😞 Still STRUGGLING To VET DEALS?

Vet Deals With Confidence & Build Your 6-Figure Passive Income Plan in 90 Days

...so you can work fewer hours, spend more time with family, and finally collect a check without the headaches.

Spots are limited and filled on a first-come, first-served basis.

In this exclusive mentorship program, you’ll get:

1-on-1 coaching with a fund manager earning $250K/year in passive income

A personalized roadmap to $10K–$30K+/month in passive cashflow

Proven tools to vet deals, operators, and asset classes like a pro

A full investing system (the A.C.H.I.E.V.E. Method) so you can stop guessing

The clarity and confidence to start investing—and start collecting checks in 90 days or less

Trusted By Executives Of:

Dear future passive earner

Let’s be real.

Working until 65 and living off 5% from savings isn’t financial freedom.

It’s survival.

And these days, $1 million isn’t enough to quit work comfortably anymore.

According to Northwestern Mutual, the average American now needs $1.46 million to maintain their lifestyle after leaving the office.

That’s a 53% increase since 2020.

Can you imagine where that number will be in the next 5 or 10 years?

Warren Buffett said it best:

“If you don’t find a way to make money while you sleep, you will work until you die.”

That’s why smart investors turn to passive income.

If you’re reading this, you’re not looking for a get-rich-quick scheme

You want to be an informed, strategic investor.

Someone who makes their money work for them without being tied to a screen all day.

Maybe you’ve reviewed deals but never invested because you didn’t know how to vet the operator.

Or you’ve made investments but they stopped paying distributions...

...Or, they never cash flowed in the first place...

Maybe you’ve invested with a sponsor and you’re only getting 1% return on your deal (instead

of the double digit yields you were promised).

Either way, you might be familiar with asset classes like:

Multifamily apartments (where returns regularly hit 25% and your capital doubles in 5 years)

Multifamily apartments (where returns regularly hit 25% and your capital doubles in 5 years)

Oil & gas (where you can write off up to 80% of W-2 income)

Oil & gas (where you can write off up to 80% of W-2 income)

Private credit (funds that let you “park” money and get higher yields than money markets)

Private credit (funds that let you “park” money and get higher yields than money markets)

Mobile home parks & self-storage (investments that cashflow from day one)

Mobile home parks & self-storage (investments that cashflow from day one)

But if you’re like most investors, maybe you’re having trouble pulling the trigger.

If that’s the case, you’re not alone…

Because while everyone talks about how great passive investing is…no one teaches you how to do it!

So you miss out on life-changing income because:

You don’t have a structured plan

You don’t know how to compare deals or spot red flags

You don’t want to make a costly mistake (but staying on the sidelines isn’t the answer either)

But every month you wait, you’re falling behind.

The money sitting in your bank is losing value to inflation.

You’re still trading days for dollars.

And you’re not any closer to achieving passive cash-flow.

That’s the #1 Reason Most People Never Build Passive Income

It’s not lack of capital.

It’s not a lack of opportunity.

It’s lack of confidence.

Confidence to commit to the right investments.

And when you lack that confidence, you either:

Invest blindly—and hope for the best.

Stay on the sidelines—and keep trading time for money.

Neither leads to financial freedom.

Nothing changes.

And so you’re stuck:

Watching your kids grow up through pictures and videos, instead of creating memories with them

Making investments that never go anywhere

Going on vacation only to deal with headaches from work emergencies

Jumping from one high-stress job to another, never finding real stability…

Digging into your savings if you’re laid off…

Actively investing in rentals or Airbnb's just to deal with tenant headaches, putting your life on the line with massive loans, and dealing with distractions 24/7…

Always putting off that “greater purpose” in your life…

Or retiring when you're 65, after you’re too old to enjoy your wealth

But what if it didn’t have to be that way?

What If You Didn’t Have to Figure Out Passive Investing Alone?

Here’s a secret: investing isn’t about finding the “perfect” deal.

It’s about having a proven system to evaluate opportunities, avoid common pitfalls, and invest with confidence.

What if you had that system?

What if you had someone who has literally achieved what you're trying to achieve, earning $250,000 a year in passive income, and is a seasoned fund manager to guide you?

What if you could borrow their expertise, get a second set of eyes on deals, and make smarter investment decisions from day one?

You would have the power to:

Choose when you work, choose when you don’t

Finally say “I don’t need your paycheck”

Quit your VERY active W2 and enjoy your wealth

Spend more time with your wife and kids

Find your true purpose in life outside of making money

Stop trading your life energy and time for added returns

Earn 10%-30% without an ounce of work outside due diligence.

Now you can…

Choose when you work, choose when you don’t

Finally say “I don’t need your paycheck”

Quit your VERY active W2 and enjoy your wealth

Spend more time with your wife and kids

Find your true purpose in life outside of making money

Stop trading your life energy and time for added returns

Earn 10%-30% without an ounce of work outside due diligence now you can…

Introducing

Cashflow Academy

Build Your 6-Figure Income Plan in 90 Days with Help from a Professional Investor Earning Over $250,000 a Year in Passive Income

If you don’t want to rely on your W-2 income forever, you need a plan to start replacing it.

In this Private Mentorship Program for accredited investors, you’ll learn my system for finding and investing in low-risk, cash-flowing investments.

Plus – you’ll leave with a personalized 6-Figure Income Plan for finding your next passive investment…one that generates cash-flow within 12 months or less!

No more investing without a plan.

No more playing guessing games with your financial future.

No more wondering who you can trust and who you can’t.

No more looking at deals, wondering what makes one good and the other bad.

No more confusion about passive investing.

Over the course of 90 days, you’ll work 1-on-1 with me and learn everything you need to know about the world of passive investing.

But why should you listen to me?

Hi, my name is Pascal Wagner

In 2021, my dad passed away, leaving my mom an inheritance…but no source of consistent income.

So, over the next 6 months, I spent $50,000+ and countless hours attending masterminds, investor dinners, and burning the midnight oil finding passive investments.

Ones that provided her monthly cashflow, so she wouldn’t have to sacrifice her lifestyle, healthcare, or retirement.

I accomplished that goal (she’s currently receiving $10,000+ in 100% passive income each month).

And once I felt confident enough, I moved the majority of my net worth into passive investments as well.

