their questions and insights.

Outcome: You know how to break down a deal, compare options, and recognize red flags before you wire money.

Milestone 4 – Run A Deal End‑To‑End Through The Checklist

This is where you get the full‑rep muscle memory.

Pick at least one live deal you’re seriously considering.

Use the Deal Research Checklist to fill out everything you can from decks, PPMs, and public info.

Bring your gaps and questions into office hours or your 90‑minute Deal Evaluation Session.

Vet operator credibility, alignment, and downside scenarios.

Discuss cashflow, equity, and tax impact of saying yes – or walking away.

Outcome: You’ve taken at least one real deal from “interesting” to a clear invest‑or‑pass decision, using a process you can repeat.

Milestone 5 – Turn This Into A Habit

(And Leverage The Room)

Over the rest of your first 90 days – and the months that follow:

You keep sharpening your Buy Box as you see more deals.

You hear dozens of deals in office hours (not just your own) and shortcut your learning by watching others get grilled.

You start to see patterns: which structures you like, which operator behaviors are red flags, which terms are non‑negotiable.

You decide how many deals and how much capital you realistically want to deploy over the next 12 months – and we keep you honest against that plan.

Outcome: This stops being “a course you took” and becomes how you invest: a simple, repeatable habit supported by a room full of serious investors and a framework you trust.

