Attention: First-Time LPs

Build Confidence Fast And Start Earning in Just 45 Days—Without 5-Year Lockups

...so you can turn your first investment into lasting momentum.

Built for New LPs Who Want Cash Flow

Without Complexity

Why First-Time Investors Love

The Grow Your Cashflow Lending Fund:

Monthly Cash Flow— checks arrive within ~45 days, giving you clear momentum right away.

Quarterly Liquidity— no long-term lock-ups (like the typical 5–10 years); pivot anytime your goals change.

Proven & Transparent— backed by DLP Capital’s $5B lending fund (zero investor losses since 2006), with fully audited financials and clear monthly reporting.

Low Minimum ($50K)—Perfect entry point instead of the usual $200K+, making it accessible to new passive investors.

SD-IRA Compatible— Easily invest through your IRA (or let us guide you through setting one up).

(Limited to 99 investors—Reserve Your Spot Before It Fills Up.)

Why First-Time Investors Love

The Grow Your Cashflow Lending Fund:

Monthly Cash Flow— checks arrive within ~45 days, giving you clear momentum right away.

Quarterly Liquidity— no long-term lock-ups (like the typical 5–10 years); pivot anytime your goals change.

Proven & Transparent— backed by DLP Capital’s $5B lending fund (zero investor losses since 2006), with fully audited financials and clear monthly reporting.

Low Minimum ($50K)—Perfect entry point instead of the usual $200K+, making it accessible to new passive investors.

SD-IRA Compatible— Easily invest through your IRA (or let us guide you through setting one up).

(Limited to 99 investors—Reserve Your Spot Before It Fills Up.)

Built for New LPs Who Want Cash Flow

Without Complexity

Trusted by Executives Of:

The Real Problem Most

First-Time Investors Face

For most high earners, the goal isn’t just more money—it’s freedom.

Not just net worth on a screen—but...

→ Calendar control.

→ Fewer meetings.

→ More options.

They’ve done the hard part.

They’ve earned well. Saved up. Built their cushion.

But their money’s not moving. And they’re still tied to their income.

So they start looking into real estate.

They read pitch decks. Sit through webinars. Talk to a few operators.

And instead of feeling empowered… they feel overwhelmed.

“Every investment looks promising… but I have no idea how to tell which ones are legit.”

And that is the real problem.

Most people don’t start passive investing with confidence—they start with hope.

They wire six figures into a deal they barely understand, and just…

Hope the numbers are real.

Hope the distributions actually come.

And hope they picked the right operator.

But hope isn't just a bad strategy.

It’s the fastest way to lose money.

What Happens When You Choose the Wrong First Investment

It’s not just a bad deal. It’s a momentum killer.

You chase the flashiest pitch.

The biggest IRR.

The juiciest tax write-off.

The promise of riches, wrapped in jargon.

So you wire $100K into oil & gas, land development, or a flashy “value-add” real estate project.

Then...

You wait.

And wait.

No updates.

No distributions.

No idea if you made a mistake—or if this is just how it works.

And that’s when the spiral starts:

“Did I miss something?”

“Should I have asked more questions?”

“Is this how other investors do it?”

Now you’re stuck.

→ No cash flow.

→ No momentum.

→ And no clue what a good deal is supposed to feel like.

Worse?

You’re left doubting yourself.

And the sad truth?

Most first-time investors don’t lose money because of bad markets.

They lose because they chased returns before building conviction.

That’s why your first investment shouldn’t be about hitting a home run.

It should be about building a foundation.

Clarity. Confidence. Momentum.

Because once you get that first win, the game changes…

What If Your First Deal

Built Confidence—Not Doubt?

Most investors walk away from their first deal with more questions than answers.

They’re unsure.

Second-guessing.

And stuck in “wait and see” mode.

But imagine if your first investment...

Paid you your first check within 45 days

Helped you understand how real passive income works

Showed you real-time updates, reporting, and communication done right

Taught you the system behind passive investing—without locking up your capital

And made you want to invest again (because it worked exactly how you hoped it would)

That’s what the right first investment does.