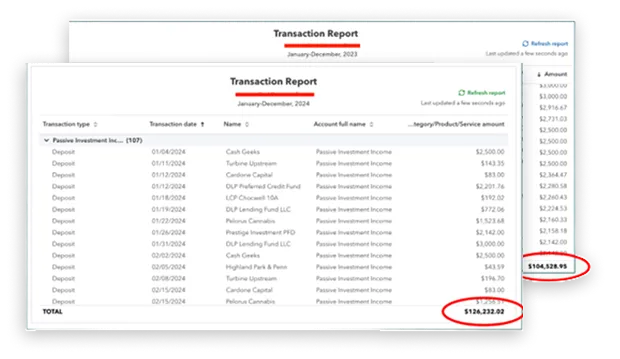

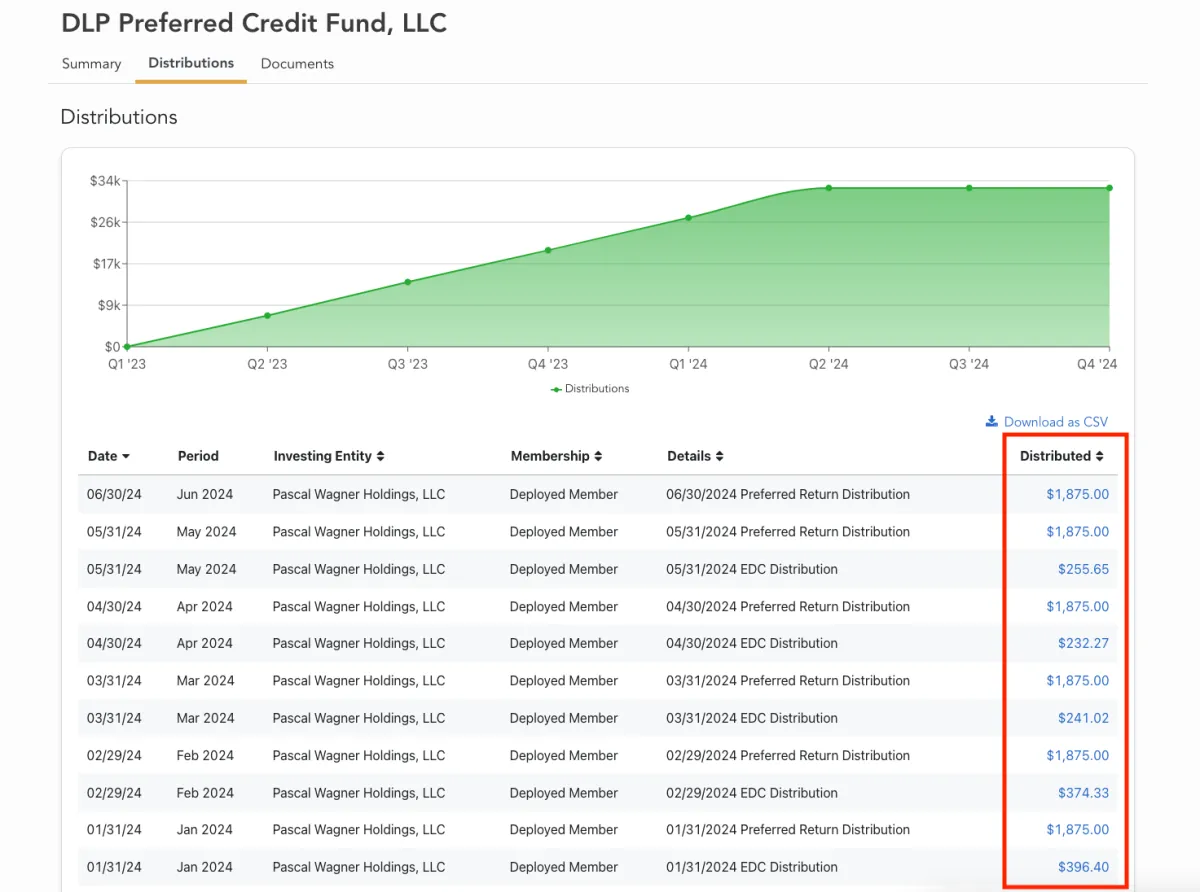

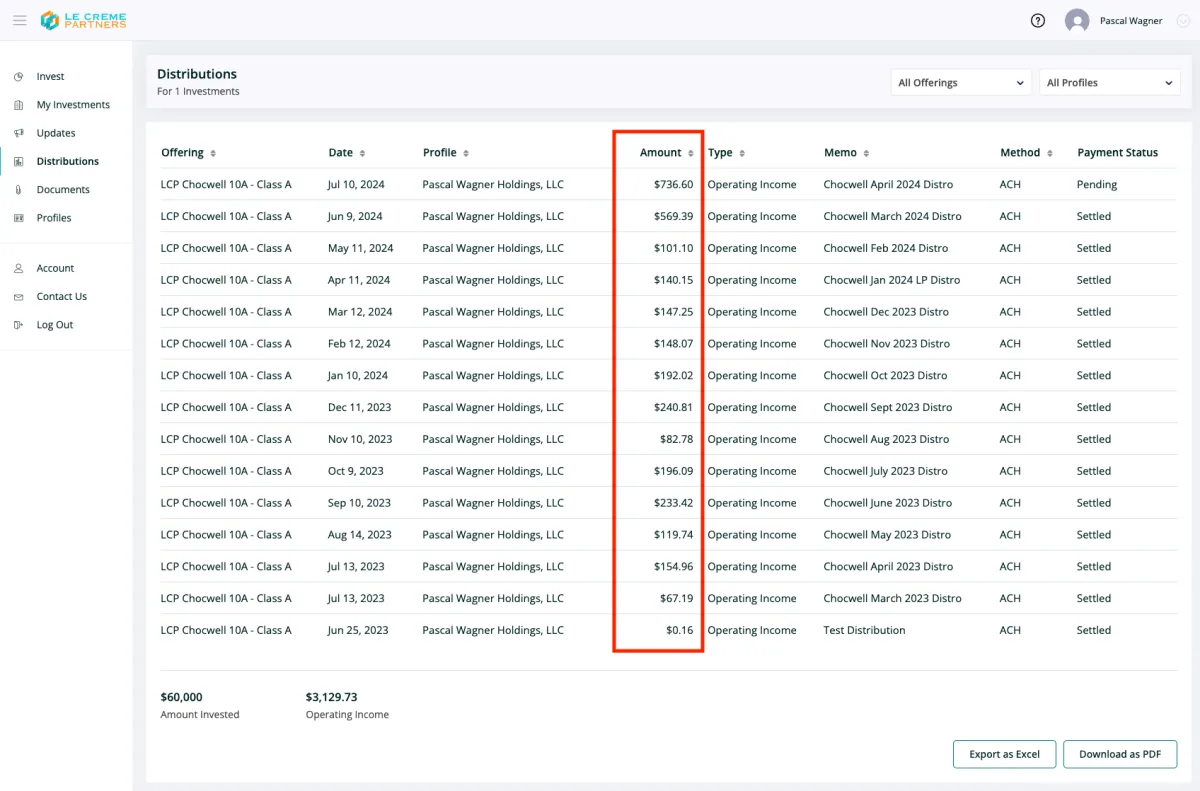

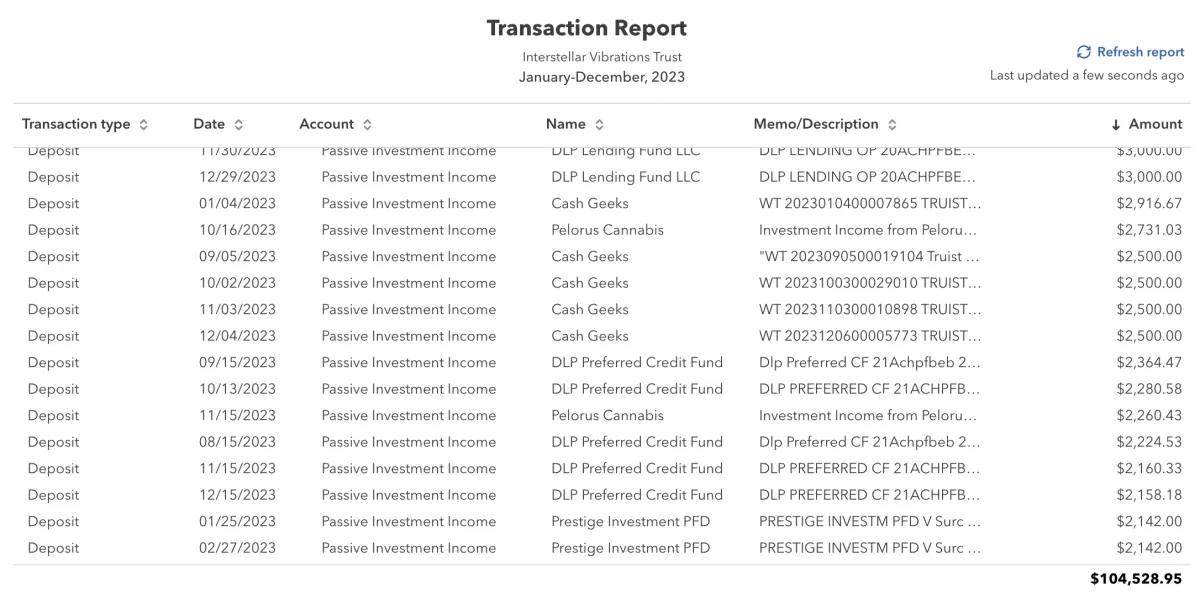

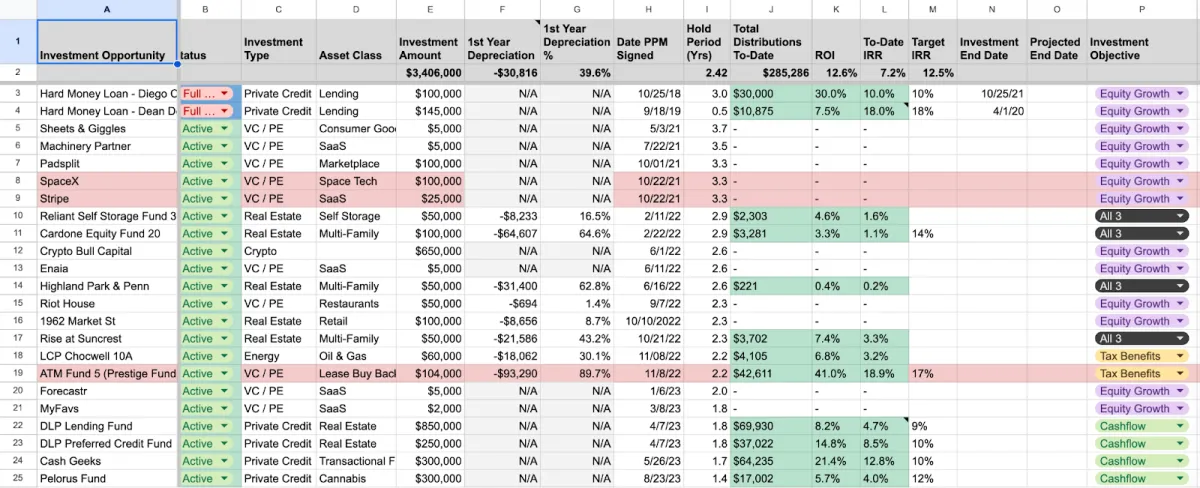

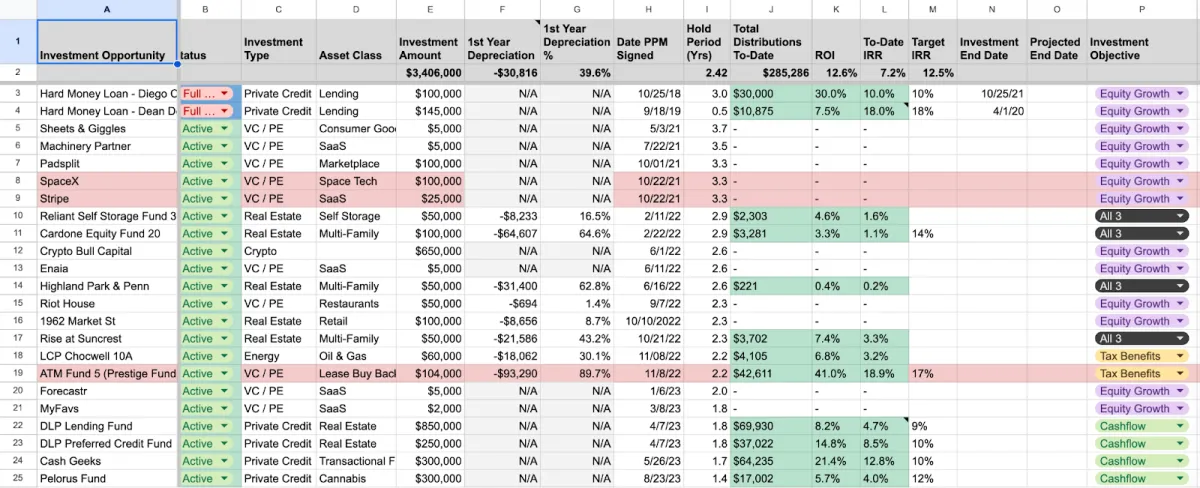

Here are earnings snapshots from my passive portfolio:

Now, I’m teaching accredited investors how to get the same results from passive investing...while removing the uncertainty, doubt, and hesitation that comes with allocating personal capital.

A mentorship for forward-thinking investors who are actively trying to deploy money and start generating passive income

For Busy W-2 Professionals Who Want Time Freedom

You’ve worked hard to build a successful career. The paycheck is good, but the trade-off? Long hours, constant stress, and the nagging thought:

“How much longer do I have to keep doing this?” You want to build real wealth without being chained to your desk.

Active Investors Who Are Tired of Managing Tenants

You got into real estate for freedom, but instead, you’re stuck dealing with tenants, maintenance calls, and property headaches. You just want cashflow without the stress of being a landlord.

You’re ready to shift from active to truly passive investing (where your money works for you).

Entrepreneurs Who’ve Had a Liquidity Event

You built something from the ground up. And now? You’ve successfully exited.

But you don’t want to just park your money in index funds and hope for the best.

You want a plan to grow your wealth without going back to full-time hustle mode.

Imagine hitting $10K, $20K, $30K or MORE of Passive Cash-flow Per Month

In Cashflow Academy, You’ll Learn…

My step-by-step process for finding operators you can trust.

How to vet deals so you can invest with confidence.

The 3 different asset classes to pursue based on your financial goals (cashflow, equity growth, or tax breaks).