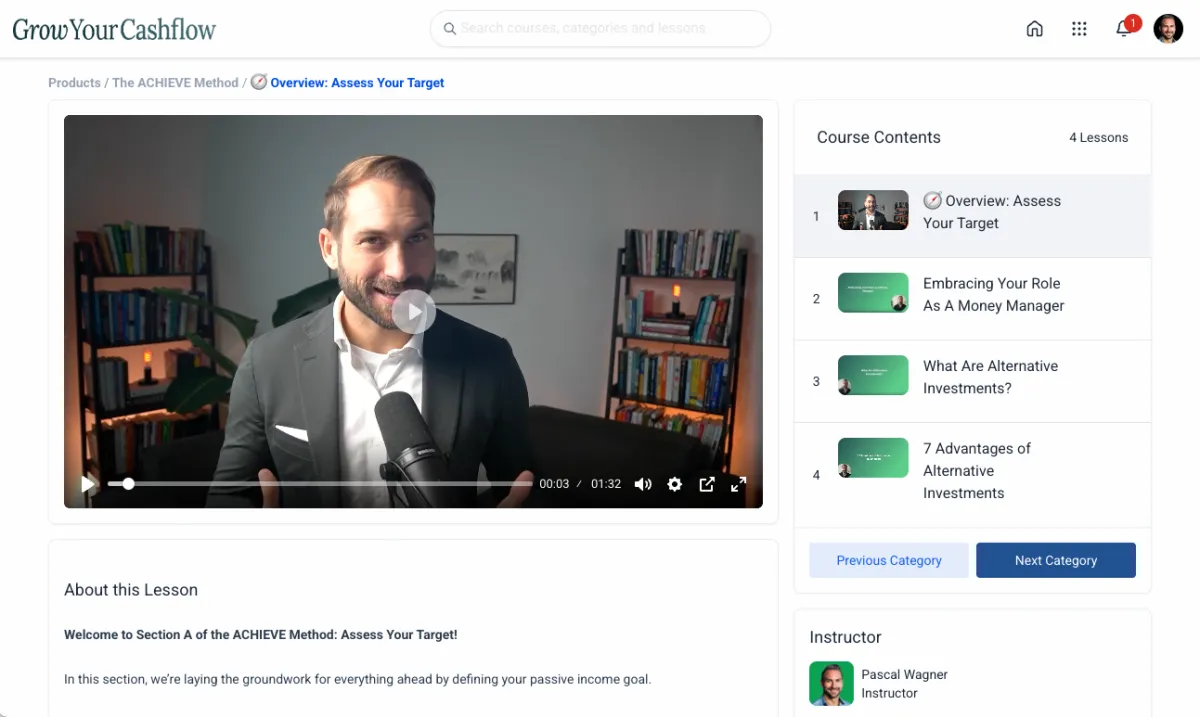

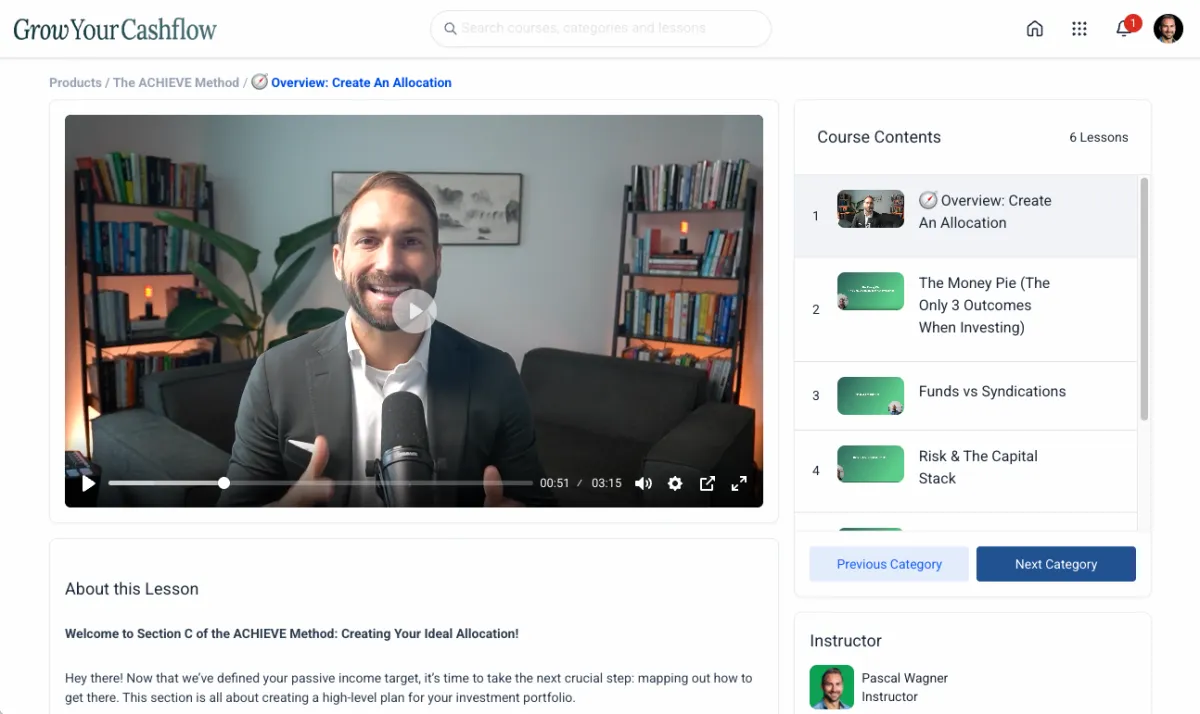

The ACHIEVE System –

Included In Your Membership

The ACHIEVE System is the 7‑step framework we’ll keep coming back to over your 12 months. It turns random decks and webinars into a clear pipeline from goal → thesis → deal → decision.

A – Assess Your Targets

Define exactly what you’re solving for across income, growth, and tax/depreciation, instead of chasing whatever comes across your desk.

Clarify your personal “enough” number

Decide what percentage of your portfolio should live in alternatives

Get clear on your time horizon and risk tolerance

C – Create Your Allocation

Map your current & future portfolio – how much goes to income, growth, and tax‑advantaged buckets.

See where you’re over/under‑exposed today

Understand the funds vs syndication tradeoffs

Decide where in the capital stack you’re actually comfortable putting money

H – Hone Your Thesis (Build Your Buy Box)

Turn vague preferences into a written Buy Box.