Not just returns.

Reps. Rhythm. Momentum.

You don’t need the "perfect" deal.

You need one that works—clearly, consistently, and confidently.

Introducing

DLP Lending Fund

By DLP Capital

Backed by $5B in AUM.

Built for Predictable Passive Income.

Most beginner investors start in the wrong place:

❌ Equity deals that promise 20% IRRs

❌ Locked-up capital for 5–10 years

❌ No cash flow, no updates, no way to pivot

They feel stuck, confused, and frustrated.

But it doesn’t have to be that way.

The DLP Lending Fund is what we wish more first-time LPs started with.

A simple, transparent, income-focused fund—built to help investors earn predictable returns, stay liquid, and sleep well at night.

📍 Managed by DLP Capital

💼 $5B AUM | Operating since 2006

🛡️ Zero investor principal losses—ever

How The DLP Lending Fund Works

(And Why It’s a Perfect Fit for First-Time LPs)

If you’ve never invested in a private debt fund, here’s the simplest way to think about it:

Instead of buying, building, or flipping real estate…

DLP acts like a bank.

They lend money to real estate investors and developers—who pay interest on those loans.

That interest is what funds your monthly distributions.

Here’s Why This Strategy Is So Reliable:

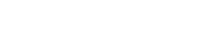

Backed by Real Estate – Every loan is secured by real property (often at 65–70% loan-to-value). That means if a borrower defaults, DLP can take the asset and still come out ahead.

Short-Term Loans – Most loans are 6–12 months, which allows DLP to stay agile in any market and reduces exposure to long-term risks.

Thousands of Loans, Not One Bet – You’re not putting money into one deal. You’re spread across a diversified pool of loans across the U.S.

Consistent Cash Flow – Because borrowers pay interest monthly, the fund can distribute income monthly—unlike most real estate equity funds where you wait years for returns.

Institutional Infrastructure – DLP services their own loans, tracks every dollar in and out, and has operated with full audits and investor reporting since 2006.

This isn’t a high-risk flip – It’s a cashflow machine backed by a $5B firm with a spotless track record.