Everything you’ve ever wanted to know about alternative asset classes (nothing’s off limits here: I’ll give you the details on Lending, Oil & Gas, Cannabis, ATMs, Private Credit, Self Storage, Transactional Funding, Multi-Family Apartments, and other alternative investments where I’ve deployed capital).

How much you need to invest to supplement or completely replace your W2 income with passive cash-flow.

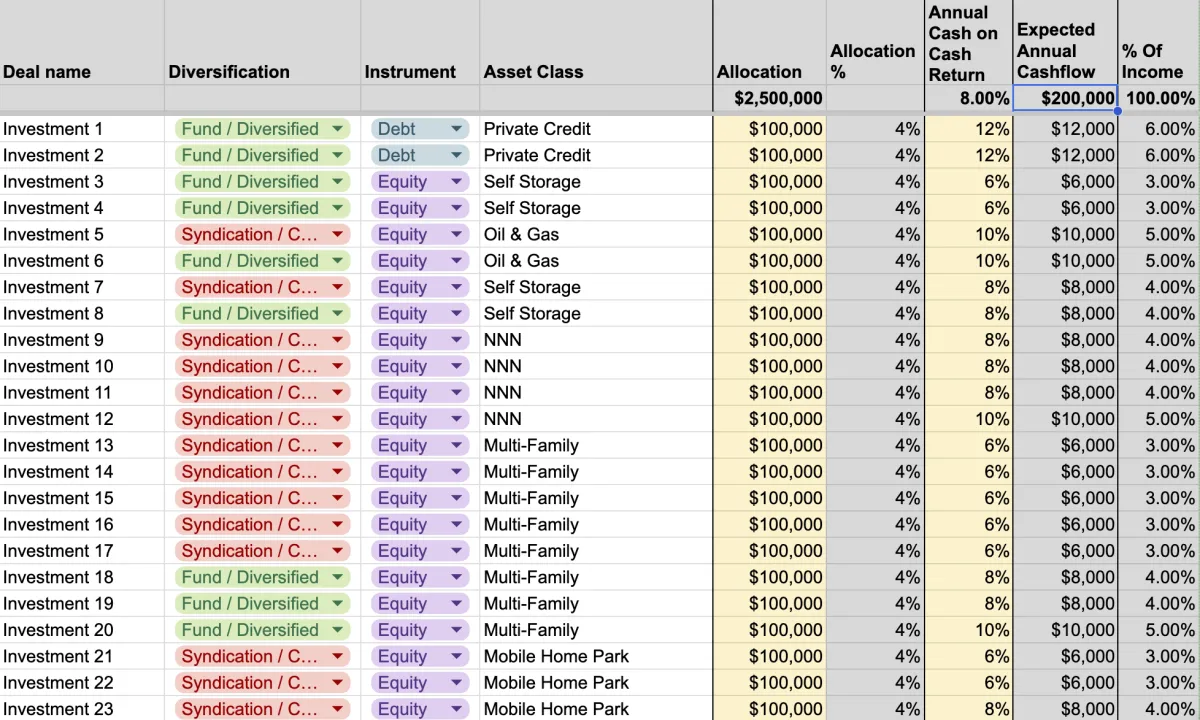

How to choose funds to meet specific income goals of $10K, $20K, $30K or more of passive cash-flow per month.

Should you be paying management fees? I’ll explain what’s standard, what’s above average, and why some fees are actually a good thing.

PLUS – by the end, you’ll know exactly how to get into the world of alternative assets, with an action plan specific to your personal and financial goals, not a cookie-cutter “blueprint” that sounds nice but doesn’t actually move the needle for your wealth.

These Investors Took the Leap—

And Here’s What Happened

You're not the first to feel unsure—you're just the next to figure it out.

Here's how others have used our Education, tools and investments to take action.

Gabby built a $100K+/year passive income portfolio—without adding stress to her life.

Kathleen made her first oil & gas investment after a single Deal Review Session.

Tod went from second-guessing deals to knowing exactly what to look for—and when to walk away.

Many others are now earning monthly cash flow—with full clarity on where their money’s going and why.

The biggest shift?

They stopped hoping—and started investing with intention.

Philip Kopesdy

Strategic Account Executive

"I Finally Got A Clear Roadmap"

"I Had Been Piecing Things Together For Months. This Program Gave Me A Framework, Templates, And A Mentor To Cut Through The Noise"

Kathleen Marcell

Customer Success & Operations Executive

"I Now have a lot more confidence"

"I have A much better Framework for Reviewing deals And Asking better questions when talking with Sponsors"

Ian Johnston

Healthcare Professional

"This Program Pulled It All Together For Me"

"Between the deal flow, the course, and your podcast, I finally got the reps I needed to feel confident reviewing deals and asking the right questions"

Here’s EXACTLY What You Get When You Join Cashflow Academy

“6-Figure Passive Income Planning Sessions”

5+ Private Mentorship Sessions

Over 90 days, we’ll work together in structured sessions to teach you my system for investing in alternative assets (so you can achieve a six-figure passive income).

This is a high-touch, 1-on-1 mentorship + homework program done at your pace. There are 5 mentorship sessions (30 to 60 minutes each), which start and end with onboarding and offboarding calls.

There will be mandatory homework assignments between each session. For that reason, you get to choose how much time you need between sessions, whether it’s 1, 2 or even 3 weeks.

If you get stuck on a certain section, we will re-learn it until you feel comfortable with the material. This is a concierge-level mentorship designed to teach you passive investing, not push you through a program prematurely.

You must also be someone who wants to take charge of their passive investing, not abdicate your responsibility. It is not money management or financial advice, either. You are learning my framework for passive investing.

I will teach you how to analyze deals, vet operators, and structure your investments – so you can start collecting passive income with confidence.

By the end, you will have a 6-figure passive income plan built to your financial goals AND the clarity and confidence to execute.

Here’s the Session by Session Breakdown

Session 1

Session 1: Onboarding Call (30 Minutes)

Goal: Set expectations, clarify your financial targets, and assign pre-work.

Where you are now vs. where you want to be: We’ll assess your current investment experience, financial goals, and risk tolerance.

Understand your past investments: What worked? What didn’t? What lessons have you learned?

Clarify your passive income target: How much income do you want to generate annually?

Overcome barriers: Identify the biggest challenges stopping you from taking action.