Use your Buy Box to define what’s in, what’s out, and what’s “maybe”

Understand the main value‑creation strategies in the deals you’re seeing

Quickly match real deals to your Buy Box (or eliminate them)

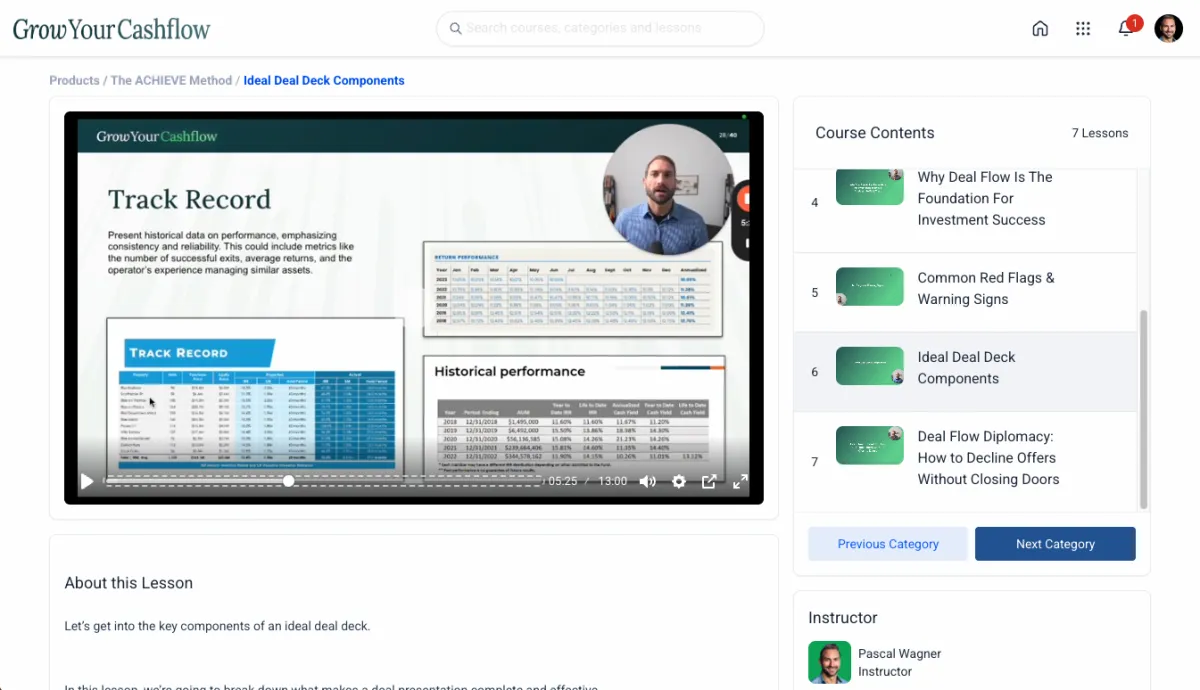

I – Identify Opportunities

Build and manage a real deal pipeline that matches your Buy Box.

Use Deal Flow + your own sources to create consistent, qualified deal flow

Learn the components of a strong deal deck

Spot common red flags and politely say “no” without burning bridges

E – Evaluate Deals (Deal Research Checklist)

Run deals through a repeatable due‑diligence process instead of winging it.

Use the Deal Research Checklist to evaluate operators, structures, and financials

Pull everything you can from decks, PPMs, and public info before you ever get on a call