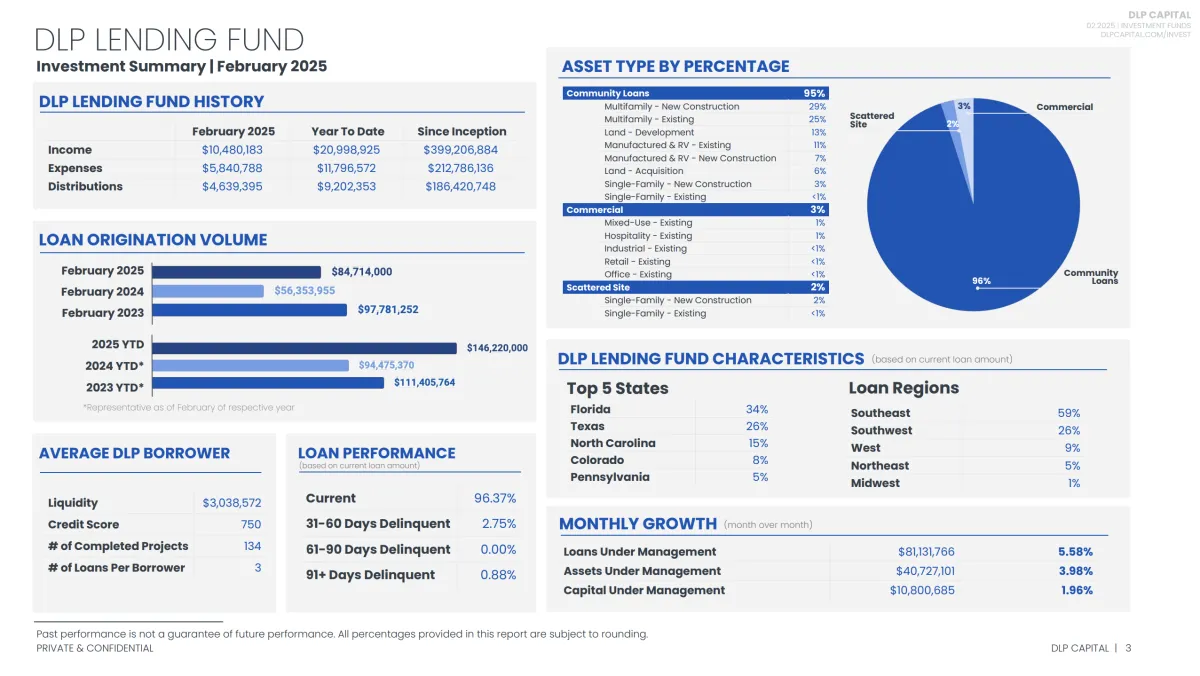

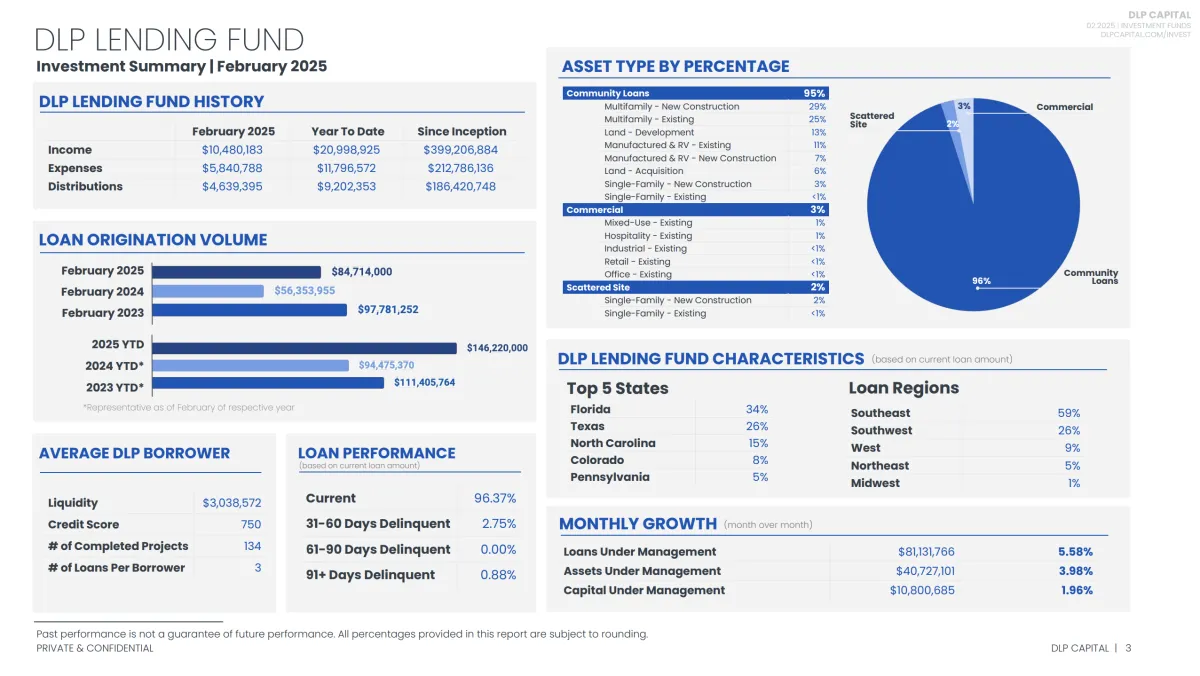

Here’s the breakdown of the loans your investment would help fund.

What Makes This Fund So Stable?

It’s not about chasing high yields.

It’s about smart underwriting, disciplined lending, and true diversification across markets and operators.