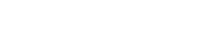

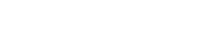

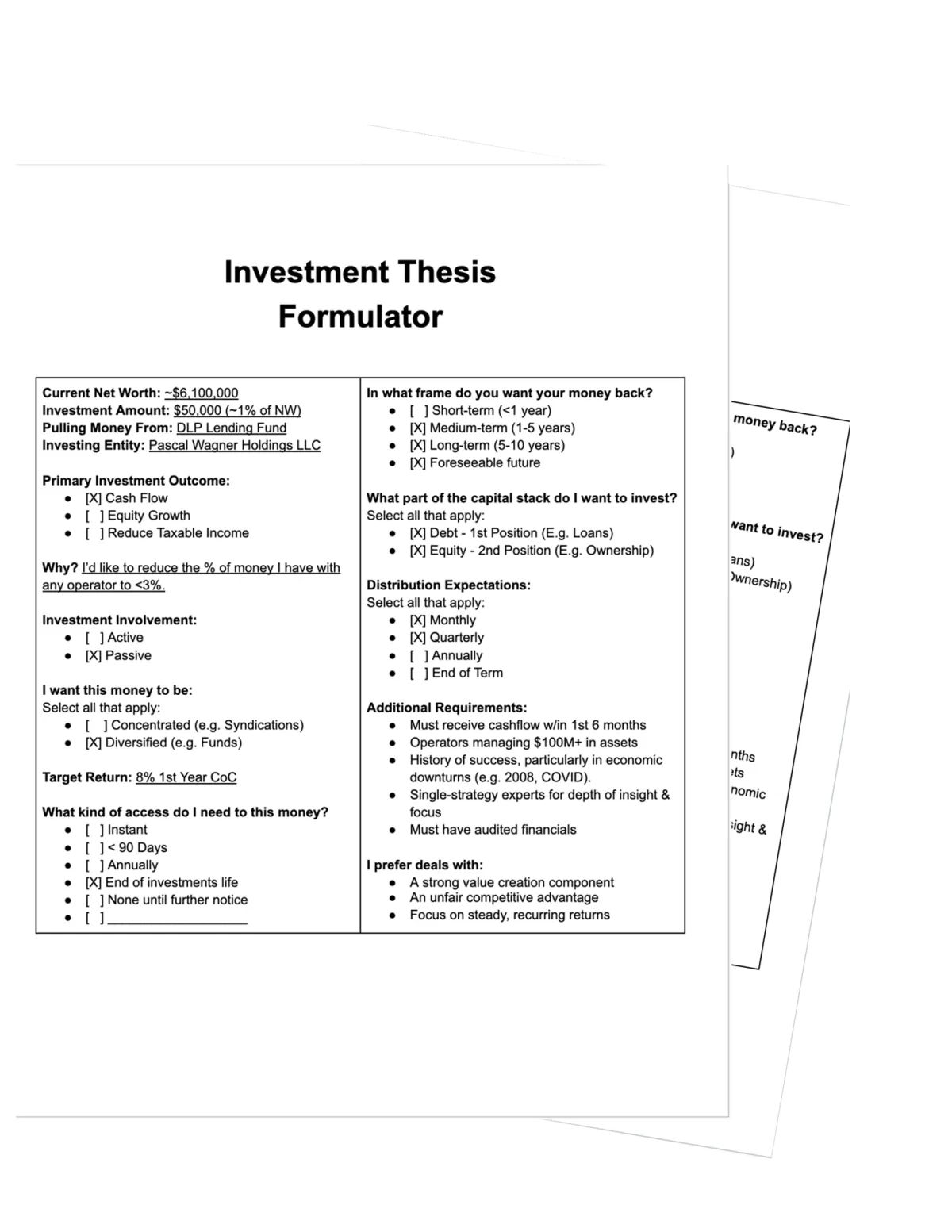

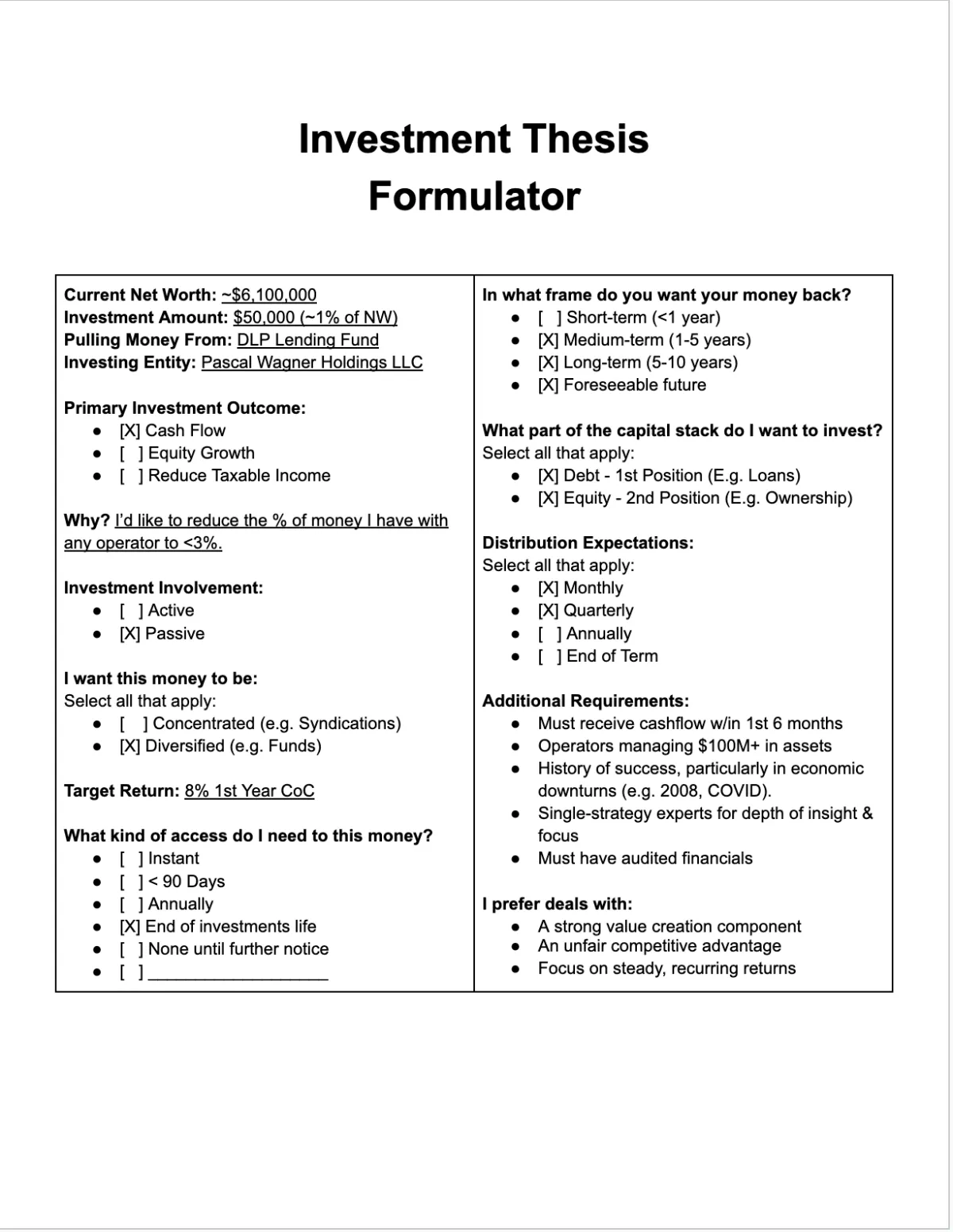

Assign pre-work for Session 2: You’ll complete three worksheets to map out your current portfolio, target allocation, and investment thesis.

Outcome: You’ll leave with a clear understanding of where you stand, what’s holding you back, and how we’re going to fix it.

Session 2

Session 2: Building Your Investment Framework (60 Minutes)

Goal: Define your personal investment criteria and asset allocation strategy.

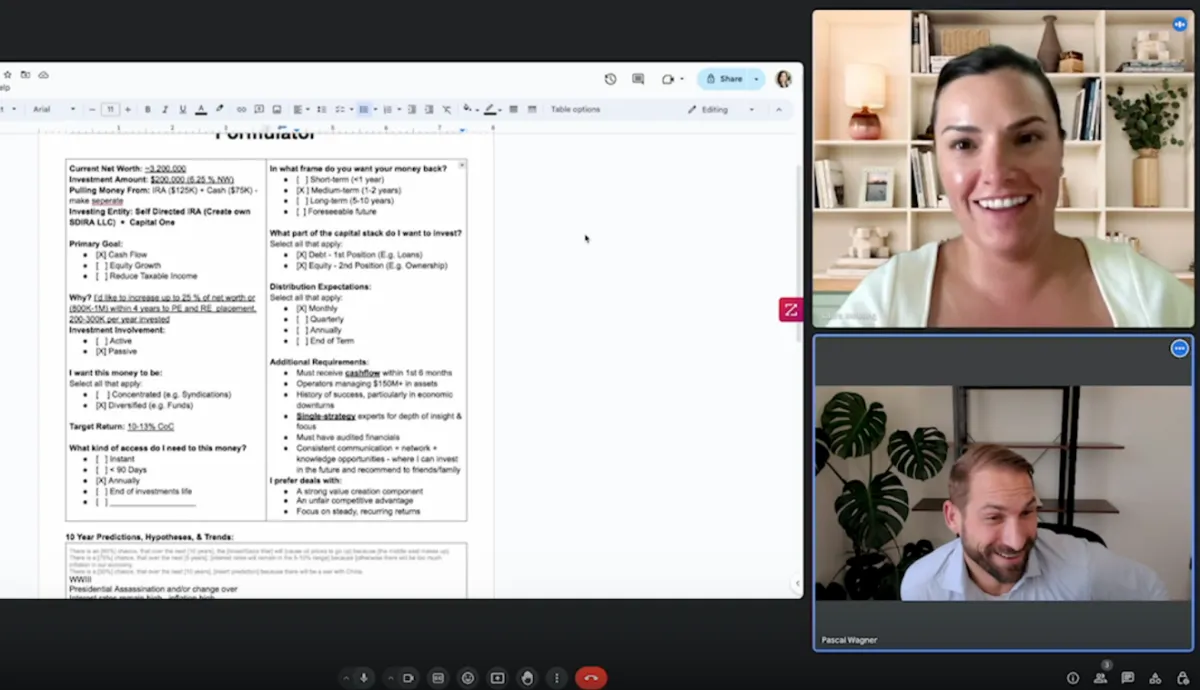

Review your pre-work from onboarding: Walk through your Asset Allocation Worksheet and Investment Thesis Formulator.

Analyze your current vs. target portfolio: Are you overexposed in one area? Where should you adjust?

Identify your investor profile: Are you focused on cashflow, appreciation, or a hybrid strategy?

Refine your Buy Box: Set clear filters to eliminate bad deals quickly and focus on high-quality opportunities.

Assign homework for Session 3: Start applying your criteria to real investment decks.

Outcome: By the end of this session, you’ll have a structured framework for evaluating deals with confidence and speed.

Session 3

Session 3: Evaluating Real Deals (60 Minutes)

Goal: Strengthen your ability to analyze and compare investment opportunities.

Review deals you’ve selected: Using your Buy Box, we’ll compare multiple investments and assess their strengths, risks, and hidden red flags.

Understand deal structure & key metrics: Learn about cash-on-cash returns, IRR, exit strategies, and risk factors.

Spot misleading claims: Learn how to identify marketing hype vs. real returns.

Deep-dive into fund strategies: Understand debt vs. equity investments, operator incentives, and liquidity considerations.

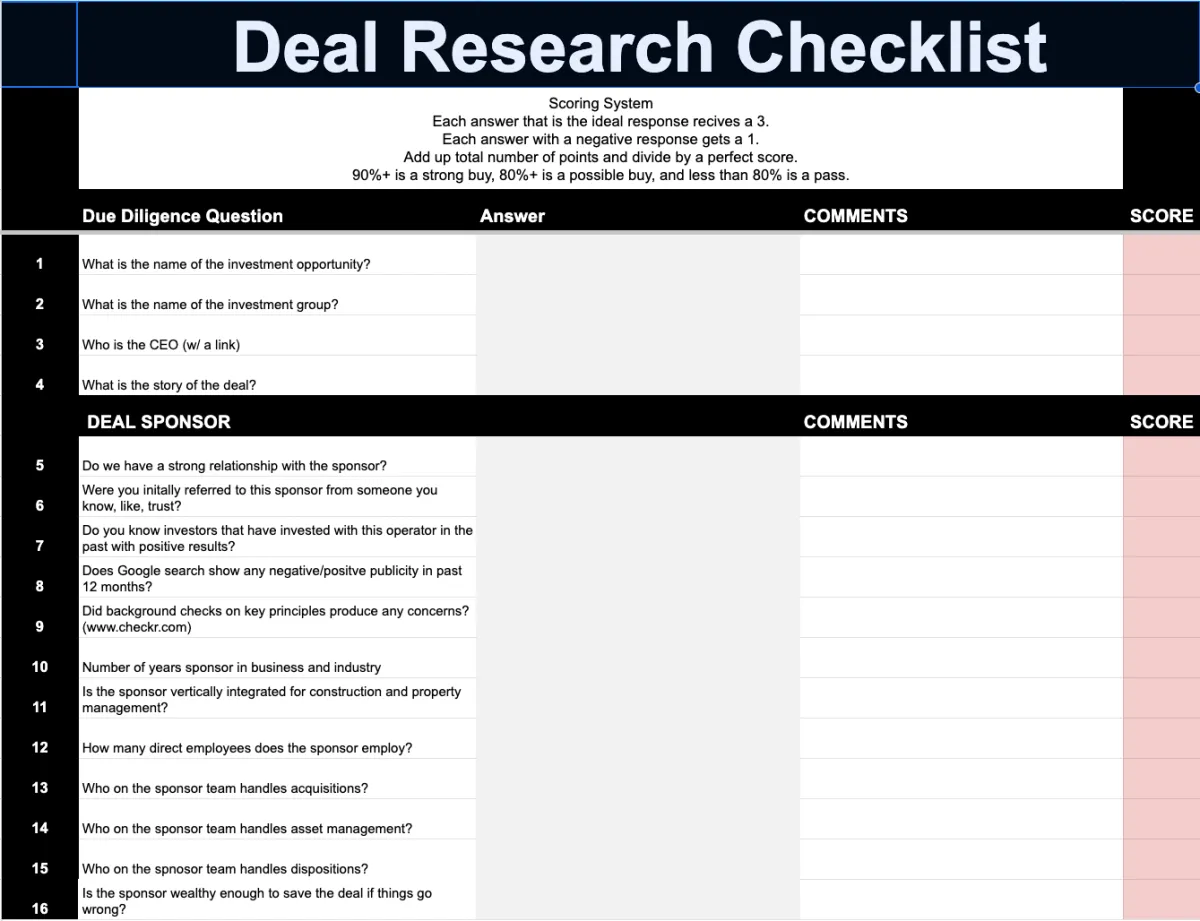

Assign homework for Session 4: Choose one deal to evaluate in detail using the Deal Analyzer Worksheet.