Separate marketing hype from true downside risk and misalignment

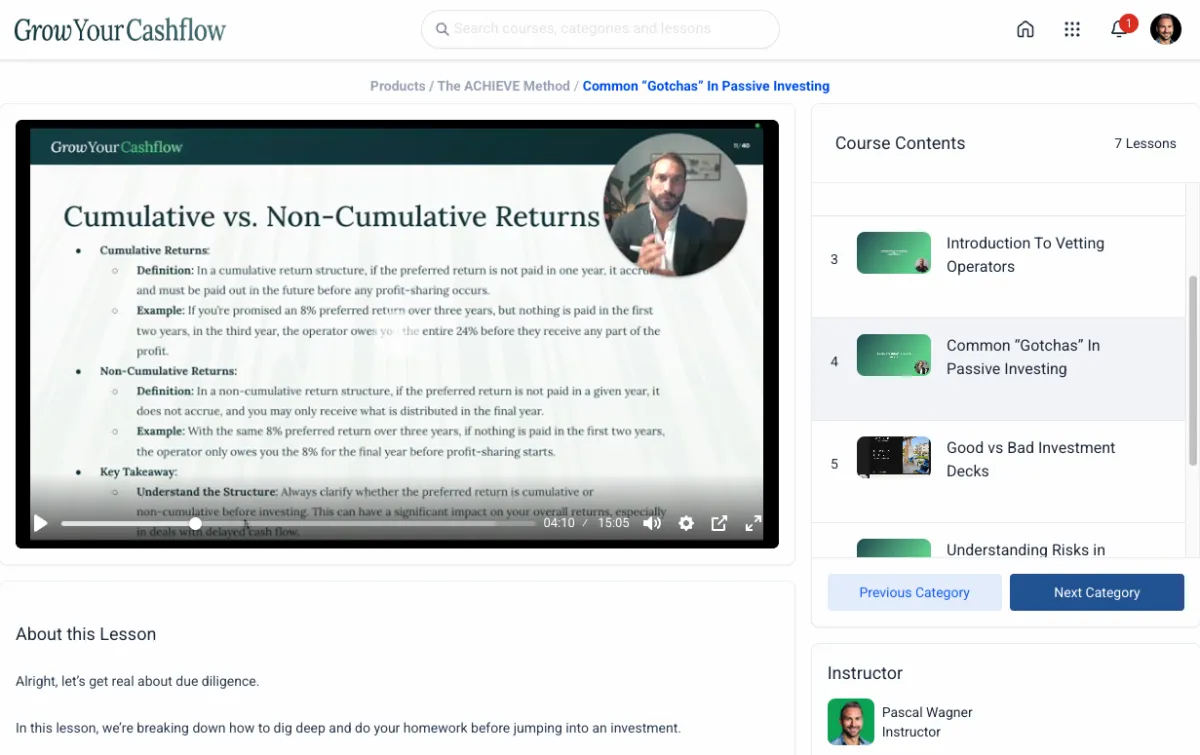

V – Validate With Feedback

Pressure‑test your thinking before you wire.