95% of the DLP Lending Fund’s capital goes to experienced multifamily developers across more than 30 states—ensuring that no single property, market, or operator can derail your returns.

→ Every borrower is rigorously vetted.

→ The average credit score is over 750.

→ Most have completed dozens of successful projects.

→ And every loan is backed by hard real estate collateral.

In fact, over 96% of loans are current, with almost zero delinquencies across a $5B portfolio.

Monthly distributions aren’t a fluke—they’re the product of a system built for consistency.

Take a look at what powers this fund below:

Since launching in 2014, the DLP Lending Fund has produced strong, consistent returns, even while other real estate funds struggled to survive.

Here’s what it weathered—without missing a beat:

COVID-19: While other funds paused distributions, DLP kept paying.

2023 Interest Rate Spikes: From ~3% to 7%—and DLP’s performance held steady.

Multiple Market Cycles: Steady returns across upturns, downturns, and uncertainty.

Past performance doesn’t guarantee future results, but this kind of track record is rare.

Especially for a fund that:

→ Pays you monthly

→ Offers liquidity every quarter

→ And has never lost a dollar of investor principal

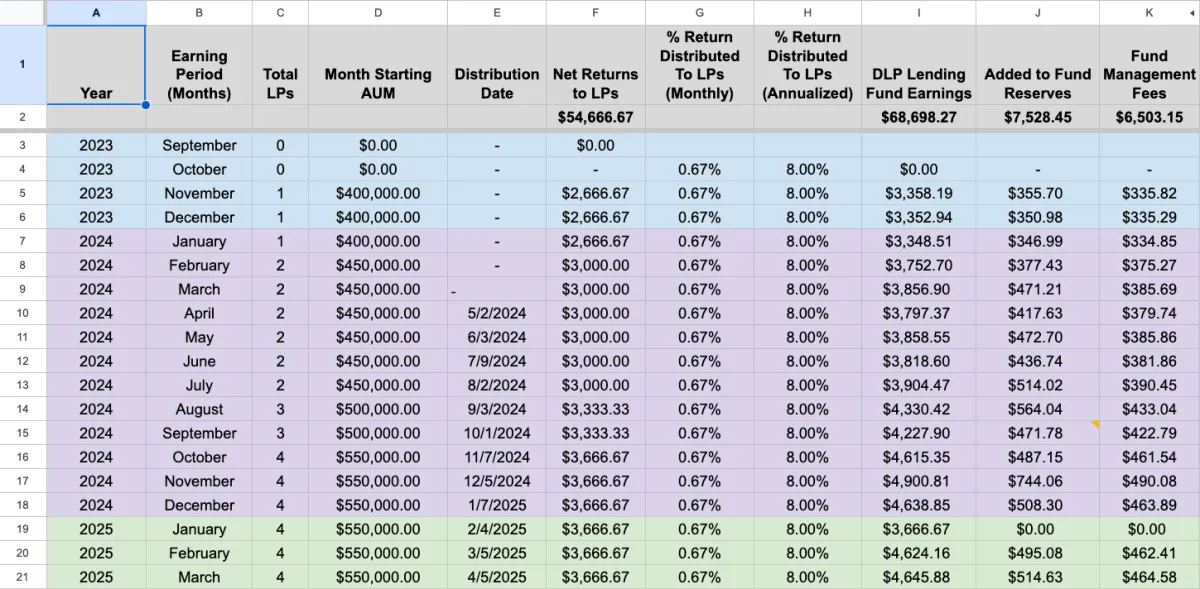

Here's what returns investors actually saw over the last five years:

What This Strategy Looks Like In Real Life

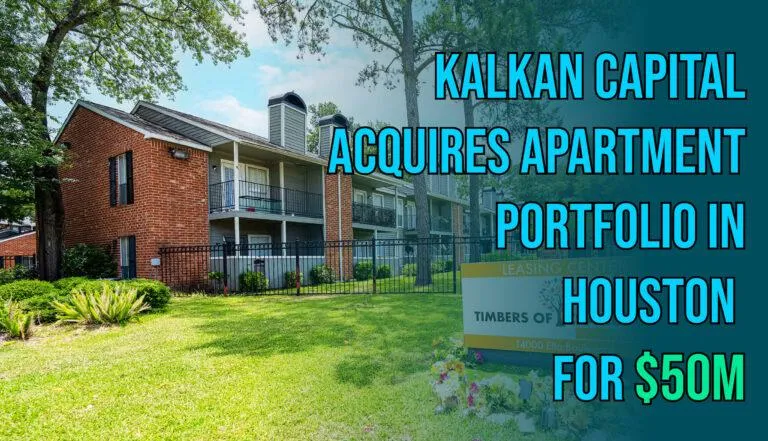

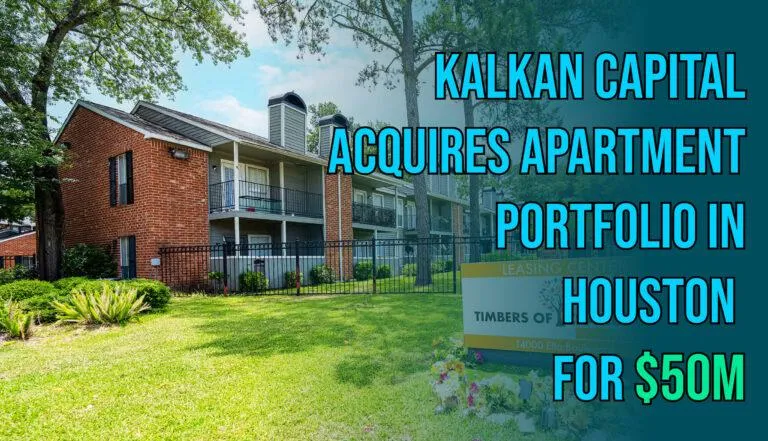

Here’s how one $34M loan helped transform 510 apartments in Houston—and generated an 18% IRR for investors in just 12 months.

Case Study: Kalkan Capital in Houston, TX

When Kalkan Capital wanted to renovate two large multifamily buildings in a crime-affected area of Houston, traditional banks passed, and DLP Capital stepped in.

The Strategy:

DLP provided a $34M loan to support the full renovation...

Not to build from scratch,

Not to gamble on appreciation,

But to revitalize existing assets and create affordable workforce housing.

The Results:

510 apartment units fully renovated

Delivered affordable housing to working families

The loan duration was just 12 months.

Generated an 18% IRR for investors.

These are the kinds of short-term, asset-backed, income-producing loans your capital helps fund.

So Why Aren’t More First-Time Investors Already in This Fund?

Because you need at least $200,000 to invest with DLP Capital.

And writing a $200,000 check into your very first private investment is a big pill to swallow.

Even if the returns are enticing.

Even if the operator is well-known.

Even if you know it should work.

It’s not the math—it’s the mental hurdle.

Most new LPs aren’t ready to jump in with that kind of commitment on day one.

And frankly… they shouldn’t.

They don’t know what normal looks like.

They’re still trying to vet operators.

They’re still figuring out how to invest intelligently.

So they either:

→ Sit on cash, afraid to make a mistake

→ Or chase deals that promise high IRRs—but deliver zero income, no liquidity, and tons of risk

That’s why we created a smarter on-ramp.

Introducing

Grow Your Cashflow

Lending Fund

Your Shortcut to Confidence, Cash Flow, and Real Momentum

Most beginners don’t need another high-risk, high-IRR pitch.

They need a baseline—a simple, proven way to start investing with confidence.

That’s why we created the GYC Lending Fund—a simple, private fund that gives you access to the same low-risk strategy used by institutional investors, but with a $50K minimum, shorter timelines, and total transparency.

We pool capital from beginner LPs and place it into the DLP Capital Lending Fund.