Outcome: You’ll know how to break down a deal, compare investment options, and recognize red flags before wiring money.

Session 4

Session 4: Deep-Dive Deal Analysis (60 Minutes)

Goal: Apply your investment strategy and make an informed decision.

Walk through your Deal Analyzer Worksheet: Assess strengths, risks, and missing details.

Analyze operator credibility: Learn how to vet their track record, experience, and alignment with investors.

Discuss tax implications: How will this investment impact your cashflow and long-term equity growth?

Determine next steps: Move forward with investing, ask more questions, or walk away?

Assign homework for Offboarding Call: Reflect on your learnings, confidence level, and next steps.

Outcome: By the end of this session, you’ll be able to assess any deal with certainty and know exactly what to do next.

Session 5

Session 5: Offboarding Call (30 Minutes)

Goal: Identify next steps and refine your long-term strategy.

Review your progress: What’s changed in your confidence, decision-making, and strategy?

Address any final concerns: Clarify lingering questions before making your first (or next) passive investment.

Discuss future opportunities: Should you diversify further? Where do you go from here?

Outcome: You’ll leave with absolute clarity on your investing strategy and the confidence to take action.

Every session is recorded so you can review our lessons whenever you want!

You’ll also receive lifetime access to the….

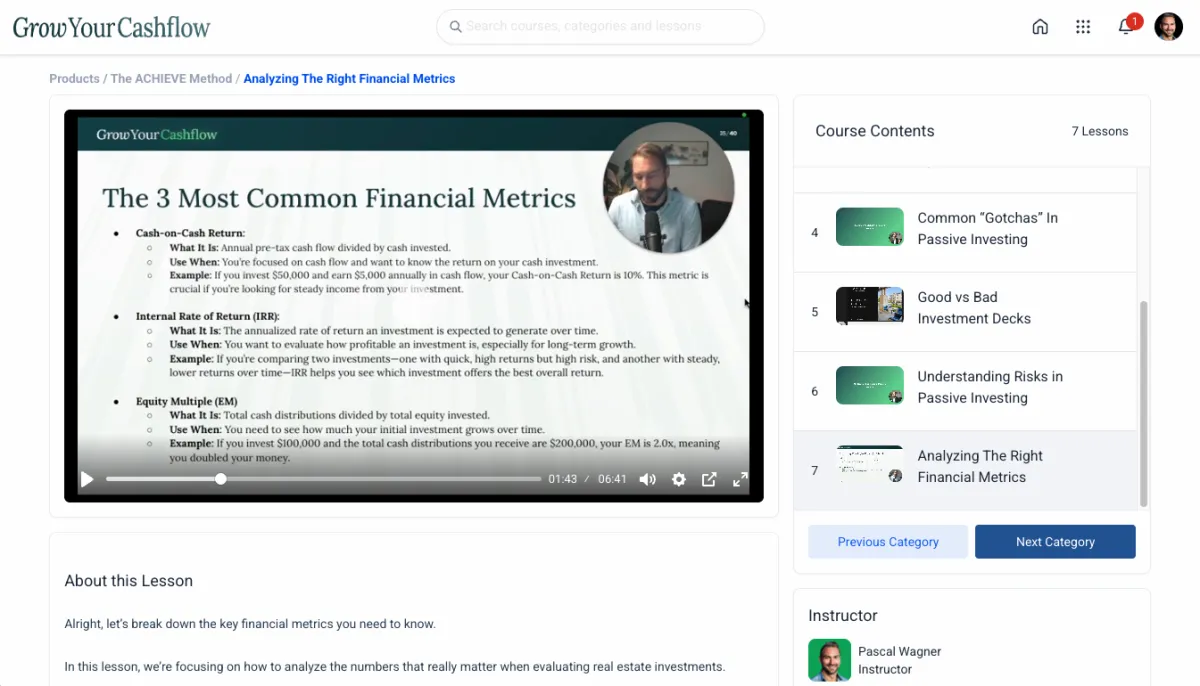

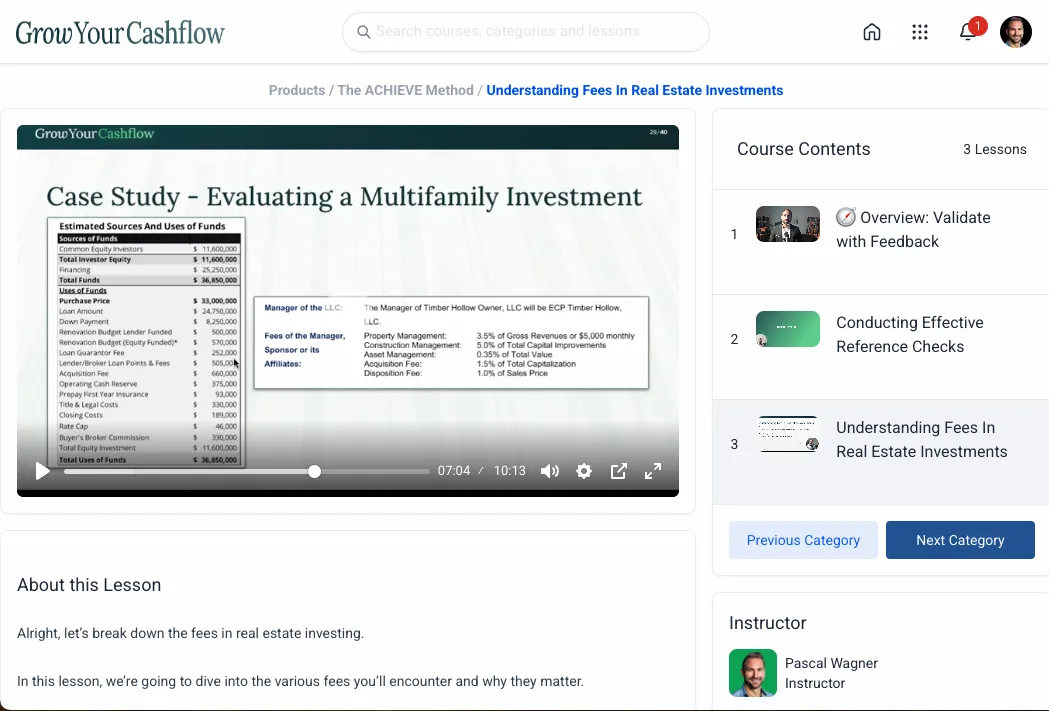

“The A.C.H.I.E.V.E. Method Investing Course”

8 hours of in-depth video training

What if you never had to second-guess an investment decision again?

imagine having a trusted reference guide – a step-by-step playbook you can return to before every deal – so you always know what to ask, what to watch for, and when to walk away.

The A.C.H.I.E.V.E. Method gives you just that!

This video training includes 8 hours of lessons, so you never feel lost between calls or forget key details.

It gives you a repeatable system for sourcing, analyzing, and closing investments…so you can take action with confidence and clarity!

Watch a free sample lesson

“Asset Class Review"

From Module 3 (Video 5)

This course includes 8 hours of video lessons that give you a structured, easy-to-follow approach to investing for passive cash-flow.

Here’s a Module-by-Module Breakdown

Module 1

A - Assess Your Target: Define Your Passive Income Goal

Overview: Assess Your Target

Embracing Your Role as a Money Manager

What Are Alternative Investments?

7 Advantages of Alternative Investments

Module 2

C - Create an Allocation: Map Out Your Ideal Portfolio

Overview: Create an Allocation

The Money Pie (The Only 3 Outcomes When Investing)

Funds vs. Syndications

Risk & The Capital Stack

Asset Class Review

Understanding the Players in Passive Investing

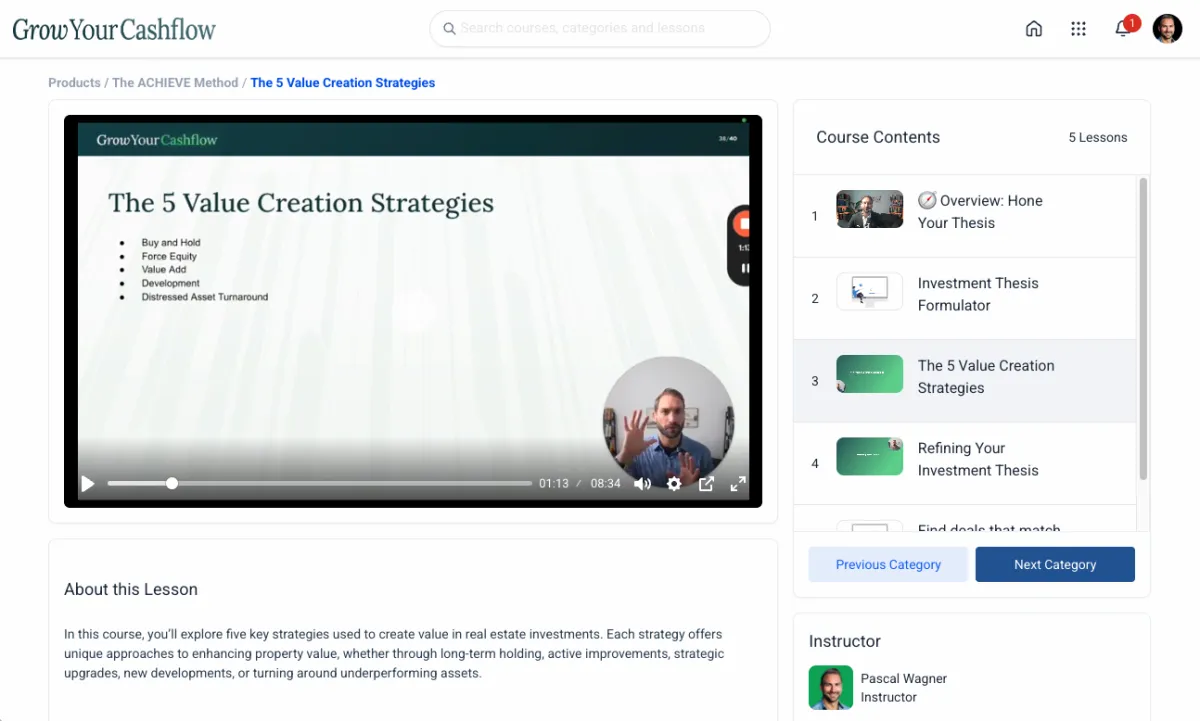

Module 3

H - Hone Your Thesis: Defining Your Filter for Opportunities

Overview: Hone Your Thesis

Investment Thesis Formulator.