Learn how to run reference calls that actually surface truth

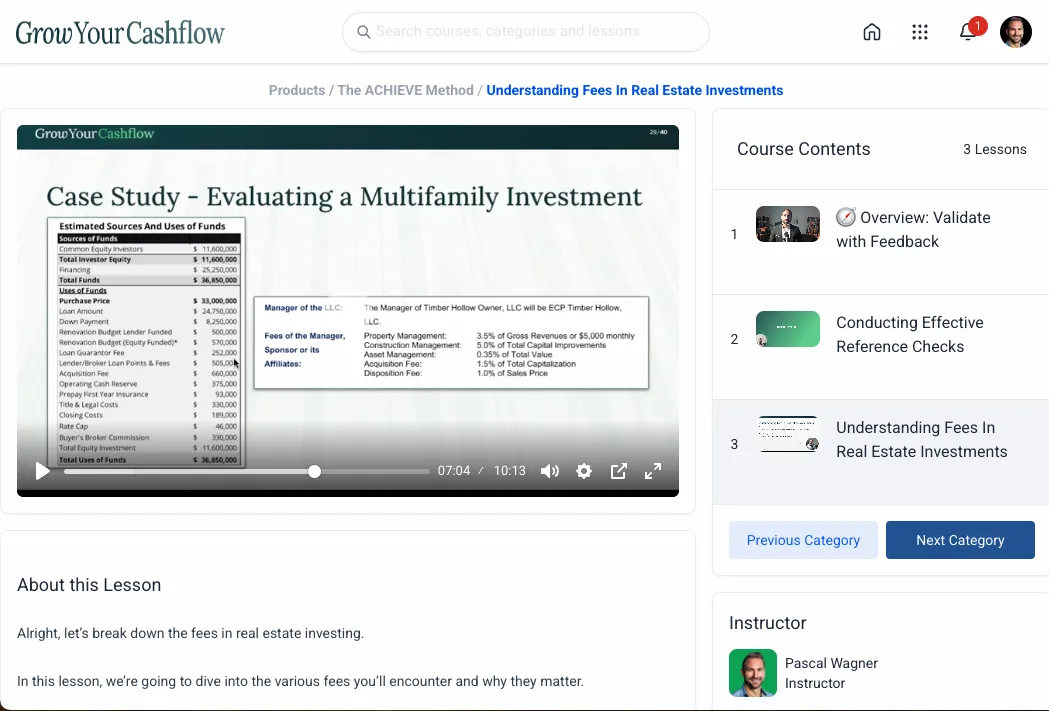

Understand how pros think about fees and incentives

Use weekly office hours to get real‑time feedback on live deals and your checklist findings

E – Execute The Plan

Confidently move from “this looks good” to “I wired” – and keep yourself protected and organized.

Make sure your paperwork, entities, and accreditation are in order before you send funds

Use our methodology to reduce fraud risk and wire‑transfer mistakes

Adopt simple tracking so your investments and K‑1s are organized for tax time

You get full access to this training for your initial 12‑month term

(and for as long as you remain an Alumni member after that).

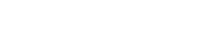

Watch a free sample lesson

“Asset Class Review"

From the ACHIEVE System (Module 3)

In this lesson, I walk through the major alternative asset classes I actually use – multifamily, self‑storage, private credit, oil & gas, and more – and show you:

What job each one can play in your portfolio (income, growth, tax)

The real pros/cons beyond the marketing deck

How to start deciding which lanes make sense for you instead of chasing every new shiny thing

This is one of 8+ hours of on‑demand training you get inside Cashflow Academy.

If this resonates, you’ll know you’re in the right room.

Plus, you get the tools you need to execute your investment plan.

Get powerful tools to remove guesswork and make confident investment decisions every step of the way.

Buy Box Builder

Define what’s in, what’s out, and what’s “maybe,” so you can filter deals fast and only spend time on opportunities that actually fit what you’re building.

Deal Research Checklist

Run the key questions and numbers through a structured checklist so you can vet operators, structures, and financials like a pro before you ever wire a dollar.

Asset Allocation Worksheet

See exactly where your money is today and how to rebalance across income, growth, and tax/depreciation so every deal has a clear job in your portfolio.

Airtable Deal Database

Browse real investment opportunities, compare deals side‑by‑side, and apply your Buy Box in real time instead of reacting to whatever lands in your inbox.

BONUS #1:

1:1 Deal Evaluation Session

In this 90-minute bonus session, I’ll help you evaluate a current deal you’re considering.

Just bring the deal into our meeting and I’ll walk you through how to start the due diligence process and any red flags to watch out for.

This bonus session is good for up to 12 months after you complete Cashflow Academy!

BONUS #2:

The Ultimate

Tax Prep Checklist

The more investments you make, the more critical it becomes to keep track of them all and ensure proper tax reporting for the IRS.

My Ultimate Tax Prep Checklist will save you hours of headaches by helping you organize and manage your tax documents. You’ll know exactly what tax forms you’ve collected from each fund manager, which ones you’re still missing, and who to contact to get everything settled.

Just follow the steps I outline, and you’ll make your tax prep neat and tidy.

12 months of access to the full course, tools, and recordings

(and ongoing access if you choose to continue as an Alumni member).

Designed For Busy People

(Not Full‑Time Analysts)

You don’t have 20 hours a week to become a spreadsheet jockey.