When you invest, you get:

Monthly distributions (within ~45 days)

Quarterly liquidity—you’re not locked in

Audited financials & reporting you can actually understand

Proven system—used by a $5B lending fund with zero investor losses

Built-in education and support to guide you through every step

(Limited to 99 investors—reserve your spot before it fills up.)

How It Works:

Access DLP with Just $50K

Your $50K gets you into the exact same fund—without A High Minimum

1. You invest $50K+ into the Grow Your Cashflow Lending Fund.

2. We pool your capital with other investors to reach the $200K minimum.

3. We invest directly into DLP’s Lending Fund.

4. You receive monthly distributions once DLP sends them to us (typically within days).

What Kinds of Returns Should You Expect?

The Grow Your Cashflow Lending Fund is designed to provide predictable, reliable monthly income—not just theoretical IRRs.

Here’s what actual investors have received through the Grow Your Cashflow Lending Fund:

8% target return, paid monthly

Distributions start within ~45 days

Full transparency, direct from DLP’s audit-grade reporting

Zero investor losses to date

Real cash flow you can plan around—not hope for

This isn’t a simulation.

It’s a real investment that pays you, educates you, and builds momentum all at once.

You Don’t Just Get Access—

You Get a Playbook and a Partner

Most fund managers throw you into the deep end.

We walk you through it—step by step.

Here’s what you get on top of the investment returns.

Personal Onboarding Support

From wiring funds to verifying accreditation—we hold your hand through every step of the process.

Self-Directed IRA Setup (Full Handholding)

We’ll guide you through setting up your SD-IRA with our preferred custodian—step-by-step.

Full Reporting + Ongoing Education

You get DLP’s official investor updates plus our breakdowns on what they mean—and what to watch for.

Bonus: Our $1,500 Deal Evaluation Session

We’ll coach you through evaluating your next opportunity—so you can level up your skills and never rely on “hope” again.

This isn’t just investing—this is investing with clarity, confidence, and peace of mind.

Don't Just Take Our Word For It...

Hear What First-Time LPs Are Saying About the GYC Fund

"Distributions are like clockwork"

"Most importantly, as with any investment, I want to see that it's real. And in this case, distributions happened just like clockwork"

- Matthew Sommers

CFO @ Solid Ratio

Boulder, CO

"Built for first-time fund investors"

“I didn’t want to make a big bet right away. This let me ease in, understand how it all works, and still get exposure to a fund I believed in. The returns have been steady, and I didn’t have to jump through hoops.”

- Philip Lima

Founded & Exited Analytics Firm

Boulder, CO

Kickstart Your Momentum in 45 Days or Less

What to Expect (Once You’re Ready to Invest)

Step 1

Book Your Call &

Finalize Your Investment

We’ll walk you through the entire process:

Answer your questions

Help you set up your investor portal

Guide you through accreditation

Review and sign documents

Step 2

Receive Your First Check

Within ~45 days of wiring, you’ll receive your first monthly distribution.

No waiting 12+ months.

No guessing.

Just cash flow—fast.

Step 3

Watch It Work

(Month After Month)

You’ll get:

Monthly income

Clear investor reports

Ongoing access to our team for support or second opinions

It’s not just about making a return.

It’s about finally knowing what a great investment feels like.

Note: You must wire your funds by end of day on the 23rd to lock in for next month’s distribution.

Exclusivity & Investor Caps

Due to securities regulations, we can only accept 99 investors total, or $10M total capital.

Once we hit our limit, the fund closes indefinitely. We can't guarantee when or if we'll open another round.

If you're considering joining, now is the time.

Ready to Invest or Have Questions? Let’s Talk

We're here to help you finalize your investment clearly, confidently, and without any stress:

Ask Any Questions – Get clear, detailed answers about the fund or process.

Walkthrough the Investment Steps – Paperwork, accreditation, wires—we make it simple.

Finalize Your Investment – Smoothly complete the process, guided at every step.

Your pathway to predictable, reliable monthly income begins here.