The 5 Value Creation Strategies.

Refining Your Investment Thesis.

Find Deals That Match Your Thesis.

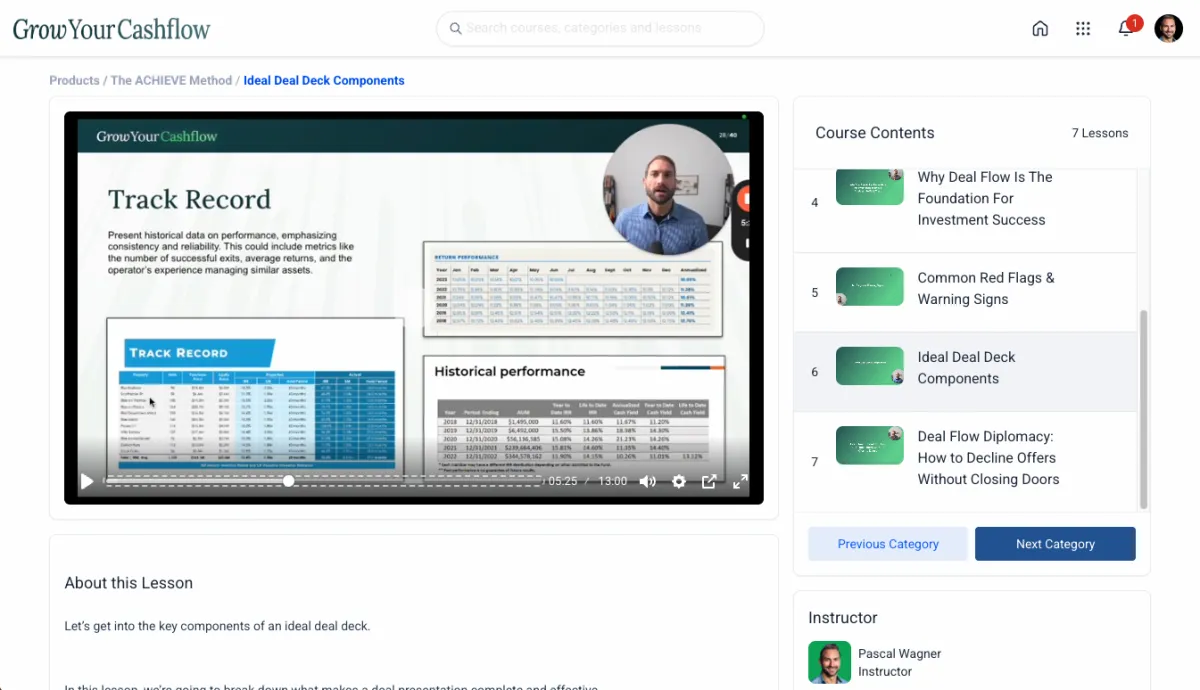

Module 4

I - Identify Opportunities: Create Deal Flow to Match Your Thesis

Overview: Identify Opportunities

Building Your Pipeline.

Managing Deal Flow.

Why Deal Flow is the Foundation for Investment Success.

Common Red Flags & Warning Signs.

Ideal Deal Deck Components.

Deal Flow Diplomacy: How to Decline Offers Without Closing Doors.

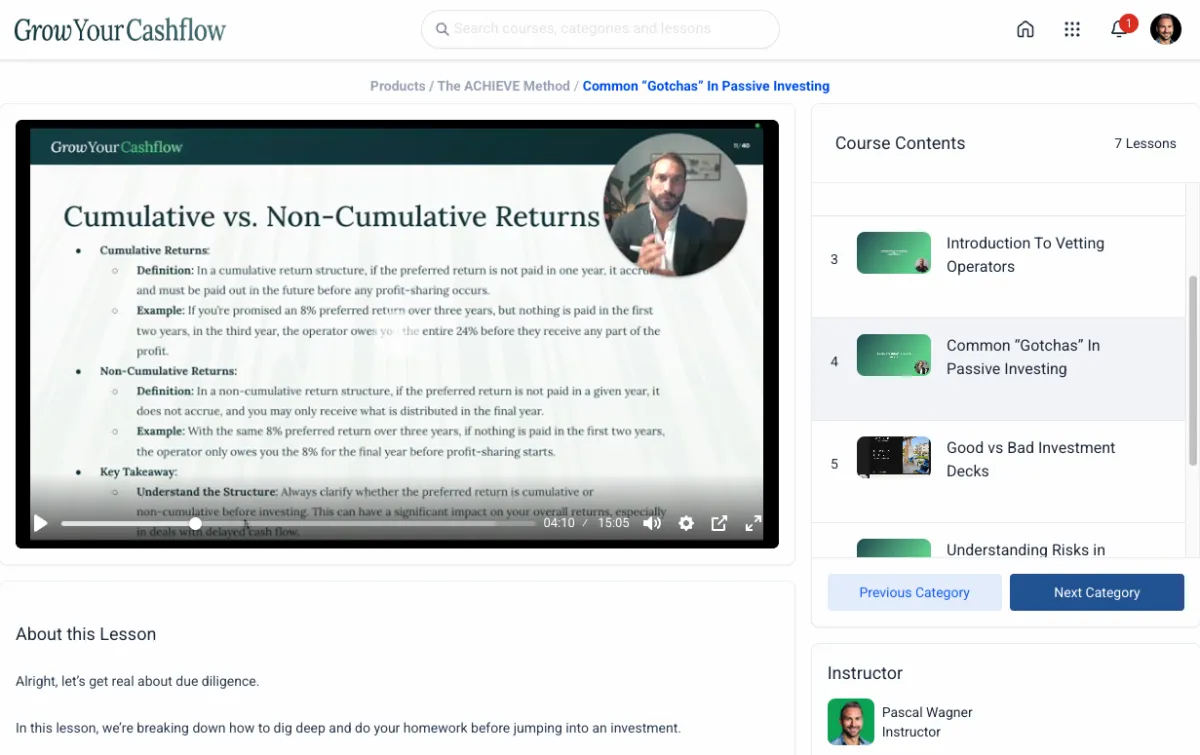

Module 5

E - Evaluate Deals: Research Using a Proven Process

Overview: Evaluate Deals

The Due Diligence Spectrum.

Introduction to Vetting Operators.

Common "Gotcha's" in Passive Investing.

Good vs. Bad Investment Decks.

Understanding Risks in Passive Investing.

Analyzing the Right Financial Metrics

Module 6

V - Validate with Feedback: Gather Insights from Peers and Mentors

Overview: Validate with Feedback

Conducting Effective Reference Checks

Understanding Fees in Real Estate Investments

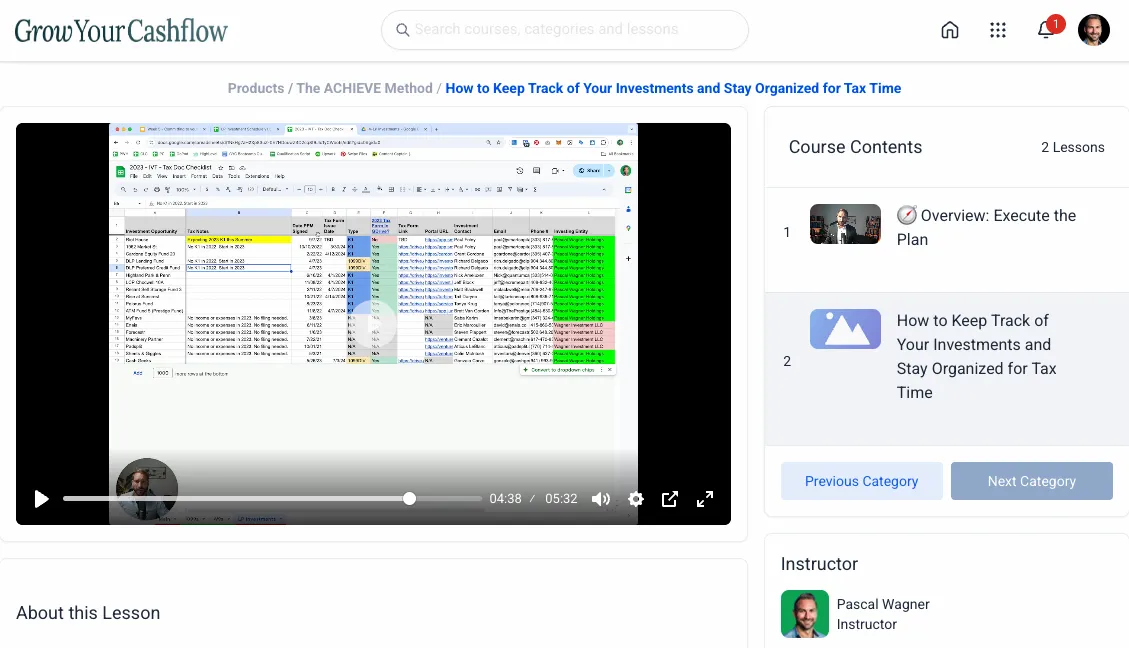

Module 7

E - Execute the Plan: Wire Funds and Start Investing

Overview: Execute the Plan

What Do Investment Portals Look Like?

How to Get Your Accreditation Letter

How to Keep Track of Your Investments and Stay Organized for Tax Time

As a Cashflow Academy Student,

You Get Lifetime Access to this Training!

Plus, you get…

The tools you need to execute your investment plan

Get powerful tools to remove guesswork and make confident investment decisions every step of the way

Investment Thesis Formulator

Define your Buy Box so you can filter deals faster and invest with clarity.