You’ve got a career, a business, a family – and a limited amount of time and attention you can put into this.

That’s exactly how Cashflow Academy is built:

→ Short, focused calls

Weekly office hours are practical working sessions, not 90‑minute lectures. You come with deals and questions, we get to work.

→ Real‑world reps, not busywork

The “assignments” are things you needed to do anyway: sharpen your Buy Box, evaluate live deals, talk to operators, organize your investments.

→ Leverage from the room

You learn just as much from watching other members’ deals get picked apart as you do from your own, so every call multiplies your reps.

Over 12 months, those small, consistent blocks of time turn into:

→ A clear plan

→ A repeatable decision process

→ And a stack of deals you actually feel good about wiring into

You’ve already proven you can work hard. This is about working smart on the investing side – without turning it into a second full‑time job.

You’re Not The First To Feel Unsure — You’re Just The Next To Figure It Out.

Here's how others have used our education, tools and support to take action.

Philip Kopesdy

Strategic Account Executive

"I Finally Got A Clear Roadmap"

"I Had Been Piecing Things Together For Months. This Program Gave Me A Framework, Templates, And A Mentor To Cut Through The Noise"

Kathleen Marcell

Customer Success & Operations Executive

"I Now have a lot more confidence"

"I have A much better Framework for Reviewing deals And Asking better questions when talking with Sponsors"

Ian Johnston

Healthcare Professional

"This Program Pulled It All Together For Me"

"Between the deal flow, the course, and your podcast, I finally got the reps I needed to feel confident reviewing deals and asking the right questions"

25+ Success Stories & Counting

These are busy W‑2 professionals, operators, and founders who were sitting on cash, circling deals, and afraid to make a six‑figure mistake. They used Cashflow Academy to get a clear plan, a simple process, and enough reps to finally start deploying with confidence.

Seen enough to know this is the room you want to be in?

Already Done A Few Deals?

You’re Not “Too Advanced” For This.

Most members aren’t brand‑new to money or investing.

They’re:

→ High‑earning W‑2 professionals

→ Entrepreneurs who’ve had a liquidity event

→ Active investors who’ve already done a few real estate or fund deals

They’re great at making money and have already pulled a few triggers.

What they don’t have is a simple, repeatable decision process they trust.

So instead of:

→ Random one‑off wins they’re not sure they can repeat, or

→ Scaling a portfolio they secretly feel was built on gut feeling,

We build a system they can use on every private deal from here on out.

If you’re:

→ Smart and experienced in life and business,

→ New(ish) to alternatives or you’ve already done some deals,

→ Ready to become the kind of investor who can look at a private offering and say,

“I know exactly why this is a yes or a no for me,”

…you’re exactly who this is for.

My 90‑Day Decision

Confidence Guarantee

I designed Cashflow Academy to help you build a six‑figure passive income plan – and feel confident executing it.

That’s why I back it with a hybrid guarantee:

1. 30‑Day Fit Guarantee

Attend your Gameplan call and your first two office hours. If you don’t feel like the program is worth every penny, email me within 30 days and I’ll give you a full refund. No hassle.

2. 90-Day Confidence Guarantee

If you complete the Gameplan call, attend or watch at least six office hours, complete your Buy Box Builder, and run at least one real deal through the Deal Research Checklist – and you still don’t feel materially more confident making investment decisions – I’ll either keep working with you 1:1 until you do, or give you a full refund. Your choice.

I can’t control markets, but I can control whether this program makes you a decisively better LP. If it doesn’t, you shouldn’t pay – and I’ll make it right.

A Serious Room For

Accredited Investors Only

Cashflow Academy is intentionally only for accredited investors.

That means you meet at least one of these:

→ Earn $200K+ per year as an individual (or $300K+ combined if married), or

→ Have a $1M+ net worth excluding your primary residence

Why the hard line?