Frequently Asked Questions

I’ve never invested in a private fund before. Is this for me?

Yes—this fund was designed specifically for first-time investors.

You don’t need to know how to underwrite a deal or vet an operator. We walk you through every step: how to submit documents, wire funds, and know what to expect after.

You’ll also get your first check within ~45 days, so you see proof it’s working fast—and gain confidence before committing to riskier or longer-term deals.

Do I need to be an accredited investor?

Yes. This offering is open only to accredited investors, as defined by the SEC.

That typically means you have:

→ Over $200K in annual income ($300K with a spouse), or

→ Over $1M in net worth (not including your primary home)

Not sure if you qualify? We’ll walk you through it on the call—and help you submit a letter during onboarding if needed.

What’s the minimum investment for your private offerings?

The minimum to invest in the GYC Lending Fund is $50,000.

This gives you access to the same institutional fund ($5B+ AUM) that normally requires a $200K minimum to enter directly.

What’s the risk?

While all investments carry some risk, this fund was built to minimize it:

→ Your capital is diversified across thousands of short-term, asset-backed loans

→ Every loan is secured by real estate (typically 65–70% LTV)

→ The operator (DLP Capital) has a 10+ year track record and has never lost investor principal

→ You’re not locked in for 5+ years—there’s quarterly liquidity if life changes

We always recommend reviewing the full PPM before investing, and we’re happy to walk you through it.

How soon can I start seeing returns?

Typically within 45 days.

What fees are involved in the Grow Your Cashflow Fund, and how do they work?

When you invest in the Grow Your Cashflow Fund, there are two main fees to be aware of:

1) Fund Expenses:

These cover essential operational costs, including annual tax preparation by a certified accountant, regulatory filings, and the upkeep of your investment portal.

2) Profit Sharing Fee:

We earn a 10% fee from the profits distributed to you. This aligns our interests with yours, ensuring we succeed together.

This fee supports our team in performing thorough due diligence on every deal, monitoring your investment, communicating important updates, and providing you with continuous support to safeguard your investment.

What exposure will I have to other investments within the Grow Your Cashflow Fund?

When you invest in the DLP Lending Fund, it’s important to understand the structure and the documentation involved.

First, there are two key documents you’ll encounter:

1) DLP Lending Fund - Deal Disclosure

2) Grow Your Cashflow Fund - PPM (Private Placement Memorandum).

The Grow Your Cashflow Fund PPM is designed to be broad and flexible, allowing us to include various types of investments that align with our mission of generating consistent, monthly passive income for our investors. We do this by investing in income-generating assets, which can include anything from real estate and lending to energy such as oil and gas. This broad scope is intentional.

However, when you invest in the DLP Lending Fund, you will also sign a specific Deal Disclosure for this Investment. The terms in the DLP Lending Fund Disclosure supersede those in the broader Grow Your Cashflow Fund PPM. Essentially, the Deal Disclosure outlines the specific terms and risks associated with the DLP Lending Fund, providing detailed information relevant to that particular investment.

The Grow Your Cashflow Fund PPM will cover general risks associated with investing in these types of funds. In contrast, the Deal Disclosure will highlight the specific risks related to the DLP Lending Fund. Your investment is isolated to the DLP Lending Fund, ensuring that it is not exposed to risks from other investments unless you decide otherwise.

This structure is designed to give you a clear understanding of the specific terms and conditions of your investment in the DLP Lending Fund while still allowing for a broad range of investment opportunities under the Grow Your Cashflow Fund.

That said, as a bonus to this customizable fund structure, as we bring in new investment opportunities into the fund, everyone shares in the fund fees. So as the fund expands, your fees diminish proportionally.

What should I know about tax planning related to this investment?

When you make this kind of investment, you should anticipate filing a tax filing extension next year. This shouldn't cost you anything or result in any penalties; this is a reality of investing in funds/syndications as a whole. Because we are an Access Fund, we cannot file our annual K1 form for you until we've received ALL tax forms for the funds that the Grow Your Cashflow Fund is invested in.