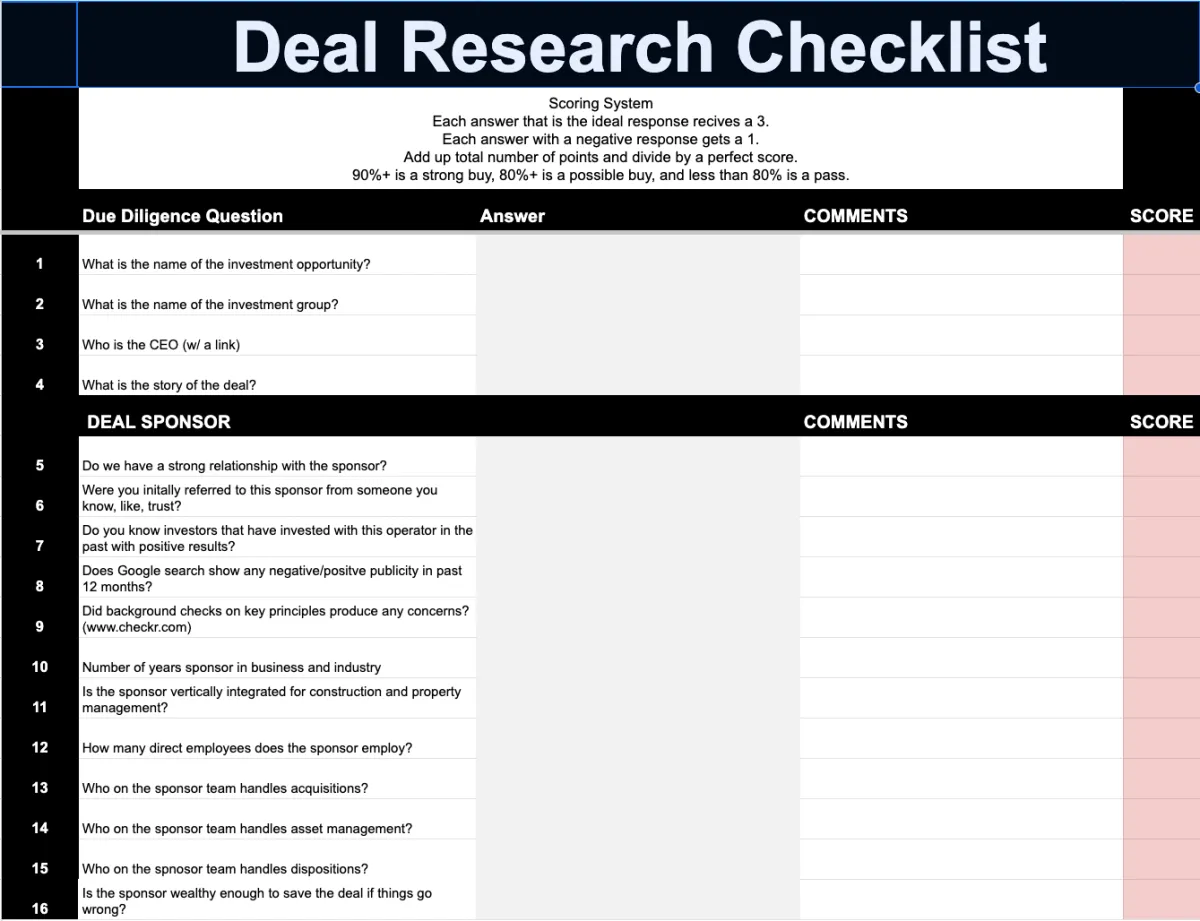

Deal Analyzer Worksheet

Run the numbers, ask the right questions, and vet deals like a pro before investing.

Asset Allocation Worksheet

See exactly where your money is today and how to optimize your portfolio for passive income.

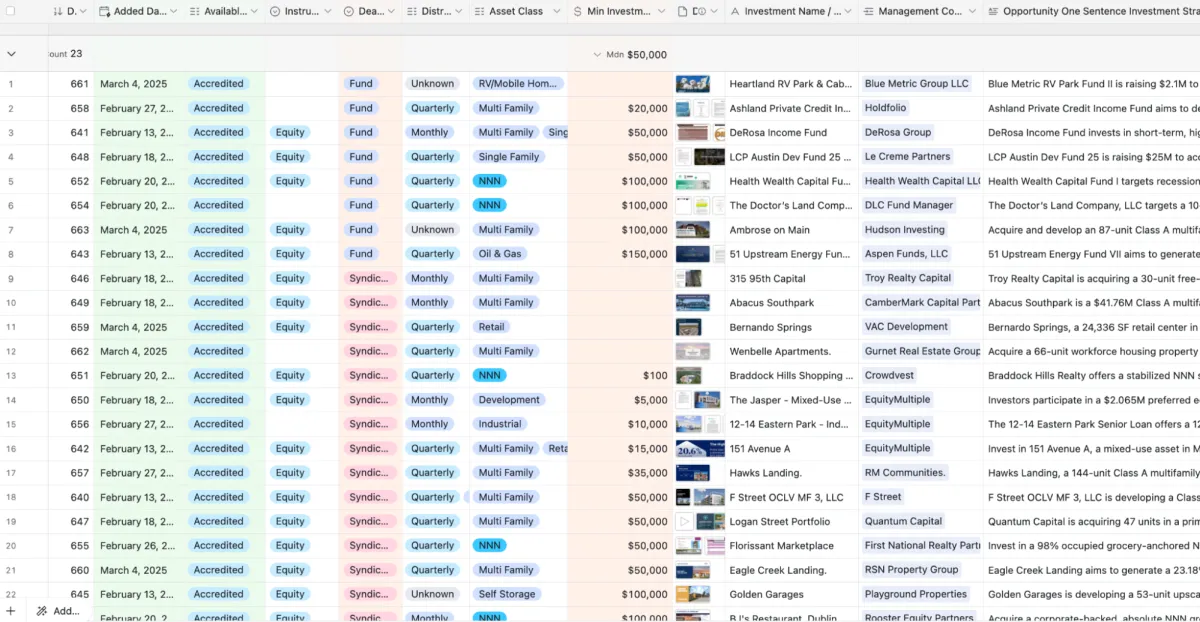

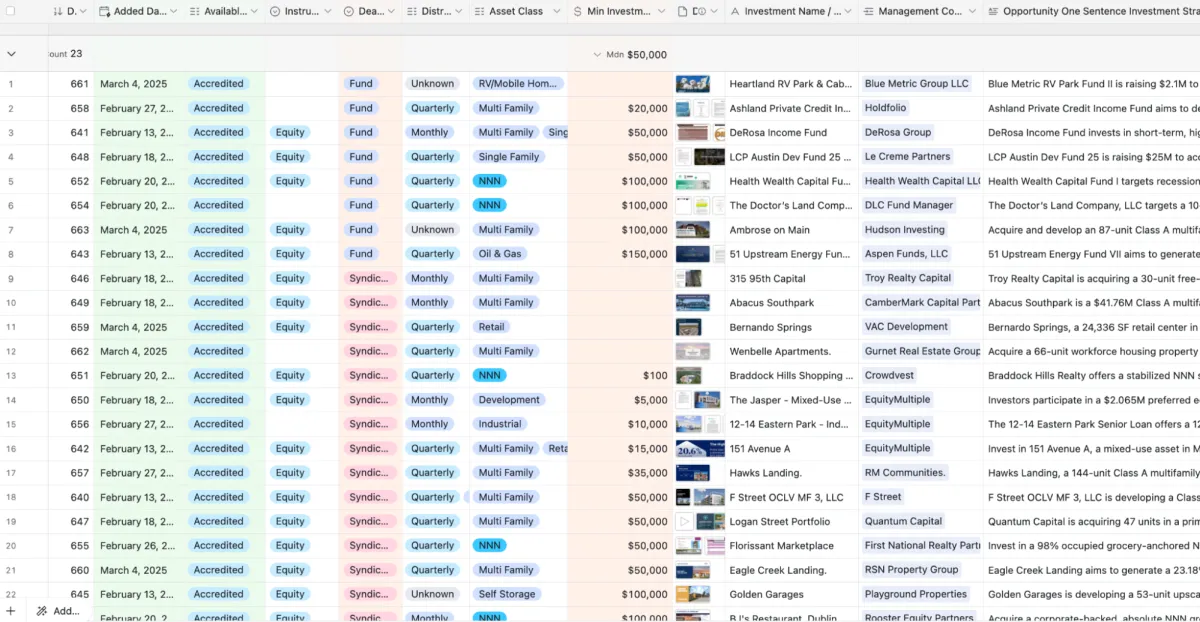

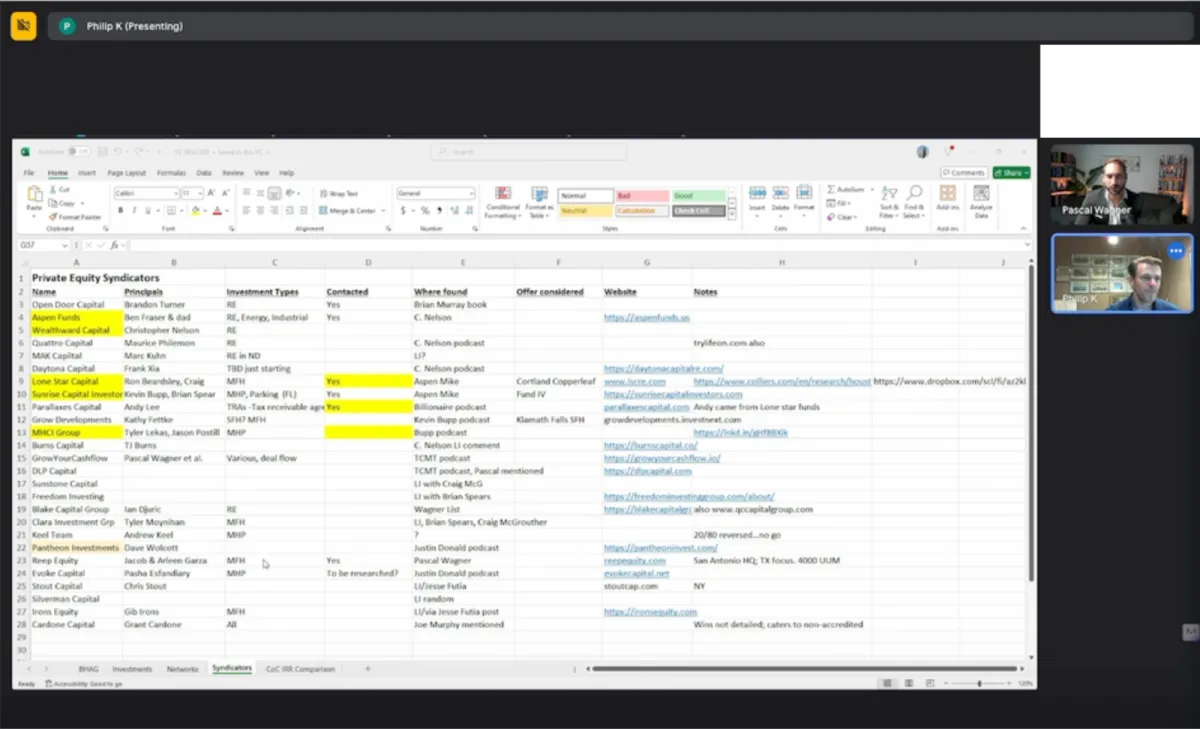

Airtable Deal Database

Browse real investment opportunities, compare deals, and apply your buy box in real time.