→ The types of private deals we’ll be working through – 506(c) funds, syndications, and other alternatives – are legally limited to accredited investors.

→ The conversations in office hours assume you have real capital to deploy in the next 12 months. That’s how we keep the room focused and valuable for everyone.

If you’re not accredited yet, this specific program isn’t the right fit right now.

If you’re on your way there and want to prepare:

→ Stay on the email list

→ Go through the Starter Kit and 7‑Ways guide

→ Use the free content to level up how you think about deals

Then, when you’re ready to deploy $50K–$250K+ into private alternatives, you’ll already be ahead of the curve – and we can talk about joining a future cohort.

The Real Cost Of Waiting

If you’re aiming to build a seven‑figure alternative portfolio, you face two real threats:

1. Making the wrong investment and losing six figures

2. Freezing up and leaving capital idle

Cashflow Academy is designed to help you avoid both:

- A clear framework so you can say no to bad or misaligned deals

- Weekly support so you can say yes to good ones without second‑guessing every step

And there’s a third threat most people ignore: the math of not deploying.

- At 5% inflation, $1M in idle capital is losing about $50,000/year in purchasing power – roughly $137 per day

- If you could reasonably earn 10% in solid alternatives, that same $1M could be generating $100,000/year in returns

Together, that’s roughly $150,000 of annual drag – the combined hit of inflation and missed opportunity.

Sitting on cash isn’t a neutral choice. It’s a compounding disadvantage.

Meanwhile, the investors you want to emulate are:

- Allocating into private deals with real cashflow and tax benefits

- Letting good decisions compound – each one building on the last

- Systematically improving their process with every deal they evaluate

If you’re serious about using alternatives to build income and protect your wealth, doing nothing is the riskiest option on the table.

Frequently Asked Questions

How much time do I need each week to get value from this?

Most members spend 1–3 hours per week on this:

~60 minutes for office hours (live or replay)

~60–90 minutes applying the checklist to real deals or refining their Buy Box

You don’t need a second full‑time job. You do need a small, consistent block of time each week where you treat your investing like it matters.

Do you tell me exactly which deals to invest in?

No. I don’t manage your money or give individualized investment advice.

What I do is:

→ Show you how I evaluate operators, structures, and risk

→ Give you tools and a framework to break down any deal

→ Help you pressure‑test your thinking before you wire

You always make your own decisions. The point is to make those decisions with a lot more clarity and a lot less guessing.

Is this only for real estate? What about other asset classes?

We cover and see deals across:

→ Real estate funds and syndications (multifamily, self‑storage, MHP, etc.)

→ Private credit / debt funds

→ Oil & gas and other income / depreciation‑heavy opportunities

The ACHIEVE System works across asset classes. We always start from your goals (income, growth, tax) and then decide which lanes make sense for you.

What if I can’t attend the office hours live?

Every office hours session is recorded and posted in the portal.

Plenty of members:

→ Submit questions or deals ahead of time, then

→ Watch the replay on their own schedule

Live is best if you can make it. But you won’t miss the content if you have a tight calendar.

I’ve already done a few private deals. Is this still for me?

Yes—most members have done something before they join:

→ A couple of syndications

→ A fund or two

→ Maybe some active real estate

The common pattern is: “I’ve done some deals, but I don’t have a system. I don’t know if I got lucky, and I don’t want to scale a process I don’t fully trust.”

If you’re brand new, you’ll learn it right the first time. If you’re experienced, you’ll clean up and formalize what you’ve been doing.

What if I don’t find any deals I like? Do I still get value?

Yes. “No” is often the most valuable decision you can make.

Inside Academy, you’ll:

→ Learn how to quickly eliminate bad or misaligned deals

→ Avoid wiring money into structures you don’t fully understand

→ Build a filter that saves you from six‑figure mistakes

Sometimes the biggest ROI is the money you don’t invest.

What if my plans change and I can’t deploy capital in the next 12 months?

he program works best if you’re planning to deploy at least $50K–$250K over the next year. That’s how the reps cement.