Are there any side letters being offered to other investors?

Every investor is signing the same document, and no one gets any side benefits. We need to treat everyone the same.

What is the withdrawal period?

Here’s what you need to understand, in plain English:

Legal Time Frame:

Legally, DLP has up to 180 days to return your funds before they are required by fund rules to cease accepting new capital until all pending Withdrawals are settled.

Practical Experience:

Over the past decade, DLP has managed withdrawals effectively, usually processing them within 2-3 weeks. According to Richard Delgado from the DLP Capital Investment Team, the longest wait time they had in the funds 10 year history, an outlier, was 10 weeks.

Transfer of Funds:

It’s important to remember that we can only transfer your funds once we have received them from DLP Capital.

Copyright © 2024. All rights reserved.

Smart Investor's Fast Track: The $200K Club

Investing $200K or more places you into our exclusive "$200K Club," rewarding you with premium benefits:

10% Preferred Return – matching what you'd earn by going direct to DLP.

Complimentary Deal Evaluation Session ($500 value) – Expert coaching to confidently vet your next investment.

Early Priority Access to future fund opportunities – You'll be first in line for upcoming deals

We designed this tier specifically for those who could go direct but prefer the unmatched clarity, convenience, and support that GYC provides.

Why is the DLP Lending Strategy So Reliable?

If you’ve never invested in a private debt fund, here’s the simplest way to think about it:

Instead of building or flipping real estate…

DLP acts like a bank.

They lend money to real estate investors and developers—who pay interest on those loans.

That interest is what funds your monthly distributions.

Here’s why it works so well:

Backed by Real Estate – Every loan is secured by real property (often at 65–70% loan-to-value). That means if a borrower defaults, DLP can take the asset and still come out ahead.

Short-Term Loans – Most loans are 6–12 months, which allows DLP to stay agile in any market and reduces exposure to long-term risks.

Thousands of Loans, Not One Bet – You’re not putting money into one deal. You’re spread across a diversified pool of loans across the U.S.

Consistent Cash Flow – Because borrowers pay interest monthly, the fund can distribute income monthly—unlike most real estate equity funds where you wait years for returns.

Institutional Infrastructure – DLP services their own loans, tracks every dollar in and out, and has operated with full audits and investor reporting since 2006.

This isn’t a high-risk flip. It’s a cashflow machine backed by a $5B firm with a spotless track record.

And when you invest through the GYC Lending Fund, you get all of that—plus our help, support, and educational resources to ensure you’re building your portfolio the smart way.

Exactly What You Get When You Invest

Investing through the GYC Lending Fund isn't just accessing a top tier fund—it's about giving you absolute clarity, confidence, and momentum right from your first investment.

Minimum Entry of Just $50K – (Normally $200K+ directly through DLP)

Monthly Distributions Starting ~45 Days After Funding

Quarterly Liquidity – No long-term lock-ups

Audited Financials & Full Transparency – Clear, detailed monthly reports direct from DLP

Personal Onboarding Support – Step-by-step guidance for wires, accreditation, and paperwork

Self-Directed IRA Setup Assistance – Full, clear guidance if investing via retirement accounts

Who This Fund Is Perfect For (And Who It's Not)

This fund is perfect for you if:

You’re making your first-ever private investment

You’re looking for a low-risk way to learn how to properly vet deals

You’re tired of sitting on cash or riding stock-market rollercoasters

You want predictable, reliable income within 60 days—not 5 years from now

This fund might not be for you if:

You need immediate, daily liquidity

You’re chasing 20%+ returns or massive tax write-offs

You prefer to actively manage or directly control your investments

Final Thought: Your Future Is Built Now

Imagine looking back 15 years from today. You'll feel genuine gratitude knowing you chose reliable, consistent action over hype.

This is your moment to build real passive income, clarity, and confidence—invest smartly, without stress or regrets.