BONUS #1: The Comprehensive List of Opportunities You Can Invest In Right Now

Want to fast-track your first passive investment? If you’re accepted as a student, I’ll send you a list of companies you can invest with today.

These include private debt funds, mobile home parks, storage facilities, multifamily syndications and more.

Once you have it, you can subscribe to their mailings and request more information about their offers.

BONUS #2: Deal Evaluation Session

(Good for 12 months!)

In this 90-minute bonus session, I’ll help you evaluate a current deal you’re considering.

Just bring the deal into our meeting and I’ll walk you through how to start the due diligence process and any red flags to watch out for.

This bonus session is good for up to 12 months after you complete Cashflow Academy!

BONUS #3: The Ultimate

Tax Prep Checklist

The more investments you make, the more critical it becomes to keep track of them all and ensure proper tax reporting for the IRS.

My Ultimate Tax Prep Checklist will save you hours of headaches by helping you organize and manage your tax documents. You’ll know exactly what tax forms you’ve collected from each fund manager, which ones you’re still missing, and who to contact to get everything settled.

Just follow the steps I outline, and you’ll make your tax prep neat and tidy.

You’ll also receive video recordings of every session and lifetime access to program updates!

Designed for Busy People

The Japanese Bullet Train of Passive Income Education

(20 hours of work)

Did you know Japan’s Shinkansen bullet train hits speeds of up to 199 mph?

It doesn’t crawl. It doesn’t wander. It gets you where you want to go—fast, efficiently, and reliably.

This program is designed the same way.

In just 20 hours total—less than three full workdays—you'll learn everything you need to confidently make your first passive investment.

Each session is short, focused, and designed to eliminate guesswork.

No fluff. No wasted time. Just the knowledge you need to get on track toward 100% passive income.

Think about it:

You’ve spent thousands of hours building your career.

What if you spent just 20 hours building your

freedom?

Not a Professional Investor? Good!

Imagine you’re going to the grocery store.

And you know exactly what you want to buy.

So you head to the aisle, take it off the shelf, and check out.

That’s how easy it can be to find your next passive investment.

It’s simply a matter of knowing what you want.

Maybe that’s a small, steady stream of passive checks every month…

…or big chunks of money paid out quarterly.

Either way, you don’t have to be an investing pro, a stock market wizard, or a real estate genie

to make it happen.

You just need a willingness to learn.

And the drive to stop trading your time for money (so you can start enjoying it instead).

10+ Success Stories & Counting

This was exactly what I needed at this point in my investment journey

I’ve been in knowledge-building mode, trying to figure out how to take action without making mistakes. This program came at the perfect time, and having someone who’s been in my shoes guiding me through this process made all the difference. The way you broke down the seven advantages of alternative investments and explored new asset classes like mobile homes and storage really opened my eyes to new possibilities. I hadn’t thought about those before, and it changed the way I look at diversifying my portfolio.

The most empowering part for me was gaining the confidence to move forward with my self-directed IRA for these investments. You gave me the clarity I needed, and now I feel super comfortable putting $200K into a debt fund. It was also incredibly valuable to learn how to balance portfolios and cash-flow – that knowledge gave me the peace of mind to take the first step.

Your investment formulator was a game-changer. It’s exactly what I needed to communicate with fund managers and organize my thinking. Now, I’m even building my own deal list, inspired by your 300-deal pipeline. It feels great to know that I’m on the right track, and it’s motivating to see that other people are doing this too. You have a clear structure that makes sense, and I truly believe you’re reaching the right audience. Thank you for giving me the confidence to take action!"

— Laura Mossing

Being able to discuss what was on my mind without judgment, and then seeing how you processed it and gave structured feedback, was invaluable

"There were some real 'aha' moments during our session. I didn’t even think about some of the things you brought up, and it really opened my mind to new perspectives. One of the biggest breakthroughs for me was using the investment thesis formulator – it helped me organize my thoughts and make sense of my priorities. It’s challenging to complete, but that’s what made it so valuable. Your content made me rethink what’s most important in my investment strategy, and the risk capital stack was especially insightful.

One of the reasons I feel comfortable moving forward is because I trust the people who really know their stuff – people like Drew Brenneman, Ken Gee, Amy Silva's, and now you. You demonstrated that same level of expertise, and that’s what gave me confidence. Being able to discuss what was on my mind without judgment, and then seeing how you processed it and gave structured feedback, was invaluable. It felt like a safe space to think out loud and get honest, practical advice.

I really appreciate how your program helps me think critically about my investment choices. It’s not just about giving answers; it’s about guiding me to find the answers myself. You’ve helped me think through things I hadn’t considered before, and that’s exactly what I needed. I feel much more prepared to take the next steps."

— Tod Spooner

The way you break down the concepts makes it accessible even for someone who doesn’t have a deep background in passive investing

"I’ve watched around 25 of your videos, and they’re all really good. I actually plan to have my wife watch them too because they explain the basics so well. Your program builds a solid foundation, and the way you break down the concepts makes it accessible even for someone who doesn’t have a deep background in passive investing. I really like that you create a framework that helps people understand not just the 'how' but the 'why' behind the strategies. It’s exactly the right level for someone looking to get started without feeling overwhelmed.

Even though I already had some knowledge, listening to your material as if I were a complete beginner made me realize how well you structure everything. You make complex topics digestible and practical. The way you set boundaries and create a clear process really stood out to me. It’s all done thoughtfully and makes sense, even to those who might feel lost at first.

I think your program is really well put together, and it’s clear that you put a lot of thought into how to teach these concepts. I’m confident that anyone who goes through it will walk away with a strong understanding of how to approach passive income investing. Keep up the great work!”

— Prashant Singri

My $100K Confidence Guarantee

I designed Cashflow Academy to help you build a six-figure passive income plan — and start taking action with total clarity and confidence.

That’s why I back it with the $100K Confidence Guarantee, which includes both a satisfaction and a results promise:

1. 30-Day Satisfaction Guarantee

If you attend the first two sessions and don’t feel like the program is worth every penny, just email me within 30 days and I’ll give you a full refund — no questions asked. You’ll know early on if this is the right fit for you.

2. Results Guarantee

If you complete the full program and, within 90 days, still haven’t:

→ Identified at least 3 strong investments that match your Buy Box, and

→ Felt confident enough to make your first investment...

…I’ll personally work with you until you do.

This isn’t just a course — it’s mentorship to help you make real progress.

Bottom line: I built this program to help you make smarter decisions and start building your $100K passive income plan. If it doesn’t do that, you shouldn’t pay — and I’ll make it right.

You Must Be an Accredited Investor

This program is exclusively for accredited investors – those earning $200K+ per year ($300K+ if married) or with a net worth of $1M+ (excluding primary residence).

Why?

Because the investment opportunities we’ll be exploring are only available to accredited investors.

So if you’re not accredited, this mentorship won’t be helpful!

One-Time Investment

$5,000 $2,997

The guidance you’ll receive in this program is easily worth thousands of dollars or more. I paid nearly 50X that for seats in group coaching that did not have the personalized experience, goal setting, or the accountability you’ll receive.

Smart Investors Protect Both Sides of the Equation

If you're aiming to build a $1 million passive income portfolio, you're going to face two threats:

1. Making the wrong investment and losing six figures

2. Freezing up and missing the right one

Cashflow Academy helps you avoid both.

For just $2,997 — less than 0.3% of your target portfolio — you’ll learn how to confidently say yes (or no) to deals, avoid common traps, and make sure every dollar you invest is working hard for you.

Think of it as an insurance policy and a fast-track — protecting you from expensive mistakes while helping you move faster with confidence.

If you’re planning to invest $1 million, can you really afford not to spend 0.3% to get it right?

Every Day You Don’t Invest,

Your Throwing Away $137

Sitting on cash isn’t a wealth-building strategy. It’s a slow leak. And every day your money stays in the bank, it’s losing value.

When inflation is running at 5%, your $1 million is effectively losing $50,000 in purchasing power every year.

That’s like throwing away $137 every single day!

So while you’re waiting to make the “perfect” investment, your hard-earned capital is shrinking.

Meanwhile, smart investors are putting their money to work, generating passive income, and staying ahead of rising costs.

The longer you delay, the more your wealth erodes.

If you’re serious about building passive income and protecting your wealth, it’s time to join Cashflow Academy.

Get the Guidance You Need to Earn the Passive Income You Deserve

Join Cashflow Academy and Build Your 6-Figure Passive Income Plan in 90 Days

Get the mentorship, system, and tools you need to confidently invest, avoid costly mistakes, and secure long-term wealth.

1-on-1 Private Mentorship: Work directly with an investor who has personally invested over $3 million in alternative assets

Personalized Income Plan: Whether your goal is $10K, $20K, or $30K+ per month, you'll walk away with a roadmap tailored to your financial objectives

5 Personalized Mentorship Sessions: Get step-by-step guidance, from setting your investment strategy to analyzing real deals

Recorded Sessions: Review your mentorship calls and course content whenever you need a refresher

8-Hour A.C.H.I.E.V.E. Method Course: Master evaluating deals, risk assessment, and building sustainable cashflow

Hands-On Deal Evaluation: Learn how to properly vet operators and identify red flags

Complete Passive Income Toolkit: Includes the Investment Thesis Formulator, Deal Analyzer, and Asset Allocation Worksheet

Discover the Asset Classes: Learn to invest in multifamily apartments, oil & gas, private credit, and more

Tax Efficiency Strategies: Reduce your tax burden while maximizing your passive income

Lifetime Access: Revisit mentorship sessions and course materials anytime

Bonus #1: Comprehensive Investment Opportunities List: Access deals you can invest in today, including private debt funds, multifamily syndications, and more

Bonus #2: Deal Evaluation Session (Valid for 12 Months): Get expert feedback on one of your potential investments

Bonus #3: Ultimate Tax Prep Checklist: Keep your investments organized for tax season and ensure proper reporting

100% Satisfaction Guarantee: Attend all 5 sessions, and if you're not satisfied, you'll get your money back