If your situation changes mid‑year (job change, business shift, etc.), you’ll still have:

→ A clear framework

→ A refined Buy Box

→ Tools and checklists you can reuse

You can always slow down, but joining too early—when you know you won’t be investing at all—is usually not ideal. If that’s you, stay on the list, work through the Starter Kit, and apply when you’re closer to deployin

How many people are in the program? Will I get lost in a crowd?

This isn’t a 500‑person webinar.

Office hours are intentionally kept to a size where:

→ You can bring your own deals

→ You’ll get direct feedback over the course of the year

→ You’ll actually know who else is in the room

Exact numbers vary by cohort, but if at any point the calls feel too crowded, I add additional time slots.

When does my 12 months start?

Your 12 months start the day you enroll.

From there:

→ We schedule your Gameplan call

→ You get immediate access to Deal Flow, the ACHIEVE course, and past office hour recordings

→ You can start attending live office hours the very next available call

What happens after my 12 months are up? Can I keep coming to office hours?

Yes – if you’re getting value from the room, I want to make it easy to stay.

Your initial tuition covers 12 months of:

- Weekly office hours

- Deal Flow Membership access

- The ACHIEVE System course, tools, and recordings

After that, you’ll have the option to continue as an Alumni member at a much lower monthly rate (around $197/month).

As an Alumni, you keep:

- Access to weekly office hours

- Ongoing Deal Flow access

- Access to any new tools or templates I add to the program

A couple of important notes:

- The Alumni rate is only available to current Academy members who roll straight into it.

- If you leave and decide to come back later, you’d need to re‑join at the full Academy tuition.

It’s intentionally priced to reward people who want to stay engaged in the community and keep sharpening their decision‑making over time, while still valuing my time and the room.

For Liquidity‑Event Investors

Sitting On Idle Cash

Cashflow Academy is the core offer. For most investors, the 12‑month program with weekly office hours and Deal Flow is exactly what they need.

But if you’ve had a recent liquidity event and you’re sitting on a large balance you haven’t allocated yet, every month you wait is:

→ More idle cash earning little or nothing

→ More missed income and appreciation in solid deals

→ More tax you’re paying that could be offset with the right structures

For a small group of members, I offer an Academy + 90‑Day 1:1 Intensive bundle.

In the Intensive, you get:

Everything in Cashflow Academy

+ 5 private 1:1 sessions with me over 90 days

+ Priority access to me between calls (email / text / DM) for deal questions

+ A private booking link for short “spot‑check” calls when something urgent comes up

It’s ideal for:

→ Founders and senior executives who’ve recently had a liquidity event (sale, secondary, big RSU/bonus)

→ Sitting on mid‑six figures or more they want to move into alternatives

→ And who would rather compress 12 months of trial‑and‑error into one focused 90‑day sprint with me

Investment:

Cashflow Academy on its own: $5,000

Cashflow Academy + 90‑Day 1:1 Intensive: $14,000 total

(The 90‑Day Intensive component is a $9,000 add‑on to Academy)

Because of the time involved, I only take on a limited number of Intensive clients at any given time.

We’ll talk on your Gameplan Call about whether Academy alone or the Academy + Intensive bundle is the better fit for you.

You can’t enroll in the Intensive without that conversation.

Tuition & Next Steps

Your tuition includes 12 months of full access to Cashflow Academy – weekly office hours, Deal Flow Membership, the ACHIEVE System course, all tools, and bonuses.

Tuition options:

→ Pay in full: $5,000 today

→ Payment plan: 3 monthly payments of $2,000 (total $6,000)

Most members choose pay‑in‑full to save $1,000, but the plan is there if spreading payments out feels easier on cashflow.

Near the end of your first 12 months, you’ll also have the option to continue as an Alumni member at around $297/mo if you want to keep office hours and Deal Flow access. That decision is completely up to you then.

Apply below to see if you qualify and book your Gameplan Call.